[ad_1]

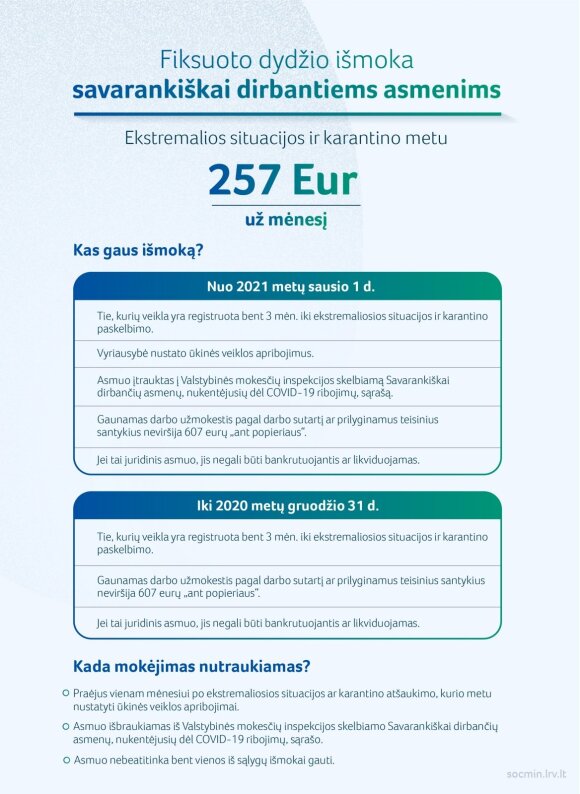

CONDITIONS TO RECEIVE BENEFITS. From the beginning of next year, the self-employed will be able to claim a full monthly benefit of € 257 if they meet the following conditions:

- Activity recorded for at least 3 months. until the publication of the local or global quarantine.

- Due to restrictions on economic activities, the person is included in the list of Self-Employed Victims of COVID-19 restrictions published by the State Tax Inspection.

- The remuneration received by virtue of an employment contract or equivalent legal relationship does not exceed 607 euros “on paper”.

- If you are a legal entity, you cannot be in bankruptcy or liquidation.

Once the emergency or quarantine has ended, the benefit for the self-employed will continue to be paid for a month, after which it will be interrupted.

Important! The self-employed who have already applied for a lump sum benefit will receive it before the beginning of the following year if they meet three conditions: their activity has been at least 3 months old. Before the publication of the quarantine, the remuneration received by virtue of the employment contract or equivalent legal relationship does not exceed 607 euros “on paper” and, if it is a legal person, it cannot be declared bankrupt or liquidated.

Until the end of the year, a self-employed person who receives a benefit will continue to receive it next year if their economic activity is restricted and is included in the list of self-employed affected by the COVID-19 restrictions published by the State Tax Inspection.

AMOUNT AND GRANTING OF THE BENEFIT. The benefit for the self-employed will be paid for the previous calendar month and will amount to 257 euros, as during the first quarantine.

If the emergency and quarantine period is less than a calendar month, the amount of the benefit paid to the self-employed for that month will be reduced proportionally.

A benefit is awarded and paid to a self-employed person, regardless of the number of self-employed activities.

The benefit is also available to the self-employed who are exempt from social security contributions: retired, disabled and people who are entering for the first time.

This benefit will not be included in the insured income and will not affect any other benefit and may be received together with other social security benefits: illness, maternity, childcare, unemployment benefits or pension.

THE BENEFIT IS GRANTED AND PAID. The decision on the granting of the benefit is made by the Employment Service and the benefit is paid by Sodra. It is paid monthly as long as the emergency and quarantine are in effect and the person meets all the conditions.

TERMINATION OF BENEFIT PAYMENT. The benefit payment is terminated:

- one month after the lifting of the emergency or quarantine during which the restrictions on economic activity were imposed.

- the person is removed from the list of self-employed affected by the COVID-19 restrictions published by the State Tax Inspectorate;

- the person no longer meets at least one of the conditions for entitlement to the benefit.

It is recalled that self-employed persons are considered sole proprietors, members of small partnerships, full members of partnerships and limited partnerships, self-employed (including business licenses), farmers and their partners with a stake of 4 ESU or plus, family members, people who receive income under copyright agreements or income from sports or performing activities.

From the beginning of the second quarantine until today, 52,266 self-employed applied to the Employment Service for a lump sum benefit.

SADM information on benefits for freelancers

© Photo by SADM

Provisions for contributions to companies

During the quarantine period, companies will be able to defer payments to Sodra without interest or interest. These contributions will be deferred by those companies whose economic activity is restricted by decision of the Government, the company must also be included in the list of victims of COVID-19 restrictions published by the State Tax Inspection. Businesses affected by COVID-19 will be able to avoid paying premiums for the quarantine period and it will be possible to cover the resulting interest-free debt for a maximum period of 5 years. During the first quarantine, the company was unable to pay contributions from the start of the quarantine and for another two months after it ended.

Employers who have applied for state subsidies to compensate employees for downtime or work can also temporarily defer payment of state subsidy Sodra contributions. This can be done in the same way and under the same conditions as the rest of the employer’s salary paid to the employee.

The Seimas today approved amendments to the State Employment and Social Security Laws, and the President has not yet signed the laws.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to cite DELFI as the source.

[ad_2]