[ad_1]

“2019 was very different compared to 2018. If then most of the investments had a negative return, then 2019 was very different in this regard. Most types of investments performed very positively, some were close to all-time highs, “Jonas Kanapeckas, Director of the Banking Department of the Bank of Lithuania, said at a press conference on Tuesday.

According to him, last year he achieved the highest return on investment in a decade, reaching 4%.

The average value of non-monetary financial assets in 2019 was LTL 4.5 billion. euros The Bank of Lithuania maintains a stable amount of gold reserves recovered after regaining independence: 5.8 tons. Last year, gold investment earnings amounted to 0.73 million. euros

The main objective of financial assets is to help ensure the stability of the Lithuanian financial system and the euro area, to create the conditions for the country to more easily absorb economic and financial shocks and other special circumstances.

“Both the investment portfolio and the reserve portfolio have successfully overcome the challenges of the first half of this year,” said J. Kanapeckas.

Highest investment in China, UK, Canada

The Bank of Lithuania notes that last year it began investing in mortgage-backed bonds from US agencies, and this year increased its investments in debt securities of China, the United Kingdom and Canada, as well as investing more in global stocks.

“We have increased our investment in Chinese government securities and have now invested 200 million in China.” USD, and we also increased our investments in Canadian and UK government securities without hedging against exchange rate risk. Our trend is that we do not insure an increasing share of the currency risk against foreign reserves, “said T. Garbaravičius.

“China is a very large country and economy, and its capital market and importance are growing. We will get to know that market very soon. It will be very difficult for other central banks to stay away from investing in China. It makes sense to be in China and invest there, but the situation needs to be monitored because it is a specific market, “he added.

The Bank of Lithuania also plans to hedge less against exchange rate risk.

“Hedging against currency risk is very expensive. By investing in securities denominated in US dollars, if we insure ourselves against currency risk, it will eat up practically all of our income,” said T. Garbaravičius.

“Investing in real estate would be one of the alternatives. We are exploring this alternative this year. We would not invest in specific objects. Of course, it would be a fund that invests in real estate in foreign countries, because they are foreign reserves (…) This is the object of analysis and the conclusions of the analysis will be at the end of the year ”, said T. Garbaravičius.

LAC is also expanding its cooperation with the World Bank, which is entrusted with the management of LTL 300 million. The portfolio in US dollars will increase by entrusting the management of the mortgage bond portfolio of US agencies.

Quantitative systematic investment strategies (algorithmic strategies) are also being developed, tests are currently underway, and systems are being developed. The central bank intends to provide more information on this in the fall.

Jonas Kanapeckas, Director of the Banking Department of the Bank of Lithuania, added that all the measures listed also take into account the context of the coronavirus crisis.

“And how can such crises affect investor elections? The Bank of Lithuania believes that the best tool is to have a portfolio prepared in advance for the main challenges in the markets. So far, we can do it,” said J. Kanapeckas.

The 2020 spring storm was endured

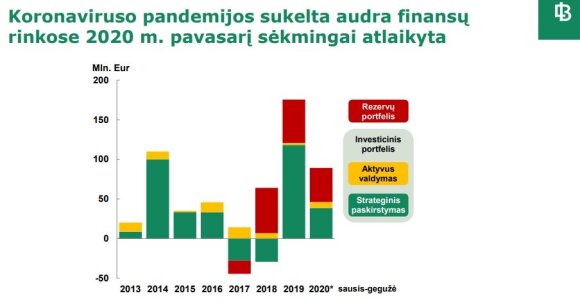

According to LB, in January-May of this year, the result of financial assets was almost 90 million. Although the volatility of prices in world financial markets at that time was particularly high due to the turmoil caused by the coronavirus pandemic.

According to the Bank of Lithuania, this result was achieved through an advanced method of investment allocation: risk parity, which the Bank of Lithuania began to apply in late 2017 and was one of the first central banks in the world to do so. Parity allows the maximum distribution of investment risk: it is divided equally into as many sources of risk as possible.

“In the spring of 2020, the storm was successfully weathered, which was influenced by the application of the risk parity method and was worth it.” And our own investments, however, we try to include riskier investments, because the returns are very low, but even during a “storm” our portfolio held out, “said T. Garbaravičius.

According to him, the investment environment remains difficult, the negative interest rate environment remains the biggest challenge when investing the financial assets of the Bank of Lithuania.

“So far, the results of the investment have been quite good. There are still five and a half months left, so the result for the year could change significantly and we do not want to raise expectations that things will be at the end of the year. The markets they are so “disobedient” and full of surprises, “explained the expert.

The Bank of Lithuania has gold, reserves, portfolios of short and long-term financial assets. The Bank of Lithuania’s total financial profit in 2019, including monetary policy operations, was LTL 25.4 million. 13.8 million euros were transferred to the state budget. euros

Non-monetary investments represent about a fifth of the Bank of Lithuania’s total financial assets.

[ad_2]