[ad_1]

After announcing the upcoming changes at a press conference last week, Delfi received a letter from a concerned reader asking if the new request was truly impossible to circumvent.

“If an intermediary brings a car from a country of the European Union with a contract signed by a foreigner without the buyer’s data, how will this process force the intermediary to take that code? After all, as now, he will sell in cash, and the new owner will provide Regitra, for example, with a German sales contract after completing his details ”, the reader considered.

Not possible without a code

Emilija Bardauskienė, Acting Head of Regitra’s Communication Department, explained that the new Vehicle Owners Accounting System is being implemented to combat situations such as those described by reader Delfi.

“As of May 1, Lithuanian residents and businesses must notify it in all cases when purchasing vehicles both in Lithuania and abroad.

T. and. Contact Regitra and obtain a unique owner’s declaration code (SDK) for the vehicle. Without this code, it will not be possible to sell or register a vehicle. So specifically for the case you mentioned, the same principle applies to him. In other words, an intermediary who has bought a car abroad will have to declare the acquisition and receive an SDK before importing it to Lithuania, ”he said.

E. Bardauskienė added that compliance with these obligations will be verified by the responsible institutions.

“Inspections will be carried out on the roads, vehicle transport in road transport vehicles, individual vehicle arrests, marketplaces and other car sales points, analysis of vehicle sale advertisements in the electronic space, etc. will be carried out. Control officers can impose administrative liability if they discover that a vehicle does not have an SDK, ”he said.

Responsibilities

According to the Regitra website, car dealerships will be able to be inspected by officials from the police, the State Tax Inspectorate, the Customs and Financial Crimes Investigation Service, the State Border Guard Service and the Transportation Security Administration. from Lithuania.

“Lithuanian customs officials will be able to check the presence of the SDK: by patrolling the country’s internal EU borders with Poland or Latvia; declaring vehicles for import or export procedures. Vehicles transported through the territory of Lithuania to other countries must not have an SDK.

If a person does not declare the vehicle in the prescribed manner (the vehicle will not have an SDK), they will not be able to sell the vehicle. Control officers can impose administrative liability if they discover that a vehicle does not have an SDK. The fine will be imposed by the authority that determined the infraction.

An administrative violation report will be prepared in accordance with article 431 (1) or (2) of the Code of Administrative Offenses (failure to comply with the requirements for the owner (operator) of a vehicle). The owner (administrator) of the vehicle is fined 150 to 300 euros for non-compliance with the requirements established in the Road Safety Law. In case of repeated violation – from 440 to 600 euros ”, Regitra informs.

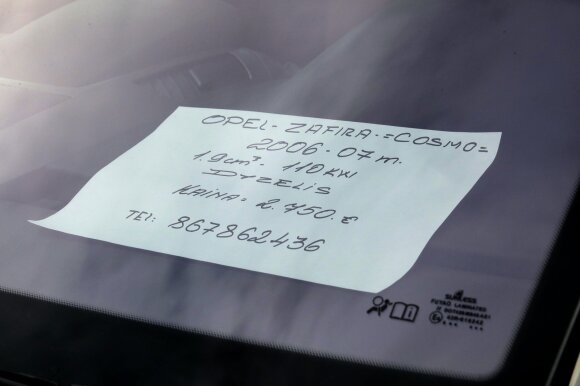

Kaunas car market

© DELFI / Nerijus Povilaitis

Avoid taxes

Until now, after the transaction, the new owner of the car was registered only at the time of registration. Some of the buyers of the vehicle did not apply for the Registry or register it in their own name, so the resellers remained unknown and therefore did not pay taxes.

According to the Minister of the Interior, Agnė Bilotaitė, currently some of the vehicle resale transactions are carried out in cash, which is not recorded or included in the system’s accounting, so taxes are hidden.

“The state is likely to lose about 40 million euros as a result.” A centralized vehicle owner accounting system is a necessary and immediate tool in the fight against the shadow car business, “he said.

Agnė Bilotaitė

The SDK will be generated every time the vehicle owner changes. It is important to know that from May an SDK will be required not only to register a vehicle but also to sell it.

The SDK code will be assigned automatically on May 1, 2021, if the vehicle is currently registered in Lithuania. Therefore, its owner does not need to take any further action. The custom SDK will also be available online or at Regitra.

“If the vehicle is on the territory of Lithuania, but it is not registered or not yet registered, a transition period is provided until July 31, 2021 to obtain the SDK. In other words, the owner will have 3 months to contact Regitra and receive the SDK.

But if, in the latter case, the vehicle is to be sold or registered, then the SDK must be obtained before taking these steps and not waiting until July 31st. With regard to those situations where the vehicle has already been purchased abroad and has not yet been imported, the owner will need to obtain an SDK before bringing the vehicle to the territory of Lithuania.

The online vehicle ownership declaration services are planned to be provided free of charge. At that time, information on administration fees at Regitra branches will be provided later. The price of vehicle registration services will remain unchanged, “Regitra said.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to indicate DELFI as the source.

[ad_2]