The Johnson & Johnson logo is displayed outside the company’s headquarters in New Brunswick, NJ

Bloomberg News

Johnson & Johnson on Thursday announced their top AAA credit ratings to borrow $ 7.5 billion in cheap financing for their acquisition of Momenta Pharmaceuticals, Inc.

J&J, which makes drugs, consumables and medical devices, stands as the only other large American corporation, except Microsoft Corp MSFT,

still carry top AAA credit ratings, which NPR’s Planet Money declares are equal to the highest possible score in consumer credit.

In theory, this means that J&J should have access to cheaper financing than companies with lower credit ratings that are considered to have a higher default or downgrade risk, although the pandemic-driven boom in corporate lending has removed the rules of what can be considered ” low “or” High “yield.

To read: A binge? Bulge? Or just the new normal for debt in America, because Fed helps to boost string of records

Question by J & J’s JNJ,

six-part business bond deal helped lock the 130-year-old-plus conglomerate into some of the lowest-cost financing available in years.

Final price details fixed the yield on the shortest five-year slump of bonds at 0.57% and at 2.49% for the longest 40-year debt class.

With the Federal Reserve’s pandemic support, U.S. corporate investment firms went on a record $ 1.4 trillion bond loan this year on record low-yield loans, issuing about 74% more debt than the same period last year, according to data of BofA.

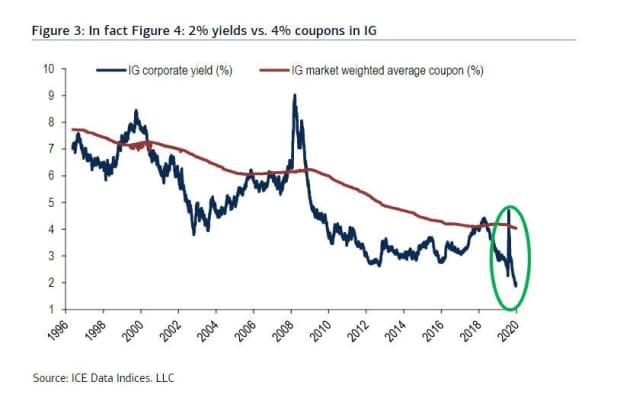

BofA Global created this chart to reflect investment grade bonds that hit a fresh 24-year low on a yield basis this summer. Bond prices are moving in the opposite direction of yields.

The new financing will mostly be used by J&J to buy Momenta MNTA,

in a valid, tender offering valued at $ 6.7 billion, which was announced Wednesday and shares of Cambridge, Mass.-based biotechnology company, sent 69% higher to close at $ 52.12 per share.

Under the terms of the agreement, J&J will pay $ 52.50 for each outstanding Momenta share. The deal is expected to close in the second half of 2020.

The rest of the debt financing was set aside for general business purposes.

Moody’s Investors Service gave the debt financing a AAA rating, but with a negative outlook. While the credit company expects J & J’s pharmaceutical company to generate ‘medium to high single-digit growth’ in the coming years, this contrasts with lower growth forecasts for its other business areas, which also carry risks associated with “unresolved litigation”. ‘opioids and talc contain,’ that may restrict free cash flow ‘over several years.’

Johnson & Johnson, Moderna Inc. MRNA,

Pfizer Inc. PFE,

and AstraZeneca PLC AZN,

have raced trials to help accelerate the development of a COVID-19 vaccine, with J&J planning to launch a trial of 60,000 people by next month to test if it can protect people against the virus.

Vaccine Hope has been one catalyst that has helped lift major U.S. stock indices to, or beyond, their previous highs for the pandemic, with the S&P 500 SPX index,

this week marks his fastest recovery in history.

Besibbe: Do not look now, but here comes the tidal wave of the fax

.