[ad_1]

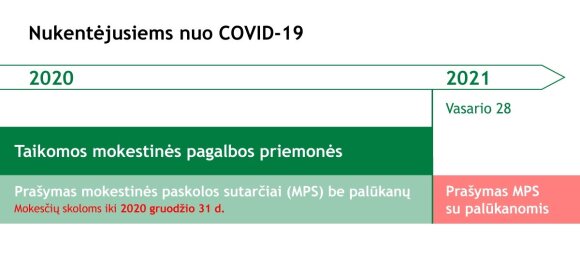

“For companies that have been negatively affected by COVID-19, the tax aid measures apply up to the meter. This means that before this deadline and during the following two months, the latter will be exempt from interest on arrears and will not be subject to tax recovery actions ”, recalls Rasa Virvilienė, Head of the Legal Department of STI, pointing out that tax victims affected by the pandemic payers for 2021. February 28 can request the tax administrator and enter into a tax loan contract until 2022. December 31, without interest.

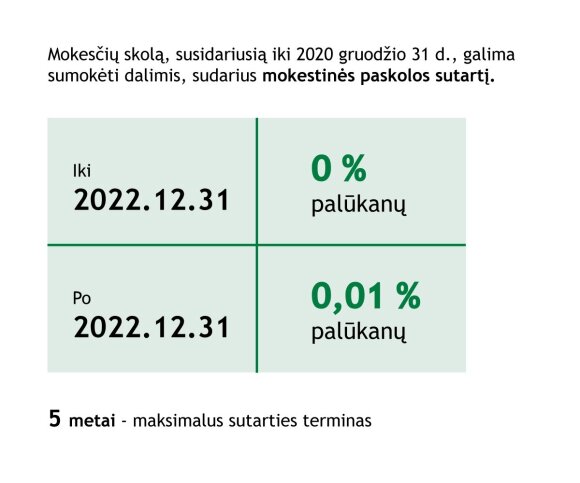

No interest and no questions asked, until 2022. December 31

An interest-free tax loan contract can be concluded for tax debts incurred before this year. subway. December 31, 2010 and pay the contributions before 2022. December 31 It is not necessary to present any additional document to the STI for the conclusion of said agreement, a request is sufficient, in which the desired terms of payment of the contributions. The request can still be submitted by logging in to My STI> Services> Request the service> Accounting and tax payments> Postponement or arrangement of the payment terms of tax arrears.

“If a taxpayer considers that due to a difficult financial situation, two years may not be enough to settle and pay the tax debt, they can request a longer tax settlement and payment period, but not more than five years. In this case, taxes until 2022. until December 31, like all the others, you can dispose and pay without interest, and for subsequent contributions it will be calculated at 0.01%. interest per day ”, says Rasa Virvilienė, noting that the standard procedure and The requirements apply to conclude a tax loan contract for more than two years, so the taxpayer must substantiate their request with documents that describe the taxpayer’s financial situation and support the data and circumstances.

STI information on business support

© VMI

You can request the deferral of contributions for one year.

When concluding a tax loan contract, taxpayers can request a deferral of the first installment for one year. In this case, when the debt is less than 300 thousand, it is not necessary to present additional documentation at the time of filing the request when it is equal to or greater than 300 thousand. – The tax administrator must submit the supporting documents mentioned above together with the application. It should be noted that the deferral of payment does not modify the term of the interest-free fiscal loan contract, it can be concluded for the period until 2022. December 31

STI information on business support

© VMI

Half, that is, more than 10,000. the debt of companies subject to tax deferrals does not reach 1,000 LTL. euros. The debt of 330 companies exceeds 300 thousand. and only 1 percent. the companies have a debt of more than 0.5 million. 54% EUR. the amount of any deferred tax.

The debt of the taxpayers covered by the aid measures amounts to 713.8 million euros. EUR, this amount owes 45.4 thousand. taxpayers (21.7 thousand companies and 23.7 thousand inhabitants). From March 16. composed of 4.5 thousand. tax-free loan agreements, 86.2 million. in the amount of EUR.

STI information on business support

© VMI

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to cite DELFI as the source.

[ad_2]