[ad_1]

“An investment and financial services conglomerate operating in the United Arab Emirates, the United Kingdom, Switzerland, India and other regions,” said a press release from Nitino Shelke, an Indian buyer of Medicinos based in India.

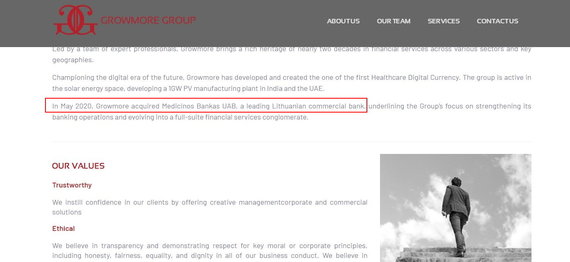

15min I tried to find out what was hidden under the strong words. However, the group’s website is a fairly modest showcase with descriptions, offering property and investment management services. Here it is noted that the group has already bought Medicinos Bankas, although the transaction has not yet been approved by the supervisory authorities. No financial statements indicating a solid financial position are provided.

www.growmoregroup.co.uk website / The website indicates that the Medical Bank has already been acquired

State records reveal more financial data.

There are several companies in the UK that share this name, with debts that exceed assets, and the registry sends them warnings that they may go into liquidation.

Growmore AG, a small Swiss-owned company, was acquired by Dmitry Pichugin of Ukraine, serving in Russia. The company was also rescued by the buyers from the liquidation.

PRNewsfoto / Growmore Group Photo / Nitin Shelke

At that time, the Dubai International Center Registry did not find the name Growmore in the public search differences. In Mumbai, India, businessman Nitin Shelke runs several small businesses.

However, this group last year distributed crypto tokens, the so-called records, with investors announcing that the group owns $ 24 billion. However, the value of the chips is currently zero, recorded in the virtual wallets of 14 people with them.

The Growmore Group has caused many doubts to financial experts: if the buyer is really the advertised one, this group has not heard from anyone and the Bank of Lithuania will have to confirm whether the buyer is suitable. The authorities promise to be diligent.

Even the communication about the transaction is different: the notice in Lithuanian indicates that the buyer is N. Sheke himself, at that time, in the notice in English, the buyer was named the Growmore group.

It is estimated that the cost of Medicinos bankas could reach around 15-30 million euros.

The Growmore group itself 15min He explained that the assets it manages are concentrated in the United Arab Emirates (UAE), the group is highly committed to the confidentiality of its clients and therefore does not disclose financial information to the public.

“Growmore does not grow out of debt in the UK

The House of Companies in the United Kingdom (United Kingdom) is public: anyone can consult the documents of the company.

The record indicates that Mr. Shelke is an Indian living in the United Arab Emirates, born in June 1972.

The first company managed by N. Shelke is Growmore Asset Management PLC, and its activities include financial management and consulting. The company is behind in the presentation of the financial statements. The latest report said the company was down, with no employees. Although the accounting assets of the company in 2018. at the end of May it amounted to 36.7 thousand. In pounds sterling, the report notes that 37.5 thousand of equity shareholders did not pay anyway, they are considered creditors. So there was no money in the company.

The UK registry had even issued a warning that the company would be decommissioned if its activities were not proven.

Luke April photo / 15 minutes / Medical Bank

The second micro-company with a similar name, Grow More Assets Management Group Limited, is registered in the United Kingdom. The debts of this company amounted to £ 134,000 and far exceeded its available assets of £ 20,000. Before N. Shelke, until 2017. In September, the company was controlled by another owner, Peter Anthony Smith of Lesotho, a company that had changed its name several times before.

There are more companies owned by British businessman N. Sheke: Growmore London Limited, Growmore African Minerals LTD, Growmore African Resources. All of his assets are £ 100 each. N.Shelke has indicated its different addresses for correspondence in companies.

In addition to N. Shelke, it is also owned by others: Rajinder Lakha, who also lives in the UAE, not only owns part of the shares, but is also listed as director, Elena Jakimova, a Macedonian living in the UAE United, it also owns part of the first companies. born in 1992, as well as other people.

In Switzerland, old ties to Russia

Another country where the Growmore Group operates is Switzerland. Here, Shelke has been controlling a company called Growmore AG since February 2018. The company has an interesting story: It used to operate under a completely different name: Leyton Suisse AG, and it was run by Ukrainian lawyer Dmitry Pichugin.

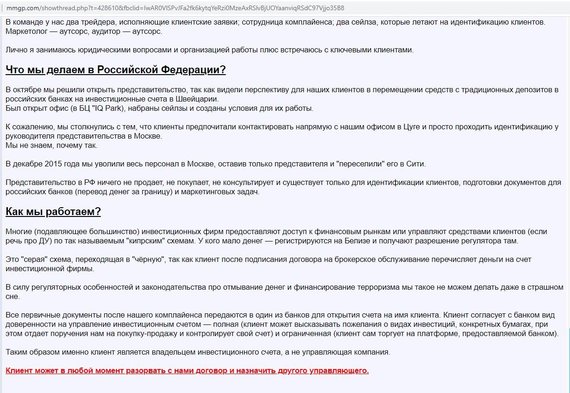

“I represent a small Swiss investment firm that specializes in low-risk fixed income products. 2015 I received a permit to work as a financial intermediary in August, ”wrote D. Pichugin in the forums in 2016, noting that he had managed his own funds and those of his friends until then.

He writes that the company had opened an office in Russia in hopes of finding clients who wanted to transfer funds from Russian banks to Swiss investment accounts. But the flaw was that clients preferred to communicate directly in Switzerland, so the office had to close.

mmgp.com information / The company in Switzerland offered services in Russia before its transfer to Growmore

“Unlike our counterparts in the Russian Federation, we charge a one-time fee for money management, which depends on the amount, which ranges from 0.5 to 2 percent,” if this information is correct in the forum. It can be understood that the company has negotiated investment service providers.

D. Pichugin specializes in corporate and tax law, implements investment projects for clients around the world, and has not mentioned this company in his biography.

When the company was transferred to the buyer of Medicinos Bankas and its name was changed on February 21, 2018, the company was liquidated by a decision of a Swiss judge in 2019. in April On appeal, the liquidation was avoided.

A search on the LinkedIn social network reveals that three people have identified Growmore as a workplace in the UK. One of them, Nicole Lamg, indicated that she is an intern, that she is still a student. At the time, the Growmore Group website says: “Nicole’s experience includes asset and fund management, digital banking, and she has several years of experience in database management, sales, and financial administration.”

Luke April / 15min photo / Money

5 people indicated on the social network that they were in the workplace with the Growmore Group in the United Arab Emirates. 15min He tried to discover a company with that name in the Dubai registry, but failed. Only the address without the company name appears on the group’s website.

Entrepreneur N. Sheke has several companies in India. Growelite Solar City Private Limited was established in 2018. The company is registered in Mumbai in October, the paid capital of the company reaches 100 thousand. rupees or about 1220 euros.

Another company is Savings Consultancy Services Private Limited, which has the same capital. The companies do not have websites, and the dnb.com record indicates that their number of employees is 24 and their annual income is 1.3 million. dollars There is no way to verify this information.

Luke April photo / 15 minutes / Medical Bank

I tried to distribute crypt tokens

Growmore appears to have attempted to at least distribute crypto tokens. A separate website, gmamcrypto.com, has been created for this purpose, but does not contain information on how successful it was and how much money was raised.

The plans set out in the White Paper on chips are extremely ambitious: 10% would initially be distributed. chips for $ 1 billion. The funds raised would be used in the field of medical care, as the providers of medical products would pay with tokens, patients, etc.

Tokens called “Growmore Token” currently cost zero, and their total market value is also zero, according to etherscan.io. Almost all the tokens are in only two wallets, in total there are 10 tokens, 24 transactions were made with tokens.

The website, which distributes tokens, boasts that the Growmore Group owns up to $ 24 billion. asset dollars.

gmamcrypto.com inf./ Indicates that the Growmore Group has $ 24 billion. asset dollars

Financial market participants shook their heads

15min He heard from several financial market participants, but none had heard of such a conglomerate.

“I don’t understand anything about that buyer, and I don’t think until the Bank of Lithuania has stated here whether it is appropriate, it would not consider this transaction complete,” said one investment manager, who wanted to remain undisclosed.

He estimates that the sellers of Medicinos Bankas could have received around 15-30 million. euro price

“It just came to our attention then. You can open an annual balance sheet: the sellers wanted to get the capital value. I would say by heart it’s about 30 million euros. And what they got is probably in that box, between 15-30 million.” said the expert.

Financial analyst Marius Dubnikov says the buyer is certainly not a well-known brand.

“I think the main thing is to wait for the decision of the Bank of Lithuania (LB).” Because LB will have to check everything and LB really has a lot more tools than we do. At this point, LB’s answer should be pretty clear: If you give permission, it will probably explain a bit about the buyer, where he is from, and so on. In the current situation, this is not something known brand (trademark – 15min), it is necessary to await the decision of the supervisory authorities, “says M. Dubnikov.

He also speculated that the bank’s price should be close to book value.

Vidmantas Balkūnas photo / 15min / Marius Dubnikovas

“Before the crisis, the price might have been easier to predict than it is now, but that bank would probably have to pay for the book value,” Dubnikov said.

2019 At the end of 2007, Medicinos Bankas’ net worth amounted to 34.4 million euros, according to the financial statements.

The third banker, who wished to remain anonymous, also claimed that Growmore is a completely unknown name, first heard.

“There are many Russian companies in Dubai, their capital is mixed, they are confused, and the devil knows how to locate that market participant.” The Bank of Lithuania will have to identify direct beneficiaries very clearly, which can be very difficult to do when looking at the prism of preventing money laundering, terrorist financing and national security, “said the banker.

Bank of Lithuania: will evaluate 14 institutions

The Bank of Lithuania assures that it has not yet evaluated the sale transaction and the buyer of Medicinos bankas, since Medicinos bankas has not yet requested it.

“We have not issued any permits and, on request, we will carry out the evaluation together with the European Central Bank, the final decision on the acquisition will be made by the European Central Bank.” We will evaluate the transaction in various ways according to our competence as a supervisor: we must ensure that the buyer has a good reputation, we verify all beneficial owners and related parties, we evaluate capital issues, in particular, adequacy, quality and sustainability in general, what is the bank’s future vision? We will pay close attention to the aspect of money laundering and terrorism prevention, ”says Jekaterina Govina, Director of the Bank of Lithuania’s Supervisory Authority.

Bank of Lithuania photo / Jekaterina Govina

It ensures that potential threats to Lithuanian national security will be evaluated by a National Security Commission formed by the Government, which consists of 14 institutions, including the Department of State Security.

It has already been announced that a 100 percent stake in Medicinos Bankas will be acquired by a businessman from the United Arab Emirates, N. Shelke, who manages the financial and investment services group Growmore Group. Currently 89.91 percent. Bank shares belong to Konstantin Karos, 9.87 percent. It is owned by the company Western Petroleum Ltd, 0.22 percent, the businessman Vytenis Rasutis. The value of the transaction is not announced by agreement of the parties.

Lithuanian lawyers represented both parties to the transaction: the seller, TGS Baltic, and the buyer, Sorainen.

Luke April photo / 15 minutes / Medical Bank

Last year, Medicinos Bankas earned $ 3.99 million. The bank’s assets amounted to 356 million euros. euros Previously, the Bank of Lithuania established additional capital requirements for Medicinos Bankas.

“Growmore Group: we manage 3,000 million dollars, the majority in the UAE

The purchaser of Medicinos Bankas is a natural person: N. Shelke, founder and CEO of Growmore Group, 15min Questions were quickly answered by the Dubai-based ASDA’A group’s public relations agency.

“We provide finance, investment and fund management solutions that drive wealth creation and create long-term value for our clients. Although the majority of our operations are in the United Arab Emirates, we are ambitious and focused on the growth of vertical businesses in the UK and Europe, “said the agency specialist.

In addition to financial services, asset management, banking, venture capital, the group also operates in other strategic sectors, including healthcare and clean energy.

We asked if there was any evidence that N.Shelke or his company had the necessary funds to complete the transaction, or if we were able to access the group’s consolidated financial statements.

Growmore Group, founded in N. Shelke in 2011, manages $ 3 billion in assets, concentrated primarily in the UAE. In each jurisdiction in which we operate, we are authorized and regulated by the corresponding authorities. Currently, the majority of our revenue generating assets are located in the UAE, and companies in the UK and Switzerland are still in their infancy, but we are focusing on growth in these markets and this acquisition is a strategic step towards this goal, ”said the comment.

The UAE Group emphasizes that it operates in the private financial services sector and serves such clients, including those with a large amount of assets, as well as family offices and entrepreneurs around the world.

“As a private company, we do not disclose any of our financial information to the public in the best interest of our clients, who value trust and confidentiality. However, we understand our commitment to comply with all necessary disclosure requirements of the Bank of Lithuania to get approval ”, explains the Growmore Group.

Luke April photo / 15 minutes / Medical Bank

We asked if Mr. Shelke would be the direct beneficiary or if there were no other investors hiding behind the fiduciary instruments.

“N. Shelke is a 100% beneficial owner and the property or interest will not be transferred or assigned to any trust or investor. It is a strategic acquisition that aims to expand the group’s banking and financial services platform and grow our operations in the UK and Switzerland, ”said the comment.

Praise Lithuania

In its comment, the Growmore Group explains that it chose Lithuania for the acquisition because the country’s banking operations are well diversified and the country’s strategic location “provides a springboard to further strengthen its presence in Europe.”

“The country is famous for the fact that it is easy to develop business here.” The country has a better credit rating and structural financial reforms. The banking sector in the Baltic States is stable and well regulated, which makes it very attractive from an investment perspective, ”said the public relations representatives of the Growmore Group.

The acquisition of Medicinos Bankas in the retail banking business is part of Growmore’s strategic vision to “evolve into a full-service financial services conglomerate that provides a comprehensive solution platform for all existing clients.” It is expected to expand banking services in Europe, using the base created in Lithuania.

The Group also ensures that it is considering other acquisitions as part of its strategy to grow its banking business.

“We will release more information when the acquisition is complete,” the group explained.

[ad_2]