[ad_1]

The house is rented illegally

In Lithuania, according to the Registry Center, in recent years between 6 and 7 thousand people a year have been registered. new leases, but some of them are written off or expire. Currently, about 30.7 thousand are registered throughout Lithuania. Lease contracts for existing dwellings (apartments and houses). More than a year ago, that is, in 2019. January 1 there were 26.8 thousand of them, or about 15 percent. Less.

Kristina, Delfi Būstas, having agreed to share her story, is not included in these statistics. Rent a home illegally. According to the girl, so far she has not had any problems.

“I have been renting that apartment for many years. Although the landlord has not clearly said that the lease is illegal, I understand it myself, waiting for every month to collect the rent and utilities in cash. Or it comes in a convenient time for us, or I give him money while I drive across the country, ”says Kristina.

Tenants

According to the interlocutor, before moving into this house, he requested a lease agreement in which both parties listed the responsibilities of the landlord and the tenant.

“We signed a contract, we noted what furniture is in the apartment, that the landlord is responsible for its wear and tear and we name the amount of the rent. When I mentioned that I would like to sign a lease, the landlord broke down and then I realized that the apartment was rented illegally, ”says the girl.

When asked if she had any doubts about her choice at the time, Kristina says she had no doubts because she was tempted by the attractive price of the rent: “So it was the best price because other apartments in similar condition were much more expensive.”

Renting illegally is at risk

Although Kristina, who was interviewed in Delfi Būstas, has no problem with illegally rented homes so far, Arnoldas Antanavičius, the director of Realdata, says that people who rent homes illegally walk with a knife.

“It is unequivocally better for the tenant to do everything officially, since in this case it is protected that the landlord will not easily evict him from the rented apartment, he will have to comply with the notice notice and the tenant will have much more time to look for another living place. It is also possible to register at the residence if you have a lease. This is an advantage, especially for families with children, because it is possible to enroll children in kindergartens and schools, ”says A. Antanavičius.

Tenants

The real estate analyst adds that a legal lease is more beneficial to the owner himself. By formally renting a home and paying taxes, the landlord has more power over the tenant.

“If you rent illegally, the owners run the risk of having no legal influence against the tenants. If the property is damaged, if there are debts, etc., it will be difficult to find justice. It may be necessary to admit that illegal activities were carried out and the The owner himself is in such a situation that not paying taxes and therefore trying to save increases the risk of losses ”, says A. Antanavičius.

How to legally rent a home?

Delfi Būstas The State Tax Inspectorate (STI) asked what are the ways to legally rent a home. According to Stasė Aliukonytė-Šnirienė, Director of STI’s Tax Obligations Department, current residents, regardless of whether they wish to rent residential premises to other residents for a short or long period, can do so by purchasing a “Residential Rental” business certificate. The resident may also provide accommodation services after obtaining commercial licenses for the activities: “Provision of accommodation services (bed and breakfast services)”, “Provision of accommodation services (rural tourism services)”. It is not possible to rent real estate (RE) with individual activity certificate.

“It is worth mentioning that as of July 1, 2020. Residents who rent a residential premises with a business license must obtain a separate business license for each leased object and pay a fixed amount of income tax for it.” adds S. Aliukonytė-Šnirienė.

It should also be noted that without obtaining a business license, any real estate rental service (not just residential) can also be provided to both residents and legal entities; right after the end of the year, before May 2 of the next year, this income must be reported. and pays 15 percent. personal taxes.

Legal rental statistics

© Photo by Delphi

Which Legal Rental Tax Option Is Best For Landlords? According to A. Antanavičius, a commercial certificate is usually obtained in cases where a higher income is received from the rental of housing, and 15 percent. GPM chooses to pay people with low rental income.

“If a cheaper house is rented, it is not necessary for a resident to acquire a business permit, he can choose to pay personal income tax, which amounts to 15%,” notes A. Antanavičius.

On the other hand, while it would appear that renting a home is legally simple and inexpensive, real estate broker Jolanta Petrauskaitė says that real estate owners still see the shortcomings of the legal rental system. According to the interviewee, it is difficult for landlords, especially the elderly, to obtain a business license to rent an apartment online, and then it is difficult to complete a tax return, whether the resident has a business license or has chosen to pay the 15 % at the end of the year. GPM.

The real estate broker also points out that for some residents who rent, for example, an apartment at a very low price, the state taxes are too high.

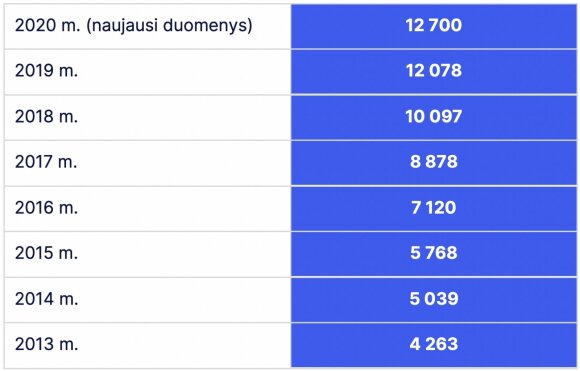

The number of legal tenants is growing slowly but surely

However, according to the STI, looking at the general trend, the number of residents renting commercially certified homes or reporting rental income remains similar or growing moderately. Since 2013, the number of residents renting homes with a commercial license has tripled.

“Looking at the trends of recent years, residents who operate with a business license report higher rental income. 2019 People who acquired the business license” Rental of residential premises without accommodation services “reported 84 million income in euros. For comparison, in 2018, residents who bought the same business license declared almost 85 million. Income in euros, 2017 almost 71 million. Income in euros. The active activity of the population is also shown by the amount of declared income received for the leasing of real estate. In 2019, around 58 thousand. declared population 178.5 million. Income in euros in 2018. 56 thousand declared population 177.1 million. Income in euros, 2017 – 56 thousand. declared population 150 million – the statistics are shared by the STI.

Money

According to S. Aliukonytė-Šnirienė, Director of the Tax Obligations Department of STI, in order to identify possible cases of tax evasion, not only the information provided to the personal tax administrator (for example, declaration data), third party data, but also information in public space. People who share short and long-term lease deals are screened.

“Last year, after conducting an analysis of the activities of the Lithuanian population offering services on the Airbnb home rental platform, small entrepreneurs declared an additional 261 thousand. Income and 49 thousand euros. taxes in euros. According to the analysis, this year more than 4,000 offers have been submitted to the Internet rental platform Airbnb in Lithuania ”, says a representative of the STI, adding that the institution, taking into account the scale of its activities, evaluated the cases in which a person offered to rent more than three real estate objects (there were 62 inhabitants of this type). It is believed that after analyzing the proposals, the STI attracted the attention of 28 residents: monitoring began against 15 businessmen and 19 taxpayers received operational inspections. One of the most frequently identified infractions is that the income received from the rental business is not accounted for, that is, residents report only a portion of the income received.

“After the STI carried out follow-up and control actions, 22 people presented / clarified declarations and additionally 261 thousand declared. 49 thousand euros of income from the provision of accommodation services and taxes payable, of which VAT amounted to – 34 thousand. EUR, GPM – 15 thousand. euros. Administrative misconduct protocols were drawn up for three people on violations of the procedure for submitting documents required by the tax administrator, as well as a resolution on violations of the procedure for submitting required documents and accounting violations, ”reports S. Aliukonytė-Šnirienė.

During the general monitoring of the real estate rental market, reports from residents about possible illegal activities are also extremely valuable. This year, according to the STI, 266 notifications were received from the population about the leasing of illegal real estate, last year 368 notifications and last year 186 notifications.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to cite DELFI as the source.

[ad_2]