[ad_1]

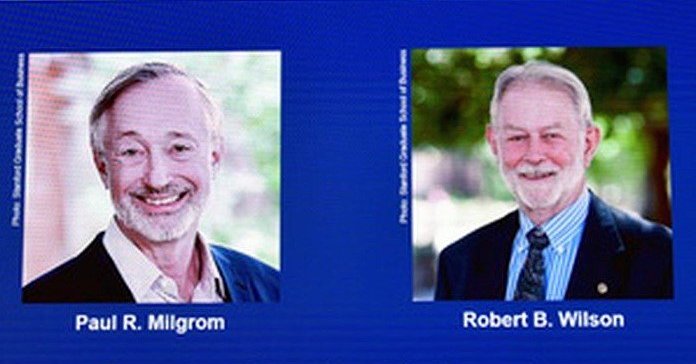

American economists Paul Milgrom and Robert Wilson won the so-called 2020 Nobel Prize in Economics on Monday for their contributions to trade auctions.

They were awarded “for improvements in auction theory and inventions of new auction formats.”

The importance of American research is revealed in the fact that these innovations have not only been put into practice in the allocation of the country’s limited resources, but have also benefited auctioneers on both sides of the barricades and taxpayers.

Created new auction forms

Throughout their careers, Milgrom and Wilson have explored how auctions work and have developed new forms of auctions for goods and services that are difficult to sell in the traditional way, such as radio or raw materials.

In 1994, for example, US authorities sold radio frequency for the first time using a format developed by economists. This has helped ensure that taxpayers benefit from the sale of state-owned radio frequencies, which are also of great value to mobile operators.

For a long time, radio frequencies were assigned as in “beauty contests” where operators indicated why they should receive them.

The Nobel Prize in Economics to American economists was also praised by Swedbank chief economist Nerijus Mačiulis, who emphasized that auctions can be applied very broadly.

Photo by Swedbank / Nerijus Mačiulis

“Many people associate auctions with the sale of works of art or other rare items to those who have too much money. However, they are often used to maximize profits for society or the state, for example by selling objects such as radio frequencies or rights to extract raw materials, ”wrote N. Mačiulis on Facebook.

He investigated the behavior of the auction participants.

Milgrom and Wilson studied auctions from different angles, noting that items sold at auctions may have the same value for all bidders (eg, oil) or different values for each bidder as objects of art.

According to the awards committee, Mr. Wilson was “the first to create frameworks” for auctions of items of common value (such as oil). In his work, he explained that auctioneers tend to offer a lower price than they think the item or service is worth. This is due to the fact that auction participants are afraid of overpaying, they avoid the so-called “winner’s curse”.

And Milgrom delved into the general and personal value of items sold at auctions. For example, when buying a house, the buyer evaluates both how much he could pay himself and what the market value of the house could be. The economist has come to the conclusion that personal worth can vary greatly depending on the buyer.

Will share a million dollars

The winners were announced in Stockholm on Monday by Goran Hansson, secretary general of the Royal Swedish Academy of Sciences.

The award is awarded to the economies of many countries around the world for the impact of the coronavirus pandemic, which experienced its worst recession since the end of World War II.

The awarding of the Economics Prize to American economists was the culmination of a week-long Nobel Prize ceremony formally called the “Swedish Central Bank Alfred Nobel Memorial Prize in Economics.” This award has been presented 51 times since 1969 and is now considered by many to be one of the Nobel laureates.

Milgrom and Wilson will share about $ 1.1 million.

[ad_2]