[ad_1]

Such benefits would be paid for children under the age of 8, children in grades 1 through 4, and children with disabilities under age 21 when enrolled in a general or special education program.

We offer sickness benefits for children up to the end of the fourth grade or older children with disabilities, taking into account the current situation where the identification of a person infected with COVID-19 isolates individual children who have had contact with the patient, but who are not yet independent enough to stay home alone. By receiving sickness benefit during the child’s isolation, her parents will have the opportunity to check whether the child is feeling well, to help with learning. We want to point out that, although a child can be healthy during isolation, the child’s parents must ensure that all isolation requirements are met: not attending public events, not communicating with strangers and the like ”, says the minister of Social Security and Labor, Linas Kukuraitis.

The decision must be finally approved by the Seimas. It is proposed that sickness benefits for the care of young or disabled children who were in isolation prior to the entry into force of these amendments be paid retroactively.

Currently, sickness benefits are paid to parents during temporary incapacity for work when the child is sick or infected.

Key Tips:

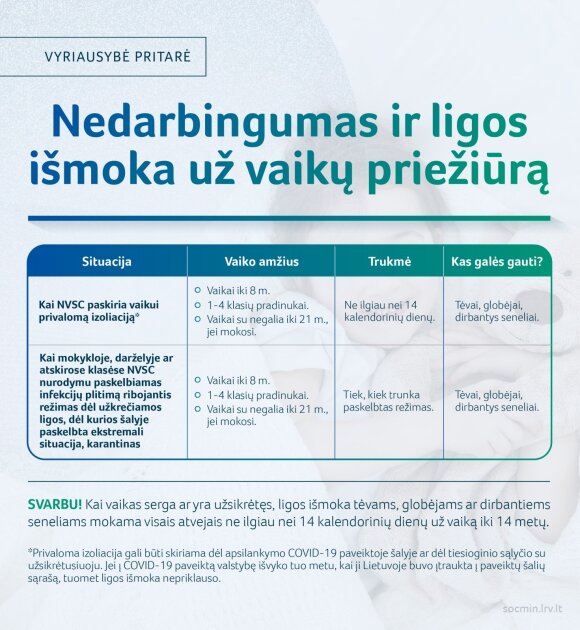

SICKNESS BENEFIT FOR MANDATORY ISOLATION OF THE CHILD. It is proposed to pay sickness benefit for children under 8 years old, first and fourth grade students, and children with disabilities under 21 years of age in general or special education when the children are not sick but the National Public Health Center (NVSC) assigns mandatory isolation.

The sickness benefit for the care of children is 65.94%. salary “on paper”. It will be available to working parents, guardians, or grandparents.

The mandatory isolation of a child can be granted in two cases: when the child visited the country affected by the coronavirus without parents or guardians or when they had direct contact with the patient. The benefit would not be payable if the child went to a country affected by the coronavirus when that country was already included in the list of affected countries.

If a child has visited a country affected by a coronavirus with their parents or guardians, the parents or guardians must isolate themselves and are therefore paid as isolation for adults and not for the child. The sickness benefit for adults in isolation is 62.06 per cent. salary “on paper”.

WHEN TREATMENT FOR THE DISABLED IS ADVERTISED IN A SCHOOL OR KINDERGARTEN.

It has been proposed to clarify what constitutes a restriction regime in school or kindergarten, and to harmonize the age at which sickness benefits are paid to children when such a regime is published throughout the institution or in individual classes.

After the Seimas adopts the amendments, if a regime is announced that restricts the spread of infections in a school, kindergarten, or separate classroom following the instructions of the National Center for Public Health (NVSC), sickness benefits may be paid for children under 8 years of age who are not ill, children in first through fourth grade, and disabled children under 21 years of age. , studying in a general or special education program.

Sickness benefits are intended to be paid as long as the school or individual classroom has a regimen that limits the spread of infections. Working parents, guardians, or grandparents may receive benefits. The amount of the childcare benefit is 65.94%. of salary “on paper”.

It is important to note that such a measure will apply when a regime is announced that restricts the spread of infections in a school, kindergarten or separate classroom due to a disease for which an emergency or quarantine situation is in force in Lithuania. When a containment regimen is announced for another illness, such as influenza, the benefit is paid for the care of children in preschool, preschool or primary education and for a maximum of 14 calendar days.

Table of child benefits

No part of this publication may be reproduced without the written permission of ELTA.

[ad_2]