[ad_1]

Although the current situation in the country due to the pandemic is quite confusing, a constant increase in child money, old age, disability and other pensions, the minimum wage helps the most disadvantaged people in the country: families with children, the elderly , disabled, lower income people. Reducing poverty and assisting the most disadvantaged are our top priorities today, ”says Monika Navickienė, Minister of Social Security and Labor.

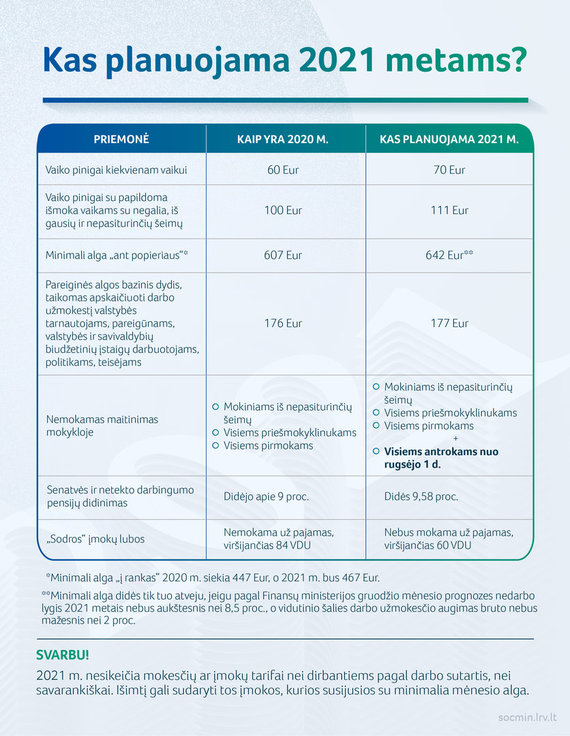

SADM Photo / What is planned for 2021.

What is planned for families with children

CHILD’S MONEY. Next year, the child’s money will increase from 60 to 70 euros. The supplement (41 EUR) is paid to children with disabilities, as well as children from large or low-income families, that is, the child’s money for disabled, children from large families or low-income will amount to 111 euros a month.

SADM nuotr./Vaiko pinigai 2021 m.

The child receives a total of about 518 thousand. children throughout Lithuania, of which about 144 thousand. children – with additional benefit for one child.

Photo by Julius Kalinskas / 15min / Boy’s money

Child money is paid to all children from birth to 18 years of age or up to 21 years of age if the child is enrolled in a general education program, including those in vocational institutions where the education includes a general education program.

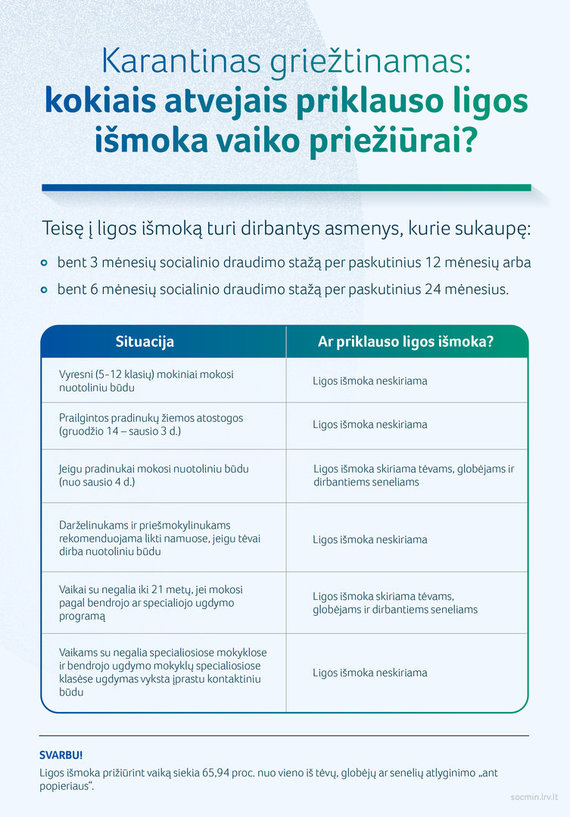

SADM Photo / Child Care Sick Benefit

A large family is one in which 3 or more children are raised and cared for. A low-income family is considered to be one in which the average monthly income per family member does not exceed 256 euros next year, excluding the child’s money and part of the salary and social security benefit for unemployment.

FREE MEALS. Beginning in September next year, not only children from low-income families, preschool and first grade, but also all second graders are expected to receive free lunch at educational institutions.

This school year, almost 350 thousand people study in the country. students, of which around 100,000 are entitled to free meals. students: preschoolers, freshmen, and seniors from low-income families. With the introduction of free meals for second graders, nearly 130,000 will receive free lunches at educational institutions. students.

What is planned for retirees and disabled people

PENSIONS. Old-age and disability pensions will increase by 9.58% next year. Not only will the old-age pension increase by this percentage, but also early retirement pensions, disability pensions, widowhood and orphan pensions.

SADM Photo / Assignment Benefits

It is estimated that the average old-age pension with the required service time in 2021 will reach 440 euros, and the average pension – 413 euros. Currently, the average old-age pension with the required seniority is EUR 400 and the average pension is EUR 377.

Photo from SADM / How are old-age pensions growing?

Beneficiaries of the lowest pensions whose total received pensions, with the exception of social assistance pensions, do not reach the level of minimum consumption needs, receive pension supplements. This year this amount is 257 euros, next year 260 euros. The specific bonus for a person depends on the duration of the acquired life. In the case of a pensioner who has completed the required service period, the total amount of all pensions received may not be less than the amount of the minimum consumption needs. People with less seniority receive a proportionally smaller part of the pension supplement.

Disability pensions are received by residents who have lost 45%. or more than your ability to work. The amount of the disability pension for work differs by 5 percentage points from the level of incapacity for work: people with a greater disability receive higher pensions than those with a lesser disability.

There are about 615 thousand people in Lithuania. retired, about 5 thousand. beneficiaries of early old age pensions, around 160 thousand. beneficiaries of disability pensions, around 30 thousand. beneficiaries of orphan’s pensions.

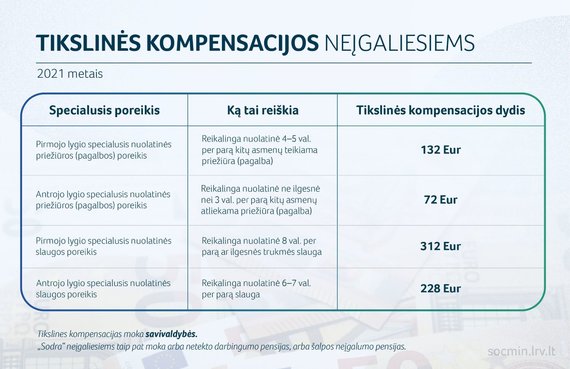

Photo SADM / Specific compensation for the disabled

What is planned for employees

MINIMUM SALARY. In 2021, the minimum wage, which is paid only for unskilled work, will rise from € 607 to € 642 “on paper.” “In the hands” would mean a salary increase from € 447 to € 467 if the person does not accumulate in the second pension pillar.

The minimum wage or lower in Lithuania is paid around 130 thousand. approximately 1.27 million individuals. insured of all types of social security.

The increase in the minimum wage does not require the approval of the Seimas, the decision of the Government is sufficient, but the state budget usually plans funds related to the increase in the monthly minimum wage in the public sector, respectively raising the minimum coefficients for employees in the budget sector .

SALARY. Next year, salaries should also increase slightly for civil servants, civil servants, employees of state and municipal budgetary institutions, politicians and judges, as the base amount of the official salary is increased from 176 to 177 euros.

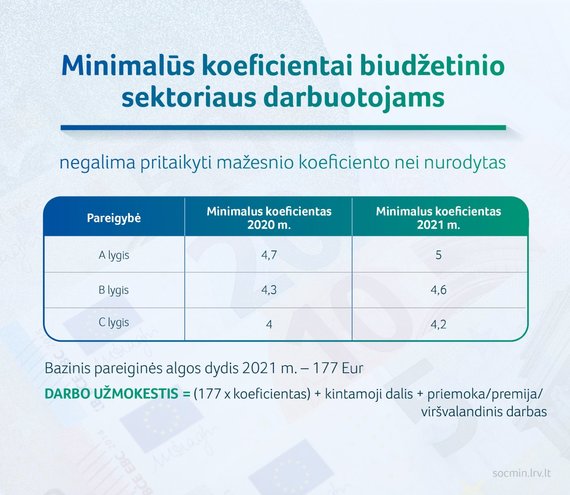

The minimum wage ratios for employees with the lowest income levels A, B and C budget would also increase.

Photo from the Ministry of Labor and Social Affairs / Minimum coefficients for employees of the budget sector

The fixed part of the official salary is calculated by multiplying the base amount of the official salary by the coefficient applied to the specific position. Salaries are usually complemented by a variable part of the official’s salary, which depends on the achievement of work goals, in addition to bonuses, bonuses or overtime payments if he has worked.

The increase in the base amount of the official salary will affect about 200 thousand. officials, employees and civil servants of the public sector.

Other benefits

When the government presents the state and municipal budget projects, the reference indicators for the social assistance benefits for the next year are approved, on which the benefits paid to the population or the right to social assistance depend.

Next year, the basic social benefit is expected to amount to € 40, the social assistance pension base to € 143, the specific compensation base to € 120 and the amount of state subsidized income to € 128.

It is expected that the amount of the minimum consumption needs next year will be 260 euros.

Taxes and fees will not change

For next year no changes are foreseen in taxes or social security contributions, either for employed or self-employed workers, except for contributions and benefits related to the monthly minimum wage.

As is well known, the monthly minimum wage depends on the social security contributions for those insured with state funds, the “floor” of Sodra contributions when the calculated wage is below the minimum, the mandatory monthly health insurance contribution for the self-employed and the annual lower limit if a person is self-employed pays mandatory health insurance contributions for one year.

The minimum wage is also linked to the social security contributions of business licensees and farmers and their partners who do not report income from individual agricultural activities.

Social security unemployment benefits are also increasing as the monthly minimum wage increases.

The “ceiling” on social security contributions should also drop next year. If at present social security contributions are no longer paid if the person’s annual salary exceeds the limit of 84 average monthly salaries, next year the contributions will no longer be paid if the average monthly salary is exceeded. It is also intended to improve the provision on the maximum contribution limit so that a person who works in more than one workplace that exceeds this threshold is also covered.

[ad_2]