[ad_1]

The month is a record

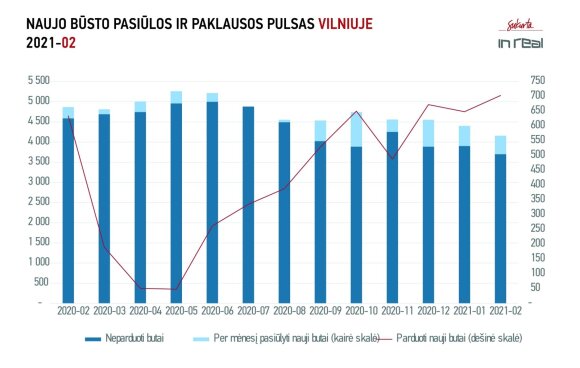

Tomas Sovijus Kvainickas, Head of Investments and Analysis at Inreal Group, says in a press release that although February is the shortest month of the year, it did not stop property developers in Vilnius from setting a new record: 703 new apartments were sold (723 new agreements, 20 previous cancellations of existing agreements). For more than a month, the growing sales in the primary market make it necessary to speak not only of the “spring” effect when buyers have postponed their decision due to quarantine restrictions and the effects of the pandemic, but also of other markets activity .

“Typical macroeconomic factors (banking policy, labor market, inflation, population opportunities, etc.) are no longer sufficient, since their change is not significant enough to stimulate such growth in real estate market activity. When looking for answers, it is necessary to examine the internal factors of the new housing market and its changes ”, says Tomas Sovijus Kvainickas, Director of Investment and Analysis of Inreal Group.

One of those domestic market factors is the deal ratio, especially in the early stages of a project. Previously, preliminary and first-month agreements for new housing projects in Vilnius used to amount to 10%. total monthly sales. In December 2020, more than a fifth of all agreements were concluded and in February more than a tenth. According to TS Kvainickas, there is a noticeable increase in sales in the second to third month, from 10 to 15 percent. up to 15-20 percent. The developers offer buyers the possibility to enter into preliminary contracts before obtaining a building permit, both to raise funds for the development of the project and to better explore the market and determine the attractiveness of the project. These contracts often provide for lower upfront payments, making it easier to accumulate your initial contribution and enter into preliminary buy and sell agreements more quickly. Only some developers refer to these advance contracts as reservations, others mark them as sales. Another important trend is the growing number of rental offers. Previously this service was only offered by individual developers, now there are companies for which it is the main activity. Those interested in this service should carefully read the service contracts and assess the real economic benefits. Third-party offerings may differ significantly from developers’ ability to split the initial contribution at no cost.

Tomas Sovijus

Market situation: “demand overheating”

Does the continued growth in activity in the new housing market mean that a “bubble” is forming in the housing market? According to TS Kvainickas, conditionally. It depends on the definition of “bubble”. Traditionally, this would require a rapid and unjustified increase in prices, a decrease in the affordability of housing. Although prices do not stop, their change does not exceed wages and can be explained by the constant decrease in vacant lots in the central part of the capital, the increase in energy needs and the increase in wages. Traditional ‘bubbles’ are also characterized by a supply shortage, and some of these threats can already be seen here.

“New projects are usually more attractive than those already on the market, but the growing interest in homes that have yet to be built shows that the current supply is not liquid and therefore the real choice is quite limited. This is especially noticeable when segmenting the offering by apartment size, location, or other factors. On the other hand, housing choice in the early stages of development is also an option. The market situation could be better defined by “overheating demand” due to increased housing affordability, which could lead to stagnation, especially for less attractive properties in the future. If the buyer can acquire a home earlier than expected for a smaller initial contribution, this means that they will not need it in the future and if the developers go overboard with the introduction of new projects to the market, their completion time can be significantly extended. As always, the most important thing is to find balance. Our advice to buyers does not change: choose responsibly what you want and what is right for you, not what “fits,” says TS Kvainickas.

Transactions in Vilnius

In February the sale of 703 new apartments in Vilnius was agreed (723 new agreements, 20 cancellations of previously concluded agreements). The monthly result is 8 percent. better than in January (661 new agreements and 13 cancellations) and 11% – than a year ago (637 agreements and 3 cancellations). February’s results also improved three-month sales to 2023, with nearly 200 more deals than the three-month result in January (1,808 deals, including cancellations). About half of the deals were in the affordable housing class, nearly 40 percent. – in the middle and about a tenth – in the prestigious. Two-thirds of the agreements were concentrated in just a few districts: Baltupiai, Naujamiestis, Pašilaičiai, Pilaitė, Senamiestis, Šnipiškės and Žirmūnai, that is, in the most developed territories. The February observations included 457 new homes in 8 new projects or phases. Housing liquidity in the Vilnius primary market continues to improve, the index value is currently 0.84. This means that the entire existing supply (in the absence of a new supply) could be sold within 10 months based on the sales results of the last 12 months. This indicator value is analogous to that of February 2020, that is, the pre-pandemic period. Currently, buyers can choose from just over 4,000 apartments, but that number includes both reserved projects and early stage projects.

Buying and selling a house in Lithuania

© Company photo

Transactions in Kaunas

There are also positive changes in Kaunas. During February 2021 the sale of 86 apartments was agreed (cancellations not fixed). This is 43 percent. more than in January (67 new agreements, 7 cancellations) and 8% more than a year ago (82 new agreements, 1 cancellation). The three-month result (292) decreased slightly compared to January (303), but the market retains the potential to improve not only in 2020 but also in 2019. The average number of new deals (78) since July 2020 is 10%. better than in 2019 (70). The follow-up was supplemented with 43 new objects in two new phases of housing projects. The sales structure by class was similar to the situation in the capital: economy class housing accounted for about half of all sales, just over 40 percent. Middle class housing was bought and just under 10 percent. – prestigious. Almost two-thirds of all deals took place in Dainava, Freda and the old town. The liquidity index stood at 1.03 at the end of February, that is, the volume of supply could materialize in just over a year. Despite the particularly short realization period, the value of the indicator still lags behind the pre-pandemic period, when it reached 0.9 – 1.0. We estimate that buyers in Kaunas currently have a choice of approximately 750 brand new apartments.

Buying and selling a house in Lithuania

© Company photo

Transactions in Klaipeda

The recovery of the primary real estate market in Klaipeda gained momentum: in February, the sale of 45 apartments was agreed (cancellations not arranged). This is 36 percent. less than a month ago (70 agreements, cancellations not registered) and 42 percent. less than a year ago (77 agreements, cancellations not recorded), but the three-month result (187) is the best since the beginning of 2018. The sales structure by class was analogous to that of Kaunas: sales of affordable homes, medium and prestigious accounted for about 50, 40 and 10 percent, respectively. Most of the houses were purchased in the Gedminai and Šauliai districts. The new facilities were not included in the February observations, but sales of large residential complexes are eagerly awaited. Due to the low supply, the liquidity index in the port city is 0.81, that is, the current supply could be sold in less than 10 months, but it is important to note that only a larger project can significantly adjust this indicator , since the current supply is only about 300 homes.

Buying and selling a house in Lithuania

© Company photo

In February, an average of almost 38 homes were sold per day

Preliminary data from the Citus real estate market also shows that February in the capital was marked by another record. According to the developer’s analysts, in the shortest month of the year, on average, almost 26 homes were sold in each of the 28 calendar days, and if we consider only 19 business days, almost after 38. Theoretical arithmetic en Continued and the day has 8 hours of work, it turns out that 4.75 new homes were sold every hour.

“We have seen a particularly active market since last fall: neither the quarantine nor the winter holidays have stopped growth.” On the one hand, the current results, in my opinion, correspond to the real opportunities of Vilnius and the “capacity” of the need for housing: the population of the city is growing, the livelihoods too. On the other hand, judging by the circumstances created by the pandemic, such a pronounced increase in the number of reservations is due to the avalanche of buyers. This assumption is possible thanks to the results of a survey commissioned by Citus last fall, which shows that the importance of almost all the observed housing selection criteria has decreased ”, emphasizes Šarūnas Tarutis, Head of Investment and Analysis at Citus.

Šarūnas Tarutis

© Photo from personal archive

When buying a home, the specialist advises to carefully and responsibly assess not only your financial capabilities, but also the long-term liquidity of the chosen purchase (opportunities to sell it in the future, added value, project solutions), the reliability of the Project developer.

“Currently, it is not easy to do so, because the” store “of new homes (the number of homes offered to buy), and therefore the choice is running out – at the end of February, it consisted of 4,527 apartments and cottages in Vilnius In January, this number was almost three hundred more: 4,812.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to cite DELFI as the source.

[ad_2]