[ad_1]

The meeting presents the Ministry’s initial review of tax benefits and public proposals, of which more than 200 have been received as of February 10. Some of them have already been announced by Delfi.

“The main objective of the tax benefits review is to implement Government Program 18, which sets ambitious goals related to poverty reduction, the indexation of pensions and the introduction of single-person pensions. Also ensure that the quality and accessibility of education and health services are at an adequate level.

Raising the salaries of public sector employees is a commitment that is made not only with the expectations of the current ruling majority, but also with those of the former. Increasing the salaries of teachers, doctors, cultural and social workers is a priority for all to guarantee the availability and quality of services ”, he said.

G. Skaistė said that the provision and scope of services are inevitably related to the scope of taxes.

“As we want to charge as fairly as possible, we start with tax exemptions. As you know, 8.5 billion. EUR 2.2 billion is raised in the budget through taxes and EUR 2.2 billion is not collected in the form of profits. Euros. “, He said.

The Minister pointed out that not all of them are effective, some of them can be replaced by other means.

“It just came to our attention then. Of those 2.2 billion. Most of the euro is justified, for example, by the amount of tax-free income or the VAT exemption for prescription drugs. We do not plan to review those benefits. .

However, we have received for others, which cover about a third of the 2,200 million. euros. That could be considered, “he said.

G. Skaistė added that, considering the high level of uncertainty due to the pandemic situation, the relevant bills will not be presented to the Seimas during the spring session.

Focus on excise duties

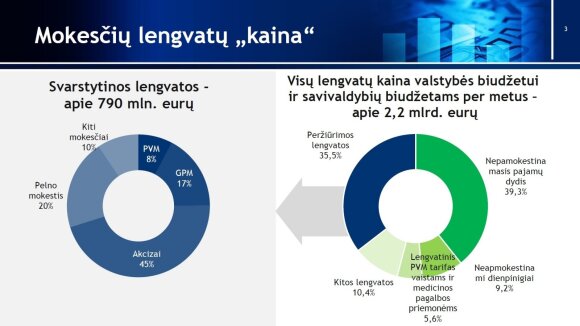

As detailed by the Deputy Minister of Finance, Rūta Bilkštytė, the benefits to be considered cost around 790 million. euros.

© Ministry of Finance

45 percent these amounts are special taxes, 20 percent. – income tax, 17 percent. – personal income tax, 8 percent. – value added tax and another 10%. – other taxes.

The remaining 2,200 million. NPD (39.3%), tax-free allowances (9.2%), reduced VAT on medicines and medical aids (5.6%) and other benefits (10.4%).

Rūta Bilkštytė

R. Bilkštytė mentioned that among the 200 proposals received by the Ministry, there is a waiver of the reduced VAT rate for heating and firewood, as well as the waiver of real estate and territorial tax benefits. It is proposed to waive incentives for agricultural activities.

At the same time, benefits are offered to expand in areas such as reinvested earnings, VAT on e-books and basic food, tourism, catering and cultural services. It is proposed to increase the NPD, legalize excise tax relief for smaller brewers, other benefits for the benefit of employees, etc.

Regarding the changes in the payment procedure and tax administration, the harmonization of the base and the revision of the documentation are mentioned.

The Ministry has also received proposals for the revision and harmonization of GPM tariffs, the abolition of the so-called “thin capitalization” rules, and so on.

“I would like to paraphrase the words of US President John Kennedy 60 years ago: dear fellow experts, please suggest, not new exemptions and benefits, but what we could give up and what we can do together to make the tax system fair,” Bilkštytė said in the meeting.

The Ministry of Finance highlights 6 aspects of the revision of the tax system: promotion of the reinvestment of profits, green exchange rate, reduction of income inequality, review of special tax conditions and benefits, investment model and long-term savings instruments term and strengthening of municipal financial autonomy. to be discussed by the working group every few months.

Speaking about the green course, R. Bilkštytė highlighted measures such as the exemption of benefits for fossil fuels, the development of taxes on pollution, various incentives, alternatives and compensations.

The second meeting of the task force for the review of tax benefits is scheduled for March 9.

Do not rule out anything

In a press conference held after the meeting, G. Skaistė commented on several specific proposals. He did not rule out the possibility that state incentives to accumulate second and third pillar pensions will be removed.

“We have received proposals from various stakeholders and for the waiver of these benefits, so I think they will also be considered in a general context with a possible initiative to introduce an additional investment account,” he said.

G. Skaistė also spoke about the abolition of heating benefits.

“The government program was talking about the benefits of fossil fuels. We have received a number of proposals for the benefits of fossil fuels. However, decisions about which of these benefits and how they will be changed are not yet available. Say today that one or the other benefit will be abolished too soon. However, all of them will be considered in a general context with incentives to give them up, “said the Minister.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to cite DELFI as the source.

[ad_2]