[ad_1]

The changing of the guard at the White House in January is likely to have a “significant impact” on the Irish economy for years to come, both positive and negative.

That’s according to the latest Quarterly Economic Commentary, released by the Economic and Social Research Institute (ESRI) this morning.

Surprisingly, despite drops in employment and domestic consumption unprecedented in scale and speed, ESRI forecasts that the Irish economy will expand by 3.4% this year.

That could be followed by further growth in 2021 of between 1.5% and 4.9%, depending on whether a post-Brexit trade deal is reached in the coming days and weeks.

In both scenarios, ESRI researchers also took into account a six-week national lockdown in January.

But Brexit and Covid aren’t the only potential risks to the economy.

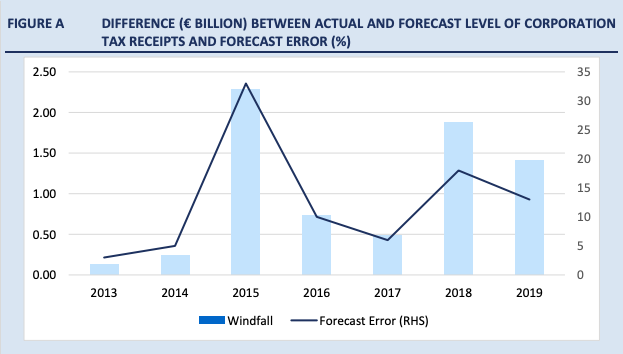

Over the past six years, Irish corporate tax revenue has been a major source of treasury funds, exceeding forecasts by more than € 7 billion, according to the report.

In the past three years, this has been fueled by the Trump administration’s 2017 corporate tax review, which has moved the country into a “territorial” system.

Effectively, this means that the United States government stopped taxing the profits of American companies made in a foreign country.

Simultaneously, the American Republicans introduced a new system called Global Low Tax Intangible Income (GILTI).

Aiming to save American jobs and discourage corporations from offshoring businesses to low-tax countries like Ireland or Switzerland, it means that income earned above a certain threshold by foreign subsidiaries of a U.S. company is taxed at 10.5 %.

There is evidence, says the ESRI, to suggest that this 10.5% rate was too low and that American companies continued to offshor their businesses during the Trump administration.

“Among the evidence presented for this is the continued increase in the level of trade in pharmaceuticals between Ireland and the United States in recent years,” the report argues.

Consequently, Irish corporate tax revenue has skyrocketed since 2017.

Graph showing how Irish corporation tax collection has exceeded forecasts since 2014.

But ESRI notes that “any change in this legislation that sees a move away from the territorial approach or witnesses an increase in the GILTI tax rate may result in lower corporate tax increases for the Irish Treasury in the future.”

US President-elect Joe Biden has pledged to double GILTI’s effective rate during his tenure.

This, the report argues, “underscores the potential vulnerability of future corporate tax revenues” and why the government cannot rely on them to finance current spending.

On the positive side, the report highlights the “likelihood of the United States re-engaging” in international efforts related to climate change and Brexit as “clear positives for the Irish economy.”

An extraordinary year

In its final year of quarterly comments, ESRI presents as complete a picture as possible of the impact of the pandemic year on the Irish economy.

Given that GDP is expected to grow 3.8% throughout the year, the outlook may appear relatively optimistic.

Irish exports continue to lead the charge.

Driven by booming sales of IT and pharmaceutical technology and services, two sectors dominated by foreign companies based in Ireland, exports have actually increased 4.6% year-on-year.

No news is bad news

Support the magazine

your contributions help us continue to deliver the stories that are important to you

Support us now

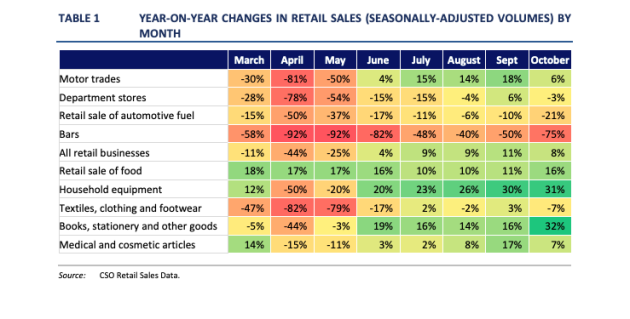

But the 2020 crisis has also exposed the duality of the Irish economy.

While multinational-dominated sectors with a higher incidence of high-paying jobs have boomed, sectors of the national economy that produce lower-paying jobs (hospitality, retail, construction, etc.) have suffered greatly.

If exporting companies are excluded, domestic private consumption has plummeted by 9% and investment by a whopping 13.6%, although there has been some recovery throughout the year.

Ireland’s job market has also been devastated.

Overall, ESRI expects the Covid-adjusted unemployment rate to reach 18.4% of the total workforce for the entire year. This is an upward revision from October, when it was forecast to be just 16.8%, and a sharp increase from last year, when unemployment was as low as 5%.

However, it is too early to speculate on the effects of scars (persistent and permanent negative impacts) on the job market.

As public health restrictions have been tightened and loosened, the unemployment rate has gone up and down over and over again throughout the year.

That will be the case next year too, but economists will closely follow these moves.

“Obviously, if we see [the unemployment rate] They don’t consistently go that low every time the restrictions are loosened, so that’s kind of an indication that there are some scars, ”explains Conor O’Toole, a senior research officer at ESRI.

If we see unemployment rates “getting more stubborn down”, it is evidence that jobs are being lost more permanently.

ESRI also expects consumer spending to rise about 11% next year, as households shed excess savings accumulated over the course of the pandemic year.

[ad_2]