[ad_1]

Lithuania, which has been growing rapidly for the past four years and has approved a surplus budget, has joined the ranks of the EU. But already this year, things can change.

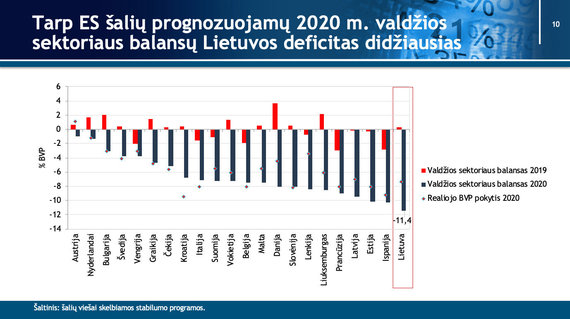

In 2020, the budget deficit in Lithuania may be the largest in the entire EU: such evaluations were provided by the Ministry of Finance, which summarized the forecasts presented in the stability programs of the EU countries.

According to the forecasts of the Ministry of Finance, in 2020, depending on compliance with risk factors, the deficit of the Lithuanian general government may vary between 9.1 percent of GDP and 11.4 percent of GDP. If the pessimistic scenario is confirmed, the budget deficit will be one of the largest in the country’s history.

Illustration of the Ministry of Finance / General government balance deficit

“In 2020, the projected budget deficit in Lithuania is the largest in the EU. Many of the planned stimulus measures are directly related to spending, both in terms of employment and liquidity. Of course, if the actual use of funds is different, the balance indicator will also be different ”, Miglė Tuskienė, Deputy Minister of Finance, approved the stability program prepared by the Ministry of Finance in the Seimas European Affairs Commission.

Photo by Julius Kalinskas / 15min / Miglė Tuskienė

According to data compiled by the Ministry of Finance, Spain forecasts that its balance of general government will be around 10.3%, Estonia around 10.1%, Latvia 9.4% and France 9%.

The lowest balance of the general government is projected in Austria, the Netherlands, Bulgaria and Sweden.

Bank of Lithuania: new initiatives will further inflate the deficit

Commenting on the data presented in the Stability Program on Tuesday, the President of the Board of the Bank of Lithuania, Vitas Vasiliauskas, pointed out that the budget deficit in 2020 may be even greater, since the Stability Program does not include a new package stimulus worth LTL 931 million. EUR: about 2.1 percent. GDP

Photo by Julius Kalinskas / 15min / Vitas Vasiliauskas

In the opinion of the Bank of Lithuania, in such a case, the deficit, based on the forecasts of the Stability Program, could reach 11.2-13.5 percent.

“The evaluation of the stability program does not include measures that were born later, various initiatives not only from the government, but also from other institutions. We have to think about the medium-term perspective, since the additional measures increase public debt and we are getting closer at the Maastricht criterion of 60%. GDP debt “, warned the Chairman of the Board of the Bank of Lithuania.

For example, the Stability Program indicates that by April 27, the economic stimulus measures adopted by the government directly affect the balance of the general government by 6.8%. GDP

“However, existing measures are constantly reviewed, new ones are adopted and the collection of budgetary revenue has decreased, which may further worsen the balance of the general government,” says the Bank of Lithuania.

The most important thing is not to eat borrowed funds.

Therefore, V. Vasiliauskas emphasizes that it is very important that fiscal measures are used with purpose, creating an advantage for the country in the medium term and increasing competitiveness. That’s what would help reduce debt later.

“If the money is used for daily expenses, in the short term it can stimulate the economy, but in the long term it will not contribute to economic growth in any way,” thinks V. Vasiliauskas.

This view is shared by financial analyst Marius Dubnikovas, who claims that a large budget deficit this year would not be terrible if Lithuania used enough cheap funds for investments that create added value and preserve jobs.

Vidmantas Balkūnas photo / 15min / Marius Dubnikovas

Otherwise, Lithuania would increase its debt again during the crisis, but would not bring any benefits.

“If we are at the tail end of the eurozone in terms of budget deficits, we have to worry, because it is clear that we will have to finance the entire debt hole.” Then, those optimistic spirits that were formed by the fact that we are going to stimulate the economy thanks to the decrease in debt. The erupting deficit ball could gobble up our borrowed funds and we would be in a situation where we increased our debt again during the crisis, but we did not get additional momentum relative to other countries. Although we have an opportunity to borrow funds, they will be used to cover the deficit. Then we will end up with higher debt for higher interest rates, ”says Dubnikov.

Conservative Mykolas Majauskas was outraged Tuesday by one of the largest budget deficits in history.

“The size of the deficit itself is a double indicator, reflecting not only the drop in revenue, as was the case in the previous crisis, when revenue was reduced and there were no resources to increase spending.” In this case, we have a decrease in income and, at the same time, a fiscal stimulus (economic stimulus package), which will drill the largest fiscal hole in the Lithuanian budget in the entire EU, “says conservative M. Majauskas.

Incidentally, the Bank of Lithuania, which evaluated the Stability Program, notes that the worst case scenario presented in the Stability Program is 7.3%. The decline in GDP is milder than the benchmarks of other institutions, for example, the European Commission, the International Monetary Fund and the Bank of Lithuania forecast 7.9, 8.1 and 11.4 percent, respectively. Decrease in GDP economy in 2020

“However, if the economic situation corresponded to a bleaker development, it would become an additional burden on public finances, i. And. The deficit and debt would be even greater,” emphasizes the evaluation by the Bank of Lithuania.

Economists: the most important year 2021

Meanwhile, Sigismund Mauricas, chief economist at Luminor Bank 15 minutes He stressed that this year, investors will be more forgiving of the state’s poor fiscal performance, which will pose the biggest challenges in shaping the 2021 budget. A large budget deficit in 2021 may also increase the cost of borrowing. And the bigger the budget deficit this year, the more difficult it will be to reduce it next year.

Photo by Josvydas Elinskas / 15min / Žygimantas Mauricas

“We will have to decide what kind of deficit we will tolerate.” And the worse this year, the harder it is to set up next year’s budget. If the health crisis ends in October and we don’t have a second wave, there will be pressure on countries to balance their budgets and shape their budgets with significantly lower deficits. Then the possibility of tightening the belts cannot be ruled out. The more we loosen this year, the more likely we are to tighten our belts next year, “says J. Maurice.

The economist emphasized that the Nordic countries, which are better able to deal with the losses caused by the pandemic, will be able to fit into the 3% budget by forming next year’s budget. From the government deficit gap to GDP, some countries can still balance even with less than 10 percent. ribos

“It is better for Lithuania to join the Nordic group and in 2021 to have around 3 percent. Budget deficit so as not to attract negative attention. Otherwise, the cost of debt may start to increase and the cost of financing is very important. The better our image, the cheaper we can borrow and less debt costs. Debt is not a challenge as long as you can borrow at low cost, “said the economist.

For this reason, if there is no second wave and the economy begins to recover, he proposes to revise the economic stimulus plan in the fall and not to waste the planned funds if not necessary.

It is true that Ž.Mauricas doubts that Lithuania will outperform the countries of southern Europe, where the quarantine lasted longer, in terms of the size of the state budget deficit in 2020. Furthermore, they are more dependent on tourism, more workers used the mechanism of inactivity time. The economist recalled that the European Commission predicts a smaller budget deficit in Lithuania than in Spain, Italy or even France.

The value of the incentives is 17%. GDP

The stability program estimates that in 2020, measures to combat the negative effects of COVID-19 (including measures to increase banks’ credit potential by 5.6% of GDP) will amount to 17.1% of GDP.

Of these, the measures evaluated in the Program, excluding the measures to increase the loan potential, amount to 10.6 percent of GDP, and the value of the measures that directly affect the balance of public administrations amounts to 6.8 percent of GDP.

At the end of 2019, the general government debt represented 36.3 percent of GDP and was 2.4 percentage points more than in 2018. This indicator was affected by the 1.3 billion accumulated at the end of 2019. funds for redemption Eurobonds in early 2020. In 2020, debt is projected to range between 46.8 percent of GDP and 50.6 percent of GDP.

State control: the budget deficit is greater than during the previous crisis

Meanwhile, the State Audit Office estimates that the pace of spending and the non-collection of revenue will lead to public debt jumping to new heights: this year the debt will exceed 50 percent of gross domestic product, and the next year will approach 60 percent.

Sigismund Gedvila / 15min photo / State Audit Office of the Republic of Lithuania

In comparison, during the previous financial crisis, debt had increased further to almost 40 percent. GDP

The general government deficit will be 10.9 percent this year. GDP, and next year – 4 percent. GDP The budget deficit will be the highest in at least 15 years and higher than during the last financial crisis in 2009, the National Audit Office projects.

General government debt has likely remained relatively stable until the economic downturn caused by COVID-19. it will reach 50 percent. GDP level and will approach 60%. Maastricht debt criterion of GDP, evaluated by the tax authority.

The State Audit Office points out that it is necessary to follow a specific and growth-friendly fiscal policy when the economic recession is expected. But we will have to think about how to reduce debt in the future.

Although in 2019. The Lithuanian economy grew faster than expected, the amount of funds accumulated in the fiscal reserves was 8.6 percent. lower than expected and amounted to 2%. GDP, writes the State Audit Office.

The surplus government rule was also not followed, and not all general government budgets were implemented in accordance with fiscal discipline rules. General government debt in 2019 at the end of the year represented 36.3 percent. GDP

[ad_2]