[ad_1]

Businesses have been forced to take advantage of bank loans and bond issues that are available due to government guarantees and central bank incentives to survive the quarantines that disrupted cash flow this year. When this support finally ends, corporate finance is at risk of reaching its limit and small businesses are already sounding the alarm bells.

Politicians are being asked to help viable companies clean up their balance sheets, otherwise they could be burdened by debt burdens that would halt investment for years and deter job creation.

“With each week, the chances of survival of closed companies decrease,” says Germain Simoneau, head of the finance committee of the French Federation of Small Businesses, CPME. “We have not yet seen a crisis of such magnitude that there is an underlying systemic risk.”

© Bloomberg

This risk is not limited to companies. Depleted balance sheets can lead to a cycle of defaults and bankruptcies that would affect the banking sector and exacerbate the recession.

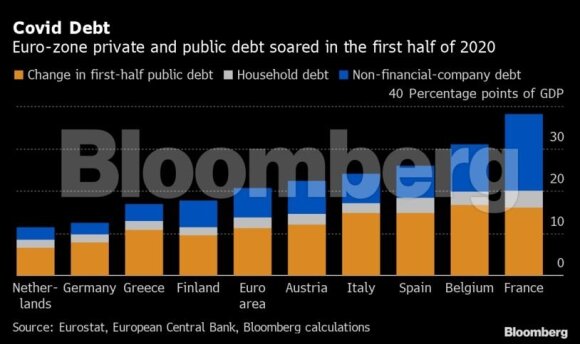

Eurozone companies owed more than 400,000 million euros in the first half of this year, compared to 289,000 million euros for all of 2019, according to data from the European Union. The European Commission warned last week that “debt repayment could cause difficulties, especially in the sectors most affected by the pandemic.”

A crisis of such magnitude that systemic risks remain to be seen.

Germainas Simoneau

Eurochambres has identified the second biggest business concern as a result of this month’s pandemic. Economists at UBS Group AG believe that despite exceptional tax support, the risk of default for European companies remains high.

In Germany, which has so far handled the crisis more successfully than most other European countries, the Bundesbank predicts that insolvency will rise by more than 35% by the first quarter of next year. A survey by another lobbying organization, SME United, found that about half of small and medium-sized businesses in France and Italy are concerned about bankruptcy.

Euler Hermes economists have estimated that small businesses in Italy and France will only need € 100 billion to recapitalize, excluding liquidity support.

Debt dependency

After all, the most realistic solution is to persuade European companies to reduce their dependence on bank loans, which they use much more actively than US companies.

The Commission and the European Central Bank have long called for the establishment of a Capital Markets Union to facilitate access to alternative financing. ECB President Christine Lagarde said on Friday that such a union “is no longer an advantage” but a “necessity”.

However, the solutions proposed in the medium term require the support of the government. It would include measures to improve business solvency so that viable companies are not buried under the burden of debt.

Associative photo.

According to Gerhard Huemer, SME United’s Director of Economic Policy, for small businesses this could mean direct tax orders to help them deal with fixed costs. For the larger ones, subordinated loans or capital injections would be more appropriate.

Such ideas are not acceptable to everyone. The EU’s “Solvency Support Instrument” did not receive enough government support at the July summit, although the famous € 750 billion recovery fund was being discussed at the time.

According to Huemer, the current approach is to provide similar support through the European Investment Bank and other EU programs. Such support would complement national decisions.

Capital before grants

In France, where corporate debt has been growing at its fastest rate despite high levels before the pandemic, the government is preparing a mechanism that is expected to channel some € 20 billion in partial capital to small businesses. State guarantees would guarantee that banks grant capital loans to companies, which will be refinanced by special investment vehicles.

French banks and the state are still trying to find a way to keep costs low while ensuring that returns are high enough to attract funds. The program should also limit risk-taking by the government and comply with EU rules on state aid.

Spain has a fund of 10 billion euros to support larger strategic companies with subordinated loans, stocks and convertible bonds.

In Germany, the government supports companies that have been forced to close by providing cash benefits. In general, Italy and Germany stand out for the use of grants and other non-reimbursable financial aids, says Margrethe Vestager, EU head of competition.

Recently, the European Commission has further relaxed its subsidy rules to allow governments to cover up to € 3 million in fixed costs for businesses. It could be a small step toward a comprehensive transformation that would reshape corporate finance in the post-pandemic era.

“During 2008-2009 we have learned from the crisis that banks must capitalize better, and the lesson of this crisis will be that the same applies to non-financial corporations,” said Michala Marcussen, chief economist at Societe Generale SA.

[ad_2]