[ad_1]

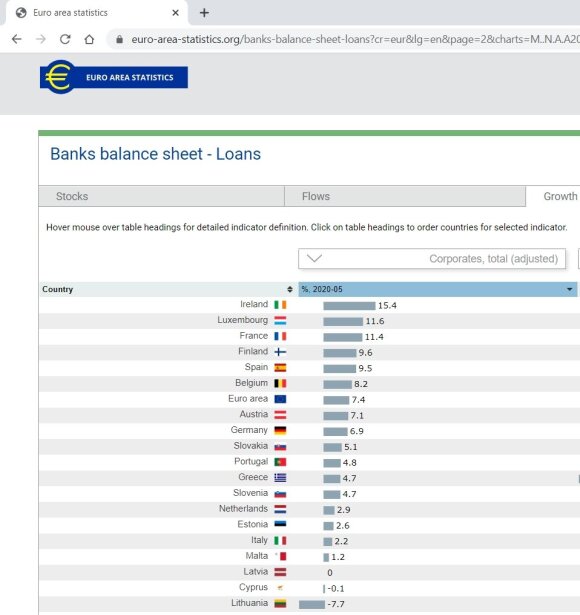

ECB data shows that compared to 2019, In May, the bank loan portfolio to companies (non-financial corporations) in Lithuania contracted by 7.7%, and this annual dynamic was the worst in the euro area in your set. In nominal terms, per year, i. Compared to 2019. In May, the bank loan portfolio for business in Lithuania decreased by LTL 734 million. EUR. In May this year, out of nineteen euro area countries, the annual decline in the bank loan portfolio for companies was recorded only in Cyprus (-0.1%) and Lithuania (-7.7%).

According to a press release, the value of the bank’s commercial loan portfolio in Latvia remained unchanged, while in the rest of the euro area, banks increased their commercial loans in May. In Estonia, the bank loan portfolio to companies grew by 2.6% during the year, compared to 7.4% in the euro area as a whole in May. annual increase.

According to Mindaugas Mikalajūnas, Director of Finance SMEs, the biggest decline in bank loans to companies in Lithuania in the euro area may be due to several factors.

“When evaluating May bank loans for business in the euro area as a whole, there is a significant difference between the dynamics of bank loans in Lithuania and in many other euro area countries: in Lithuania, the loan portfolio Business banking declined dramatically, while in the euro area 7.4 percent, for example in Germany and France, registered 6.9% and 11.4% respectively. Annual growth, the bank loan portfolio for business also increased in Italy and Spain: +2.2 and +9.5 percent, respectively.

The component of the economic stimulus measures may have had a significant impact on the different dynamics of bank lending to companies in Lithuania and many other countries in the euro area. It is difficult to say exactly, but it may be that in other euro area countries banks were more inclined to participate in the stimulus plan than in Lithuania. This may have been the case, for example, due to the fact that stimulus measures applied in other euro area countries were more financially attractive to banks than stimulus measures in Lithuania. Consequently, a more active participation of banks in other euro area countries in the stimulus measures may have contributed to the difference between the dynamics of loans in the euro area and Lithuania, “says M. Mikalajūnas.

According to M. Mikalajūnas, the biggest decline in bank lending to companies in Lithuania in the euro area could have been caused by another reason: the high caution and conservatism of banks operating in Lithuania.

“Analyzing the dynamics of bank lending to companies, we note that in Lithuania the bank loan portfolio for companies began to shrink during the economic growth cycle: for example, last year the bank loan portfolio for companies in Lithuania increased only in the first quarter, and from the second in 2019. The corporate loan portfolio of banks in Lithuania declined steadily in the third quarter, mainly due to the high degree of conservatism and prudence of traditional financiers. Commercial banks in Lithuania tend to work with existing large corporate clients, but due to reduced risk appetite, they are cautious with respect to the Lithuanian segment of small and medium-sized enterprises, ”says the head of SME Finance.

According to M. Mikalajūnas, similar trends in the statistics of Lithuanian bank loans to companies should continue for at least the next few months: in the fall. ‘

According to him, the significantly reduced level of commercial loans may have been influenced by the higher level of uncertainty among companies, which negatively affects companies’ decisions regarding the search for financial solutions.

“Although macroeconomic indicators show that the Lithuanian economy has experienced the worst period of recession and the situation is gradually stabilizing, we note that the business audience still has a relatively high level of uncertainty about the economic outlook, especially in the major export markets This uncertainty encourages companies to borrow cautiously and not rush to bear the additional financial burden, even despite the rather broad business financing package provided for in the Lithuanian Economic Stimulus Plan.

With respect to the economic stimulus measures administered by INVEGA, we note two important aspects. First, not all applicants go to great lengths to complete funding applications properly due to the bureaucratic burden, which automatically extends the time it takes for an applicant to receive funding. Secondly, due to high economic uncertainty, some Lithuanian companies are passively interested in financing opportunities and the measures provided for in the economic stimulus plan. In the public sphere, we often hear complaints from companies about the limited money supply, but in practice we often face passivity on the part of the company. Thirdly, it can be positively assessed that INVEGA responds quickly to the proposals of the partners and constantly adjusts the descriptions of the measures, “says M. Mikalajūnas.

It is strictly prohibited to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, DELFI must be cited as the source.

[ad_2]