[ad_1]

Vitas Vasiliauskas, Chairman of the Board of the Bank of Lithuania, confirmed at a remote press conference on Friday that the European Central Bank predicts that the eurozone economy will shrink by almost 9%. and it will be the biggest drop in modern history.

“A contraction is forecast for all major economies, the environment is such that due to COVID-19, this year’s economic recession will be the largest in the history of modern times, beating the shocks of 2008,” said V. Vasiliauskas .

However, the first recovery shots are already visible in the Lithuanian economy, so compared to the start of the pandemic, the Bank of Lithuania is improving its forecasts for the benchmark economic recovery scenario by 1.7 points percentage.

Prospects are improving as the Lithuanian economy and financial system have weathered the first wave of the coronavirus outbreak (COVID-19) better than expected.

“In March, we forecast more than 11 percent. Economic contraction Currently, our forecast is a contraction of 1.7 percent. Low point. Optimistic and baseline scenarios are close to each other,” says V. Vasiliauskas.

According to the forecasts of the Bank of Lithuania, according to the reference scenario, the economy will decrease by 9.7 percent, according to the favorable scenario, by 7 percent. The baseline scenario is based on the assumption that strict quarantine measures will be lifted in May and that demand and the economy will recover relatively slowly.

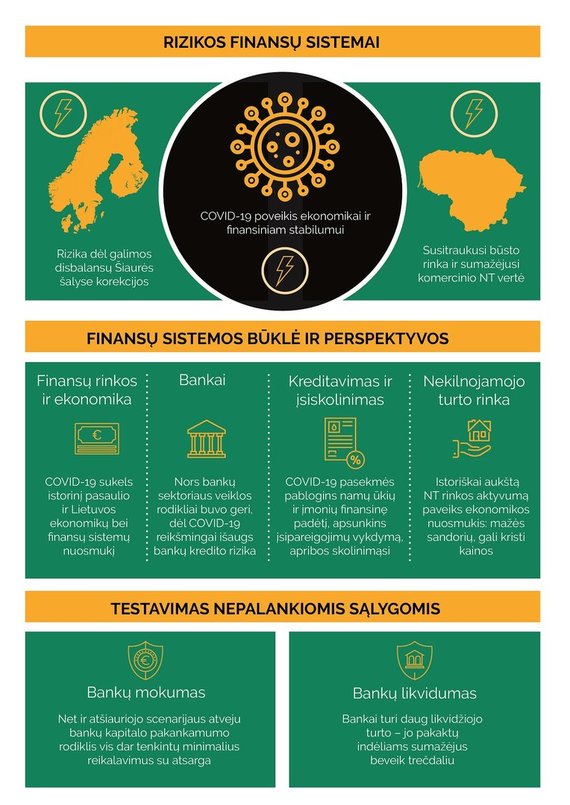

Bank of Lithuania / Risks of the financial system 2020

V. Vasiliauskas pointed out that the forecasts of the Bank of Lithuania are more moderate compared to other institutions. For example, the International Monetary Fund forecasts that Lithuania’s GDP will decrease by 8.1 percent, and the European Commission promises 7.9 percent. decline, the Ministry of Finance – 7.3 percent. withdrawal.

Signs of recovery

According to V. Vasiliauskas, when designing a smaller decrease in the reference scenario, several indicators predict: a relatively good first-quarter result of GDP (+ 2.4%), not as large as expected, commerce (-14%) and industry (-12.5%). ) in April, which is probably the worst month for the country’s economy.

Forecasts are also improved by the fact that the number of employees has not decreased since the beginning of May, population movement is recovering, and domestic demand and electricity consumption are no longer decreasing.

Photo of Vidmantas Balkūnas / 15min / Vitas Vasiliauskas

“One of the indicators of what we can expect in the future is physical activity. Its drop during the quarantine peak was impressive, almost 70%, now, 30%. We also see a stabilization in May due to the number of people insured , which has decreased considerably since mid-March, “said the Chairman of the Board of the Bank of Lithuania.

According to V. Vasiliauskas, all this shows that the state of the economy stabilized last month and will begin to recover in the second half of the year. Due to the impact of the pandemic, the unemployment rate is expected to increase this year to 11.9, the average salary will decrease by 2.6 and inflation will be 0.6 percent.

The Bank of Lithuania presents a total of three scenarios: main or benchmark, favorable and pessimistic. In the worst case, GDP would drop 17%. It is assumed that the spread of the virus in the world cannot be controlled until medical means are invented to combat the virus. Therefore, the activity of the world and Lithuanian economies remains moderate and, in the long run, the economic potential is more damaged.

The loan portfolio of companies affected by the pandemic: 40%.

Speaking about the risks to the financial system, V. Vasiliauskas emphasized that the consequences of the COVID 19 pandemic are, without a doubt, the greatest threat.

According to Bank of Lithuania economists, the loan portfolio of companies directly affected by COVID-19 amounts to around LTL 4 billion. Eur, t. and. about 40 percent. corporate loan portfolio.

Rapid response measures and accumulated corporate reserves helped companies resist the liquidity shock caused by the quarantine in Lithuania, the participation of companies in financial difficulties in April. it increased relatively little and remained unchanged in early May.

However, the consequences of the pandemic worldwide will reduce the export opportunities of Lithuanian companies and may pose a risk to their solvency in the future.

“In terms of prospects, if domestic consumption recovers after the release from quarantine, there are many questions about exports and external markets. Our forecast for 2020 is that exports will decrease by 14%. There is a lot of uncertainty, Everything will depend on how the economies of other countries will open, ”says V. Vasiliauskas.

New loans are declining

The announcement of the quarantine has had a significant impact on the Lithuanian credit market. The flow of new loans decreased, the volume of loans with deferred payments increased.

Within 10 weeks after quarantine was introduced, the flow of new home loans decreased by 30%, consumer and other loans by 37%, and business loans by 17%.

“The demand for loans has decreased. That was not felt immediately after the quarantine announcement, but a little later, the darkest month was April,” says V. Vasiliauskas.

It is true that at the end of May the loans rebounded, in May compared to April. the interest rate increased by approximately 18 percent. The Bank of Lithuania’s decision to reduce the anti-cyclical capital buffer rate for banks from 1 to 0 percent also improves opportunities to lend to companies and individuals.

Demand for loans has fallen. That was not felt immediately after the quarantine announcement, but a little later: the blackest month was April, says V. Vasiliauskas.

According to V. Vasiliauskas, the risk of the consequences of COVID-19 in the financial system will be limited by the better financial position of companies and banks and the responsible loans during the decade, which prevented the formation of credit bubbles.

“Credit is growing sustainably with the economy,” said V. Vasiliauskas.

According to the Bank of Lithuania, banks have a strong capital buffer and companies have sufficient reserves to withstand a short-term liquidity shock.

However, V. Vasiliauskas points out that a big difference compared to the previous crisis is that companies now depend much more on mutual debts (commercial credits and corporate loans, in total, more than 12 billion euros) than on the bank financing (about 9 billion euros). EUR).

For this reason, if the effects of the pandemic were to continue and the chain of settlement between them began to break, it would pose additional risks to corporate finances. However, V. Vasiliauskas points out that the liquidity situation in companies is much better than during the 2008-2009 crisis.

A significant drop in property prices is not expected.

Comparing this crisis with the one that occurred a decade ago, V. Vasiliauskas also notes a great difference in the real estate market.

“Based on our assessment, in terms of the relationship between the economy and house prices, in 2008 house prices were overvalued by a quarter. In 2019, house prices were 5 percent lower. that fair value, in principle, we do not see any discrepancy in the housing market, ”emphasized the Chairman of the Board of the Bank of Lithuania.

Photo from 123rf.com/Home

So far, prices in the real estate sales market have not decreased, although home rental prices, according to V. Vasiliauskas, have fallen between 5 and 10 percent in April and May.

“It will pass on housing prices will be seen. However, it should be noted that the liquidity situation of real estate developers is not really bad, so all this allows us to say that it is difficult to expect sudden changes in Prices. Corrections can be made, but we do not expect shocks, “says V. Vasiliauskas.

According to him, there are currently around 3.5 thousand people in Lithuania. unsold apartments, and the real estate developer loan portfolio at banks accounts for about 30 percent.

Recent bank surveys have revealed an increase in so-called “housing tourists” asking banks about financing options, but that research does not translate into final contracts.

“The number of consultations per month has exceeded the pre-quarantine level, but far fewer contracts are concluded than before the quarantine,” said V. Vasiliauskas.

It is true that the Bank of Lithuania notes that the interest rate did not change significantly after the introduction of quarantine, but the amount of the initial contribution increased slightly.

Meanwhile, the growing commercial real estate market in recent years will also reduce the economy: the Bank of Lithuania forecasts that the number of vacant offices will increase, which may also affect prices.

Banks are ready for the crisis.

The latest results of the adverse stress tests carried out by the Bank of Lithuania have revealed that banks are well prepared to withstand the economic shock.

Even if the harsh scenario were to materialize, although the banking system’s capital adequacy ratio would drop by almost 10%. p., but would still have a margin above the minimum requirements.

“Liquidity in the banking sector is the best in history, the accumulated reserves are large,” emphasized V. Vasiliauskas.

Banks could also resist withdrawing a third of deposits: i. and even five times more than the largest decrease in deposits in history during the previous crisis. Deposits in the banking sector decreased mainly in 2008. October. – 6.2 percent.

V. Vasiliauskas notes that this time the dependence of Lithuanian commercial banks on the Scandinavian parent banks is much less, as the parent banks have issued significantly fewer loans to banks operating in Lithuania than in 2008-2009.

The European Central Bank (ECB) forecasts that the eurozone economy will shrink 8.7% this year, but will grow 5.2% next year.

[ad_2]