[ad_1]

If the vehicle is currently registered in Lithuania, the SDK will be provided automatically.

Those whose cars are not registered must contact the “Registry” within three months and receive a code. It will be possible to report the available vehicle and receive the code in the electronic system.

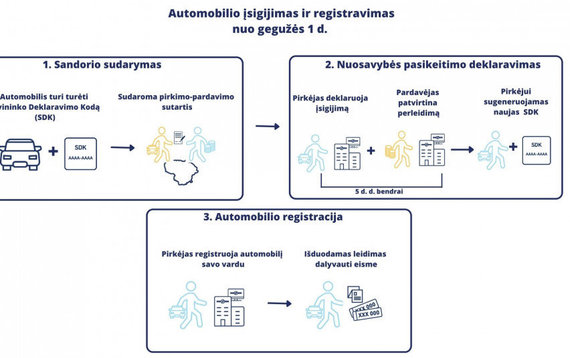

As of May 1, the person who bought the car will have 5 days to contact Regitra and notify the purchase, provide the SDK and other information. After the provider validates the information provided, a new unique SDK will be formed. Only then will it be possible to register the vehicle.

A new code will be generated every time the vehicle owner changes.

Without an SDK, the vehicle will not be able to register.

If you buy a car abroad, it will be necessary to notify Regitra about the purchase before entering Lithuania, then an SDK will be formed.

MIA / New vehicle registration procedure

Not having a code is a fine

“From now on, there can be no car on the road, on the market, in a private parking lot or on the Internet that does not have an SDK code,” Deputy Director of the State Tax Inspectorate Artūras Klerauskas told the press conference. – For example, when agents stop a car transporter on the road, it will immediately check if the cars have an SDK code. Exactly the same when carrying out market controls, the car will have to be registered in each case. Also on the Internet, each advertisement must indicate that the car is already registered. “

As he explained, until now no one really knew how many times the car had been resold.

Currently, the start of the transaction is allegedly a German citizen, which in many cases is a lie, and in the end only the final buyer remains. Among these chains there may be a few more transactions that took place when people received resale income, but no one has known about these transactions until now. Now each resale will be arranged, – said A. Klerauskas. – In this business there is a whole segment of merchants who are invisible people. They do not register activities, they issue a fictitious document on behalf of a foreigner, and they themselves are missing, they are not officially car dealers. The system will lead us to see which people resell cars and how many cars they have sold. “

Saulius Šuminas, deputy general manager of Regitra, explained that a person who has bought a vehicle abroad will have to immediately declare the purchase and receive a unique SDK.

Luke April / 15min photo / Saulius Šuminas

“Suppose officials see that a car with foreign license plates is entering the country, a Lithuanian is sitting behind the wheel. Officials will be able to immediately ask where the declaration code is, there is no code, the question of what to do with that vehicle like permanent resident of Lithuania, ”said S. Šuminas.

If a person deliberately stops without registering the purchase of a car, he is fined 75 euros for the first time and 440 euros for the second time.

The goal is to reduce the shadow

“Our goal is consumer safety and, at the same time, fighting the shadows. We hope this will encourage society to form a civilized and transparent trading tradition of vehicles, as well as their parts, which will reduce shadow trading of vehicles to a minimum, and vehicle buyers can rest assured of the reliability of the vehicle. transaction. ”Says the Minister of the Interior Agnė Bilotaitė.

“Currently, part of the vehicle resale transactions are carried out in cash, which is not recorded or included in the accounting of the system, hiding taxes. As a result, the state is likely to lose about $ 40 million a year. euros. The centralized accounting system for vehicle owners is a necessary and immediate tool in the fight against the shadow car business ”, affirms the Minister of the Interior, Agnė Bilotaitė.

Photo by Julius Kalinskas / 15min / Agnė Bilotaitė

In recent years, the State Tax Inspectorate (STI) has paid special attention to the control of the used car trade sector.

In 2018-2020, the STI identified almost 5 million LTL in this sector through the performance of control actions. additional taxes to pay. The value added tax (VAT) liability reported by controlled taxpayers in 2019, compared to 2018, increased by 26.8 percent, while the growth of the sector without controlled taxpayers was only 1.3 percent.

However, an analysis of the sector shows that it is often the end buyer who suffers and incurs losses from unscrupulous sellers, whose security, transparency and traceability of the transaction must be ensured.

The experience of neighboring Latvia, which has introduced a compulsory vehicle registration system, shows that the amount of taxes paid in this sector increased by 27.2 million in the first year. euros.

You can find more detailed information about the changes on the Regitra website.

[ad_2]