[ad_1]

Predicts the collapse of the real estate rental business

Jurgis Vilutis, the head of the long-term lease management platform Valdantis, an investor-practitioner, spoke on the Delfi Tema program that the hot rental market does not need to cool down due to rising rental prices, as is the case of real estate. shopping. He thinks otherwise: the rental market must be encouraged, not stopped and regulated.

On the show, J. Vilutis expressed great fears about the possible collapse of the rental housing business over the next 15 years. He bases his thoughts on data from Statistics from Lithuania and Eurostat.

According to him, there is currently a sufficient number of rental housing to cover all the demand. As the interlocutor points out, now there is a transformation from worse to better housing, which is why it is said that the rental price is rising, that is why people are investing in real estate for rent, but it is worrying that in 15 years about 120 thousand. there will be fewer young people in Lithuania.

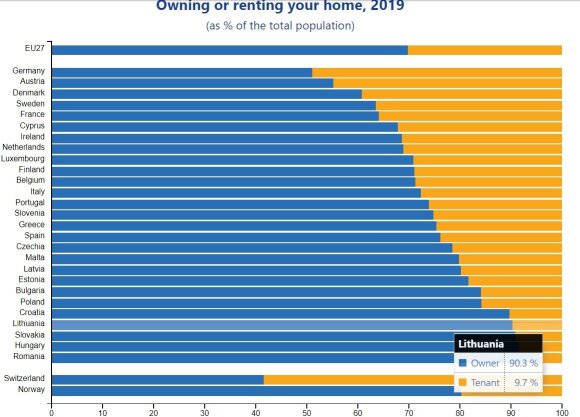

Proportion of rented and owned properties in EU countries in 2019 Eurostat data.

“It just came to our notice then. According to Eurostat, only 9.7 percent of rents are currently rented in Lithuania. Housing and more than 90 percent. Housing is owned when the European average (rent – Delphi) is close to 50%. We are always moving towards the European average and we are nowhere to be found. So we should have around 40-50 percent in 10-15 years. rental housing.

However, there are other statistics that are quite negative. These are the demographic data published by our Statistics Department. Judging by age groups, most of the homes are rented by people between the ages of 20 and 34, who currently number 527,000. If we look to the future, what will happen in the next 15 years, there are currently 406 thousand people between the ages of 5 and 20 in Lithuania.

This means that in 15 years the number of those who most want to rent a home will decrease by 121 thousand, or will be about 60 thousand. apartments that will no longer be needed for rent. This is the entire Vilnius market. The question is what will happen to our real estate investments when 60 thousand. apartments – we will encourage immigration, or 120 thousand will return. young people? This is a great challenge for investors ”, fears J. Vilutis.

Residents by sex and age groups in 2009 and 2020 Data from the Department of Statistics.

Another threat is co-living like

As one of the threats to the rental market, especially for poorly equipped homes, the Managing Director also sees the planned construction of a new rental housing concept, called co-livingais.

“Investors are coming who will offer projects such as co-livingas. This will be a major intervention in the rental market. There are also baby apartments with antique furniture and an antique sofa. Let’s say that the price of these apartments is 300 euros and the price of a better one is 400 euros. Now people win well and will choose co-livingus. Why live with a baby who will shake your belongings at night or won’t let you in with friends? Those 100 euros do not mean anything, because their salaries have gone from 700 to 1,000 euros, so that they can live better, “says the interlocutor.

What will you do with the rental housing in the future?

Due to this situation, people who have bought rental homes in the future will have to repair them to attract a tenant, or they will have to sell them cheaply because there simply will not be enough tenants. Could long-term rental apartments that cannot find tenants be converted to short-term rentals? J. Vilutis thinks it would be too complicated.

Coexistence rental

© Company archive

“The yield on short-term rentals is going down very hard. Kovidas shook up short-term rentals, on the other hand, made a nice head start as several hotels went bankrupt. So people who come to Vilnius or Kaunas will not have a huge selection of hotels, they will not sprout up so quickly, so they will choose a more short-term rental. So it won’t collapse just yet, and those apartments that must covid changed to long-term lease, will return to short-term lease.

If we calculate and compare: there are currently 30, 40 or even 50 thousand people in Vilnius. apartments for rent, when short-term rental housing is about 5-8 thousand. It doesn’t make a large amount, so go for 20 thousand. apartments in that market (short-term leases Delphi) will be too complicated. Also, a large amount each year, even up to 30 percent. BUY FOR INVESTMENT IN HOUSING FOR RENT. Let’s calculate 30 percent. of 6 thousand, it turns out that about 2 thousand. Apartments are listed annually for rent. In 15 years we have 30 thousand. Increase in rental supply if it continues at this rate. Currently, there are about 40 thousand rental homes in Vilnius. There are some scary aspects when you look at the future of the rental business, ”says investor Vilutis.

Believe that the market is self-regulating

Capital Team real estate broker Ignas Zabarauskas agrees that demographic changes will affect the future rental market.

“I think that the rental market, like all markets, is a living organism, so it will adjust. Many rental players, that is, investors, will see that those returns are not what they expected, they will put their investments in another way , they will leave this rental market, so I think these things will adjust a bit.

In the next moment, the mindset of today’s 25-35 year old tenants is a bit different, it is no longer the real Lithuanian who needs to have theirs. I think that as they get older they will rent more bravely, they will change location to look for housing. I think the rental market will adjust.

In today’s rental market, we have considerable profitability. According to other European countries, this is a really high percentage. I think that in the long run that percentage will go down a bit, because the property itself becomes more expensive and the rental demand will go down a little ”, says the real estate expert.

Ignas zabarauskas

Rental yields have fallen dramatically, looking towards smaller cities.

At the time, J. Vilutis, the director of Valdantis, says that rental income has dropped dramatically at the moment, so investors are looking to smaller Lithuanian cities to earn more.

“The best thing was to make money in the secondary market by buying a large abandoned apartment and converting it into rooms, renting it or converting it into two apartments. To this day, the entire market is devastated and the prices of these apartments have risen very strongly. If 5 years ago we were able to offer our clients between 9 and 10 percent. return, today we are talking about 4-5 percent. and we say that it is already good.

In fact, we traveled to smaller cities with larger investors: we developed several projects in Marijampolė, one in Alytus. We are talking about apartment buildings for rent because there are simply no rental options and people pay the price you ask in mind. It turns out that you can get 9-10 percent, but already in smaller cities and regions. Of course, there is a certain threat that the population will continue to decline. It is a constant headache for investors how to invest to pay off and not lose money ”, says the interlocutor.

Is it worth investing in rent?

So, considering this rental business perspective, is real estate rental worth investing in now? J. Vilutis points out that in 15 years the market situation may still change.

“15 years is a long period, incentives can be adopted, the political situation in the neighboring country can change and more migrants will begin to arrive in our country, and perhaps the government will facilitate migration processes. “We will definitely bring more people to Lithuania, it is important that we have easier access for immigrants due to employment and accommodation, which is a tragedy at the moment, we mentioned the crossroads to declare the place of residence of an ordinary person from abroad “. ,” he says.

Coexistence rental

© Company archive

Did you win by investing during the pandemic?

The investor adds that residents who invested their money in real estate during the pandemic won for two reasons.

“With NT, it is such that it is always too expensive to buy it, the best time to buy it was 5 years ago. This is repeated every year and for decades. Real estate is not an investment to buy and sell, although some people do. It’s a long-term investment, even if you buy and real estate prices are down but rent, it generates a steady return, and over time real estate will only get more expensive. I think that the people who invested in the pandemic really won for two reasons: they protected their finances from impending inflation and they have the opportunity to earn passive income and earn in the future with price changes, “he says.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to indicate DELFI as the source.

[ad_2]