[ad_1]

“Our goal is to include all declared amounts of added value in the budget. This is one of our main tasks. We have high hopes in this direction, because the fiscal discipline of some of our clients is not yet exemplary”, – at the conference “New reality – New finance” held in Kaunas. Financial management from red hot to green finance in the future, “said J. Stankienė.

According to STI data, in 2018 the VAT gap in Lithuania reached 25.9%, in 2019 it was 21.6% and in 2025 it is expected to be 15%.

According to the Ministry of Finance, in 2017, 3,776 million. EUR VAT. In the absence of a gap, 1.04 billion would have been raised. euros more.

In 2021, LTL 4,033 million is expected to be collected from VAT in state and municipal budgets. euros. Reduce the VAT gap by 5% points, the budget could be increased by around 260 million euros. euros.

J. Stankienė said that in the near future an integrated and coherent VAT administration system (“from – to”) should emerge in this area.

According to the European Commission, the VAT gap in Lithuania is one of the largest in the European Union. According to the latest data from 2018, a larger deficit was only observed in Romania (33.8%) and Greece (30.1%).

The smallest gaps were recorded in Sweden (0.7%), Croatia (3.5%) and Finland (3.6%). The EU average was 9.2%.

“One of the main challenges continues to be the underground economy. All actions, strategies move in that direction. We also pay attention to the processes caused by the pandemic, to the growing expectations of customers, we want a state of well-being, business dynamics ”Said J. Stankienė.

Presented the strategy

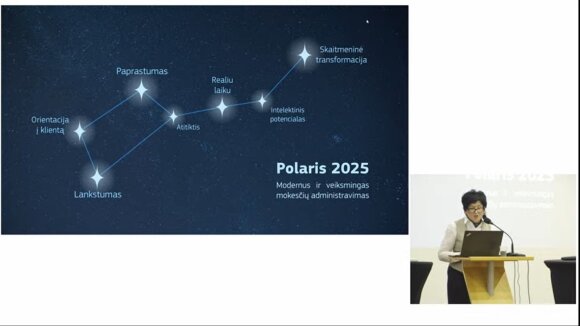

J. Stankienė presented the CTI strategy “Polaris 2025” to the participants.

“This is STI’s 5-year strategy. The name consists of our addresses. These are simplicity, customer focus, flexibility, compliance, real time, intellectual potential, and digital transformation. All these stars, the management has a common contact with each other, “he said.

© State Tax Inspection

“Our goal is to be easy for our taxpayers. We will strive to free up operational capacity. It is not about layoffs, but about the relationship between CTI financing costs and taxes / contributions paid to the consolidated total of the state budget and municipal budgets and funds, ”said J. Stankienė.

It is indicated that in 2020 the fact of this indicator was 0.64%, in 2021 it is expected – 0.7%, and in 2025 – 0.66%.

“It is also expected that in 2024 the STI will have a legal entity. It is a merger of the counties operating under the Ministry and the counties into a single unit, which would allow a more efficient use of management and human resources, as well as other expenses.

It is planned that in the future the seven external information systems (My STI, EDS, IN.MAS, EPRIS, TIES, AIS, MOSS) will be available in one place, when they now have their own characteristics, different design solutions “, – at the conference, among others, what the director of Kaunas STI told me.

Currently, the STI employs 2.6 thousand people. workers. 1,324 work in the STI under the Ministry of Finance, another 1,276, in five county inspections.

In 2020, 10.3 billion were raised. budget in euros. The plan was fulfilled 91.5 percent. The deficit was due to 805.6 million. tax arrears subject to tax aid measures.

“In 2020, 5.9 million. Returns. 70 percent. Population submitted GPM311 returns” with a click “and this took an average of 2-3 minutes. 5.2 million. Contributions were received, of which 90% handled automatically.

17 thousand were fulfilled. monitoring and control actions, resulting in 84.9 million euros. STI’s clients are 2.1 million. taxpayers. There are 258 thousand. companies and 1.85 million. population. There are 93 thousand VAT payers ”, taught J. Stankienė.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to cite DELFI as the source.

[ad_2]