[ad_1]

15 minutes the cycle of publications of the ongoing study on what was previously unknown continues Vitoldas Tomaševskis, one of the richest people in Lithuania. Related companies in Belarus have been included in the EU sanctions list. This section reviews the investments of companies related to V. Tomaševskis in Russia.

He lent a large sum to the business of the Russian magnate

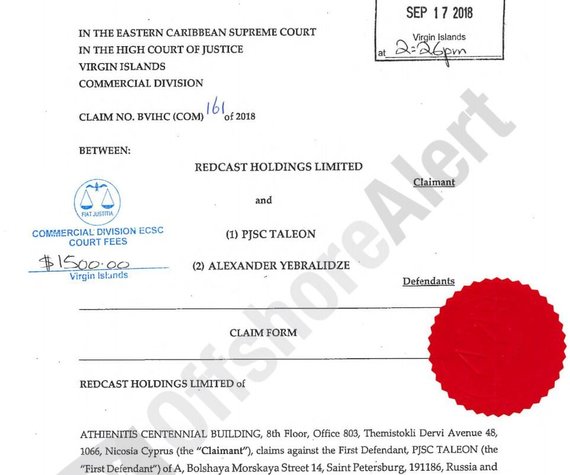

In 2018, the Cypriot company Redcast Holdings Limited, which is related to V. Tomaszewski, filed a lawsuit in the Virgin Islands against Alexander Ebralidze and the Russian company Taleon, which he controls. The Cypriot company demanded that the Russian magnate’s business pay the debt. Claim amount – US $ 65.7 million. The amount loaned is said to have been $ 30 million, but has been increased by interest.

Abrelidze is a Georgian-born magnate living in St. Petersburg who unsuccessfully attempted to run for the Georgian presidency in 2009, advocating neutrality and close ties to Russia. He was hampered by the fact that he had not lived in Georgia for the past 40 years.

OffshoreAlert inf./ Document filed with the court

A. Ebralidze led the Taleon business group, which owned a luxury hotel and club in Saint Petersburg.

However, it appears that the loan to the Georgian oligarch business was not previously granted by the same company that filed the lawsuit, but by Hansel Asset Management, registered in the Virgin Islands. At least it shows it publicly available online companies Taleon data.

This is another link with V.Tomaševskis, as Hansel Asset Management of the Virgin Islands along with V.Tomaševskis indirectly controlled Cypriot company Hansel Trading Limited. The latter traded petroleum products produced by Yuri Čižs at the Triple Company in Belarus, as 15 minutes described in the second part of the study.

Wikipedia / Alexander Ebridze photo

15 minutes He tried to contact or receive comments from V.Tomaševskis, give him the opportunity to present his position, explain or clarify the information, but instead the law firms in Lithuania and Switzerland threaten litigation, including criminal cases.

Much 15 minutes Based on the data collected, the ultimate beneficiary of Cyprus Redcast Holdings Limited may be V. Tomaszewski.

Tomaševskis’ links with Redcast Holdings Limited

- In its documents, Redcast Holdings Limited referred to V. Tomaševskis as a related person.

- Tomaševskis had loaned more than 8 million to Redcast Holdings Limited. euros

- In its documents, Redcast Holdings Limited also mentions companies directly controlled by V. Tomaševskis, who lent money and transacted.

- The Lithuanian businessman, who had financial affairs with this company and V.Tomaševskis, testified for 15 minutes that the owner of Redcast Holdings Limited is V.Tomaševskis.

- This Cypriot company previously controlled the Lithuanian company EC Turtas, whose apartment in Vilnius’ old town could be used by V. Tomaševskis.

- Loreta Zakarkienė, still billed as Tomaševskaja, has been officially among Redcast Holdings Limited’s shareholders for a long time.

- V.Tomaševskis is mentioned among the shareholders of companies in various jurisdictions, whose names use variations with the words “Redcast” or “Hansel”.

- V. Tomaševskis flew in a private plane, whose owners mention the Redcast Group registered in the Virgin Islands as a shareholder among related parties: this company was a shareholder of Redcast Holdings Limited.

V.Tomaševskis is mentioned in the data of “Panama Papers”

V. Tomaševskis’ name is also mentioned in the journalistic investigation of the Panama Papers, which examines leaked data from Panama’s law firm Mossack Fonseca. This company is known for helping the world’s richest to avoid taxes. Several high-ranking Russian officials have previously been reported to have concealed their business in Panama and the Virgin Islands, although since 2013, Russian law has not allowed public officials have offshore companies.

One such person is Viktor Zvagelski, a former Russian Duma deputy and member of the United Russia party, owner of Bariton Consultants and Delcroft Real Estates. Before his career as a politician, V. Zvagelskis was a businessman and traded in alcoholic beverages. He denied to the Russian media that he had ties to Panamanian companies.

AFP / Scanpix Photo / Mossack-Fonseca Building in Panama

In June 2016, the law firm Mossack Fonseca attempted to find out who the true shareholder of the Panamanian company Delcroft Real Estates was: according to internal correspondence, this offshore company, acting in the interest of politicians, intended to acquire SG Private Banking . Still, this deal failed. In the summer of 2016, Lithuanian citizen Vitoldas Tomaševskis became the owner of an offshore company in Panama, he wrote novayagazeta.ru.

However, V. Tomaszewski may not have taken over the actions of a Russian politician.

However, the name Delcroft Real Estates appears in the documents of companies related to V. Tomaševskis. In 2016, the Lithuanian Cypriot company Openlane owns in the financial statement borrowed 4 million Delcroft Real Estates euros

The project in Kaliningrad has met with resistance from local communities.

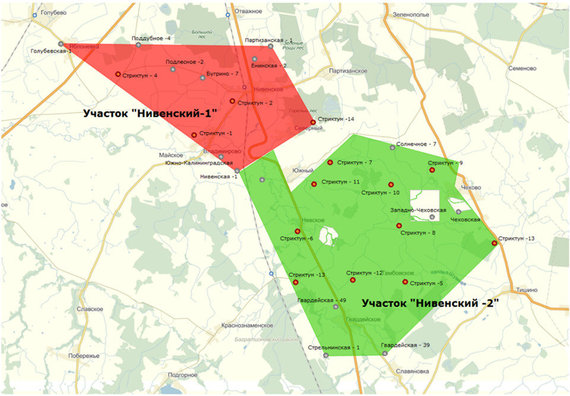

Around 2014, residents of the village of Nivenska (Wittenberg) in Kaliningrad were alarmed by a mysterious Dutch investor who plans to open a magnesium-potassium salt mine and a processing plant on the outskirts of the city.

An unprecedented investor purchased an industrial and technical base in Kaliningrad from Lukoil. At a depth of 1.1 kilometers in the reservoir, it was planned to extract minerals and process them into table salt and potassium sulfate for agricultural fertilizers. The mine has been declared to have a capacity of 5.5 million tons and the processing plant 2.5 million tons. tons, then there was talk of investing 30 billion rubles in the project (385 million euros at the current rate), wrote on kgd.ru.

The premises due to the harmful effects on the environment for some time. fight fiercely against the planned mine. It is feared that the extraction of potassium salts could cause an ecological catastrophe not only in Kaliningrad but also in northeast Poland, Posted by exclav.ru.

The Russian Federal Service for Consumer Protection and Human Welfare has assessed that the construction of the salt mine represents a potentially significant risk to the population. In 2017, residents even turned to Vladimir Putin. During the visit, the Russian president instructed the region’s leaders to deal with this situation, then the regional autonomous government proposed and agreed to create a kilometer-long health protection zone.

A large mine is planned in Kaliningrad

Relations between the two bidders lead to Cyprus Redcast

Two unknown Russian companies competed in the land auction for this mine: Temperans and Striktum, the latter of which won and received a license to mine potassium and magnesium ore deposits near the town of Nivenskoye.

Activists in the Kaliningrad region began to discover what was behind the Striktum company, and there was long speculation as to who the company might belong to. Portals rezonans39.ru The company was linked to Belarusian businessman Yuri Chiz, but no one could identify the final beneficiary.

The Russian company Striktum, the builder of the salt mine, was controlled by the aforementioned Dutch company, and the latter ruled for many years Redcast Holdings Limited, a Cypriot company affiliated with Tomaszewski. The company’s managers are former representatives of the Lithuanian legal services firm Lewben.

Photo from www.leamber.com/Vilius Kavaliauskas, Vitoldas Tomaševskis and Algis Bitautas in Shanghai

The legitimacy of the auction was widely questioned on the Russian portal, as the head of two rival Russian companies, Striktum and Temperans, was named by the same person, with links to the Lewben Group between the two participants.

Lewben, who won the auction at Temperans, had a capital ruble and a 99.9 percent stake. Shares: Owned by VAP Global, a company registered in the Virgin Islands, is written Russian business directory.

Documents from Redcast Holdings Limited, a Cypriot company linked to Tomaszewski, confirm that the two Russian companies competing for the construction of a salt mine in Kaliningrad may be related.

Cyprus Redcast 2015 among the companies it manages appointed the shareholders of Striktum and Temperans.

For serious damage to Russia, leaders sentenced in Moscow

Parallel to the project in Kaliningrad, the names of the same Russian companies – Striktum and Temperans – were heard in a criminal case in Moscow.

In January 2018, the Moscow Ostankin District Court sentenced five defendants to 3.5 to 6 years in prison in a scandalous criminal case for deliberately selling a Russian state-owned company, Quantum-N, at a deliberately higher price. low. Russia is estimated to have suffered 1 billion rubles (at the current rate of € 12.8 million), he writes. Kommersant.ru. It is true that prosecutors estimated the damage at up to 3.5 billion. rubles

Anna Myagkova, CEO of Striktum, and Stanislav Korenkov, CEO of Temperans, have been sentenced to 5.5 years in prison, Russian media reported.

The story began in 2011, when Vladimir Kozhin, director of the Asset Management Department of the Russian President Vladimir Putin’s administration, started the privatization process of the Russian state-owned company Quantum-N. The company’s assets at that time were valued at $ 700 million. rubles (9 million euros at the current exchange rate). An auction for the sale of the company was announced.

The Russian state company Kvant-N previously worked in the Russian space industry, developed autonomous energy supply sources, but also managed a large number of real estate – 12 buildings in an area of 50 hectares.

As in Kaliningrad, two of the same Russian companies, Striktum and Temperans, competed in the announced auction. Only in Moscow did Striktum lose, and Temperans was announced the winner. Temperans took control of Quantum-N for $ 760 million rubles

Subsequently, after receiving a statement from the Russian Space Agency, the police launched an investigation into large-scale fraud, considering that the sale price was too low compared to the market value. Estimates show that the cost of the Quantum-N-managed building complex exceeds $ 3.5 billion. rubles, vol. that is, several times the sale price of the company.

The main suspect was Alexander Nistratov, assistant chief of the Federal Property Management Agency, who fled to the United States, where he had obtained a residence permit, he writes. Kommersant.ru.

Even people close to President Putin’s witnesses who signed the documents testified to the case: the aforementioned V. Kožinas, as well as the Duma deputy, the former head of the Federal Agency for State Property Administration, but They avoided responsibility by explaining that they were unaware of the intentions of their subordinates.

The agreement was canceled, but here the story in Moscow did not end.

Photo from 123rf.com / Moscow Kremlin

By the time Temperans controlled the acquired company Kvant-N, around $ 1.5 billion had been hijacked from Russia’s Alfa Bank and the Russian space agency Roskosmos. rubles, write pravo.ru. After taking charge of the real estate, the managers of the companies adapted it to the business center and rented it. In 2013-2015, Temperans and Kvant-N entered into many agreements with companies on the same day for a variety of jobs and services for more than $ 250 million. number of rubles Studies have shown that the work was not actually carried out.

According to the announcement, Temperans took 900 million from Alfa Bank. Credit in rubles by committing the assets of Kvant-N – 20 objects that belonged to a state company. Although the court awarded the bank almost 1 billion rubles, Temperans has no assets, he wrote. pravo.ru.

The total outstanding claims of Temperans’ creditors amounted to 2.2 billion rubles, or 28 million rubles. Eur at the current exchange rate, Show court orders.

15 minutes According to data collected in 2006, the Russian company Temperans was the beneficiary of a large loan even before the acquisition of the state-owned company Kvant-N. Redcast Holdings Limited, a Cypriot company linked to Tomaszewski, mentioned another Cypriot company in their submissions. The latter to the Russian company Temperans In 2011 it lent 16 million euros

The developer of the Kaliningrad mine has changed.

Let’s go back to the salt mine in Kaliningrad. In the course of the cases in Moscow, in April 2018, the developer of the mining project changed. Another Russian company, K-Potash Service, took over the rights to the project from the Russian company Striktum mentioned in the lawsuit.

But the final beneficiary of the project does not appear to have changed. By Dutch company The shareholder of the Russian company K-Potash Service was the Cyprus-registered company Openlane. The latter is controlled by a long chain of foreign companies, where Lewben Group representatives hold positions of responsibility for various periods.

The Openlane company is also related to the Lithuanian Vitoldas Tomaševskis. This Cypriot company controls the Lithuanian company EC Turtas, which owns a luxury apartment in Vilnius’ old town and participates in the Lithuanian amber business. Algis Bitautas, co-owner of this last business 15 minutes confirmed that V. Tomaševskis was the final beneficiary of this company.

In addition, Cypriot companies are associated with V. Tomaszewski they are borrowed tens of millions of euros quantities Kaliningrad Salt Mine Development Companies.

Finally, the concept of the project in Kaliningrad was renewed to reassure the local population: the area near Nivensk is intended to be used only for administrative buildings, direct production here was promised It wont happen.

Supported by the local government

In January 2019, the governor of the Kaliningrad region, Anton Alichanov, described the mine project as significant and stated that “its implementation will allow the region to become a world leader in the production of potassium-free chlorine fertilizers and magnesium “and the project is worth 300 million. euros Posted by rugrad.eu. It is expected to raise 2 billion. rubles (25.7 million euros) per year.

In February 2019, the Kaliningrad media kaliningrad.rbc.ru reported that the investor in the salt mines, the Russian company K-Potash Service, was allowed to build a three-story administrative building.

And a few months later, a subsidiary of the K-Potash Service bought 35 hectares of state land for a mine near the village of Vladimirov at auction. The initial price was 3.3 million. rubles (42.5 thousand euros), and the company was the only participant in the auction. It was announced that the auction would be extremely short and that the area had not previously been included in the privatization plans. This was caused by space prosecution charges.

Vasilijus Kučerakas, director of implementation and security of the K-Potash Service project, assured at the round table of the Regional Duma that the land had been purchased or provided by the Investment Council with the required radius, he writes rugrad.eu. He mentioned that the total surface of the mining and processing plant will be 53-54 hectares.

This Kaliningrad salt mine project is still under development.

Invested in raw material extraction

In this post 15 minutes The investment list of Redcast Holdings Limited, a Cypriot company associated with V. Tomaszewski, described in 2006, is not exhaustive, as this company has listed dozens of companies at different times between related parties.

In the 2013 financial statements Cyprus Redcast has indicated controlling 42.5 percent. shares of the Russian company Invest Trade. He had made significant investments in it: Redcast had loaned more than $ 11 million to the company. euros

Invest Trade is an oil and other raw material extraction company in Russia’s Komi region, licensed to explore and extract mineral resources. Since 2019, the company has faced problems: 8 unforeseen inspections have been carried out, and 6 of them have been identified as violations, as well as previously registered legal disputes between shareholders, referred to checko.ru.

Another business in Russia, with which V. Tomaszewski may have been involved, is Belaz-Pomorie, whose field of activity is the extraction of mineral resources.

BelAZ is a state-owned automobile factory in Belarus that produces trucks for large mines and quarries and other mining equipment. Russia is the main export market for this company.

And the Russian Belaz-Pomorie appears to be serving the Russian raw material mines.

Belaz-Pomorie reportedly reached its peak in 2013, receiving $ 4 billion. rubles (around 93 million euros at the then exchange rate) and earned 945 million. rubles (about 22 million euros) profit.

100 percent. Russian actions of Belaz-Pomorie 2010-2014 revised Cypriot company Lavemar Holdings Limited. Contains 15 percent. Redcast Holdings Limited, a company related to V. Tomaševskis, also owned shares, shows reports in the cyprus registry.

The other shareholders are four more companies. At least one of them, Formpak Investments Limited, registered in Cyprus, belonged to Sergei Čiž, The son of Jurijus Čižas.

Photo of Vytautas Pilkauskas / Belaz 75710

In 2013, the Cypriot company Lavemar Holdings Limited paid dividends to shareholders, including the V. Tomaszewski-related Redcast, four times, totaling approximately 10 million. euro at the then exchange rate. Later in 2014, this Russian business was transferred for 150 thousand. euros

Since 2017, Belaz-Pomorie has 60 percent. The owner of the shares is Tatjana Čiž, the daughter of Jurijus Čižas, and the remaining part of the shares belongs to the head of the company.

In the next part of the investigation we will describe the relations and projects of companies related to Lithuania in Lithuania, as well as in Ukraine. The traces of this investor were in the company that governed the Trade Union Palace, investing in amber businesses. In Ukraine, the amber mining business has acquired a political undercurrent.

About research and sources

Birut journal Davidonytė and Ernestas Naprys, journalists from the Investigation Department, carry out this journalistic investigation for 15 minutes.

We rely on publicly available information, testimonies, and responses from story participants to each person.

The study used data from legal entities and property registries in Cyprus, Spain, the Netherlands, the United Kingdom, Ireland, Russia, Ukraine and Lithuania. The investigation was also based on information provided in judgments or lawsuits in Lithuania and abroad, as well as on the financial statements of companies in different countries. Foreign media reports, social media accounts, testimonials and other public sources of information helped establish the connections.

In conducting this investigation, we tried to hear V. Tomaševskis’ position in several ways: We asked his representatives questions both in Lithuania and in Switzerland. However, their responses have not yet been received and all requests have been rejected.

The relationships between the individuals and legal entities described may have changed.

If you have more information on the subject, you would like to ask a question: you can write to the research team for 15 minutes by email at [email protected].

[ad_2]