[ad_1]

I collected food and drink checks for almost three days. They are from several restaurants, cafes, street food venues. ITS representatives claim that many of the receipts issued to me are void.

L.Tubio / 15min photo / Checks received in Palanga

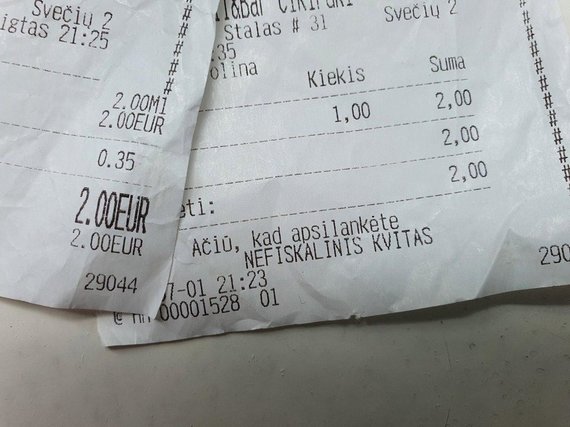

At a fast food café, I received a two-part check with a payment card. In one of them there is a service receipt, in the other there is no such record.

According to Vilija Liutikienė, a Klaipėda County ITS representative, if the buyer had received only one service receipt, they would not have been able to make a claim, for example, of poor quality food, because such receipt does not complete the order cycle. It is necessary to obtain a tax receipt.

How to recognize it will be discussed at the end of the text.

Frequent receipts are marked “non-tax receipt” at the bottom. According to V. Liutikienė, these checks are used to form an invoice that the customer must pay. These receipts are also not final on the order and therefore are not considered valid.

L.Tubio / 15min photo / Non-fiscal receipt received in Palanga

It should be noted that it would be a mistake to assume that the catering establishment that issued the wrong receipt is always manipulating the numbers. My case shows something else: After receiving a non-tax receipt and asking why they just brought it in, the waitress cried, leaned over the trash, and pulled out the recently sealed tax check for my order. In other words, the receipt was removed but was not delivered to the customer for any reason.

Waiters should also not issue the following receipts to customers:

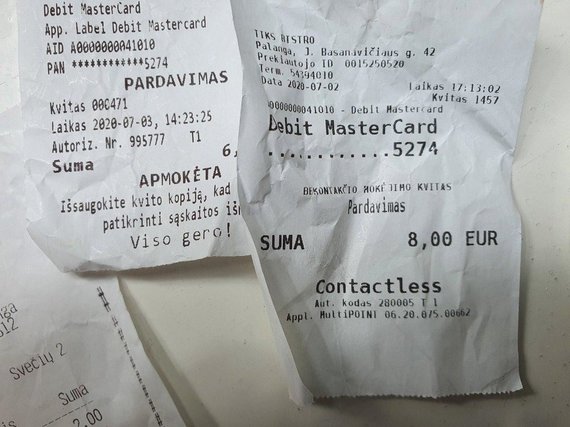

L.Tubio / 15min photo / Check received in Palanga

According to the STI representative, it only shows the fact that the product was paid for with a card. Such a check would not be enough for you if you wanted to complain about receiving poor quality cold beets.

You will not miss the chefs of the cafe, the administration and here is this receipt:

L.Tubio / 15min photo / paper receipt

According to ITS specialist V. Liutikienė, such handwritten receipts are generally not accounted for in any way, so after payment you should request a tax check.

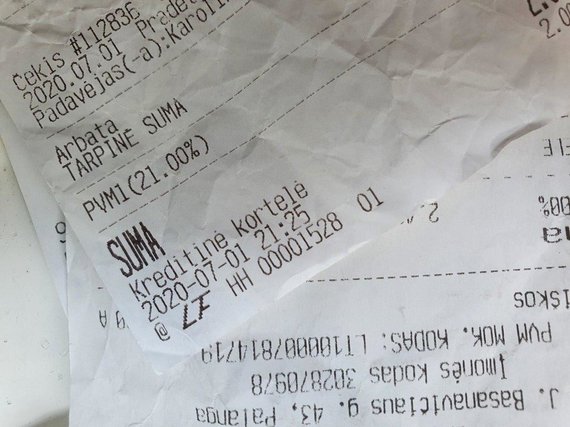

How do you know that you are receiving the correct receipt?

According to her, there are two more important signs. The first is that there must be a symbol at the bottom of the check LTF:

L.Tubio / 15min photo / Check marked with the LTF symbol

Second: the amount of the check must match your account. In other words, there are sometimes cases where a person pays for the property several tens of times more than what is stated on the check, says an ITS specialist.

L.Tubio / 15min photo / ITS representative from Klaipėda Vilija Liutikien condado county

According to V. Liutikienė, the waiters behind the counter, and not the owners of the business, suffer mainly from unfair accounting. An employee can incur a fine of 90 to 200 euros for issuing an incorrect receipt from the register.

And a manager who does not take the appropriate measures to stop such actions can “earn” a fine of 840 to 1350 euros.

[ad_2]