[ad_1]

“Given the high level of uncertainty caused by the situation of the pandemic and the global context that it is difficult to face the pandemic not only for our country but also for other countries, (…) we have decided to focus more on discussing the benefits to themselves and in detail. discussion with the social partners “, – said G. Skistė at the meeting of the working group dedicated to discussing tax benefits.

Photo from personal archive / Gintarė Skaistė

“During the spring session (projects 15 minutes) we are not taking it yet, ”he added.

The Finance Ministry held its first meeting of the Tax Incentives Review Working Group on Tuesday.

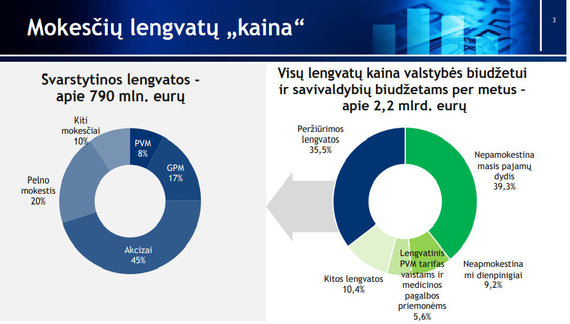

During it, G.Skaistė announced that due to tax benefits, the state budget does not receive around 2.2 billion. and a third of this amount can be revised for “valuable” benefits.

In these charts from the Ministry of Finance, you can see the structure of tax exemptions and what is to be reviewed.

Ministry of Finance / “price” of tax benefits

“Of those 2.2 billion.” Most of the euro is benefits that are justified and important from a social justice point of view, such as tax-free income or value-added tax relief for medicines prescription, “said the finance minister.

Mykolas Majauskas, chairman of the Budget and Finance Committee of the Seimas, told the BNS news agency that substantial fiscal changes could only take place from 2023, although he does not rule out that some of the changes will also take effect in 2022.

Photo by Sigismund Gedvila / 15min / Mykolas Majauskas

In addition, according to the head of the commission, an agreement on the tax reform must be reached between the Seimas, the Government and the Presidency, as well as between the government and the citizens.

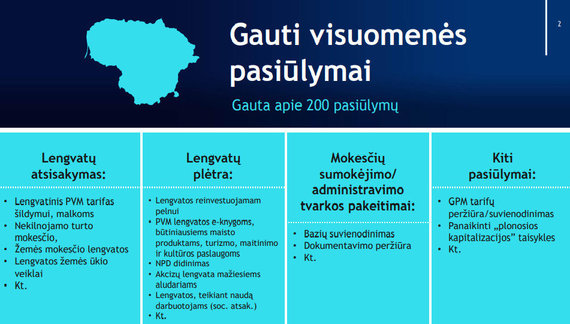

According to the Ministry of Finance, the public submitted more than 200 proposals for the review of tax benefits. You can see them here.

Ministry of Finance / Public proposals for the review of tax incentives

Six directions

Deputy Finance Minister Rūta Bilkštytė announced that the revision of tax benefits is planned in six directions.

First, it is planned to review the mechanism that incentivizes companies to reinvest profits.

Currently, the state applies incentives to reinvest profits in research and experimental development.

According to the deputy minister, although the amount of relief is large and costs the state 83 million. Profit does not reach its full potential, which means that investment growth does not guarantee sustainable economic growth.

Lukas Balandis / 15min photo / 15min in the studio – Rūta Bilkštytė

According to her, the review of corporate tax benefits will consider the development of the current model, the proposals of President Gitanas Nausėda to apply the benefit to companies that increase wages or move to the Estonian model, where profits are not taxed at the time of obtaining.

The second direction refers to the implementation of the green course.

There are plans to remove incentives for fossil fuels and fiscal pollution, but this will be done by identifying alternatives and compensating companies to improve potential losses due to higher environmental standards.

“Our vision is to establish a clear strategy and prepare incentives,” said R. Bilkštytė.

Photo by Julius Kalinskas / 15min / Chimeneas

The third direction of the tax incentives review will be related to efforts to reduce income inequality, the deputy finance minister said.

According to her, the working group will discuss the possibilities of adjusting the progressive rates of the PIT and will carry out an analysis of the balance of taxation on income and social benefits.

The specialists will also consider the possibility of introducing a so-called family declaration, which makes it possible to assess not only a person’s income, but also their obligations to dependents for tax purposes.

Photo by Sigismund Gedvila / 15min / Money

Self-government, investment and special taxation

R. Bilkštytė also said that the working group will review the special tax benefits and conditions. This is the fourth direction of the review.

You will conduct a cost benefit analysis of VAT incentives applicable to small businesses, film production, healthcare facilities, providing benefits to workers, agriculture.

The Working Group will also decide if the objectives of these incentives cannot be achieved by other means, and possible solutions include both exemption and extension of the benefit and a change in the tax model.

Photo by Chris Murray / Photo by Unsplash / Operator (associative photo)

The fifth chapter of the review of preferences is related to the model of long-term investment and savings instruments.

According to the Deputy Finance Minister, different small investments are currently subject to different income taxes, so people sometimes choose investments not on the basis of their risk or return, but on the basis of existing returns.

“To ensure the equivalence of investment instruments, according to the preliminary assessment, it would be convenient to move to a new model of income from active investment in financial instruments and long-term savings, possibly called investment accounts”, R. Bilkštytė fixed .

According to her, the working group will also discuss current benefits for large collective investment institutions and their participants.

Photo from 123RF.com / Stock Exchange

The last, sixth direction of the review is related to the objective of strengthening the financial independence of municipalities.

It is considered the full transfer of taxes on land and real estate to their budgets. Some of these tax incentives, such as those for diplomatic missions, churches or state priorities, would continue to apply, but other incentives could be introduced or removed at the discretion of municipalities.

We fill up.

[ad_2]