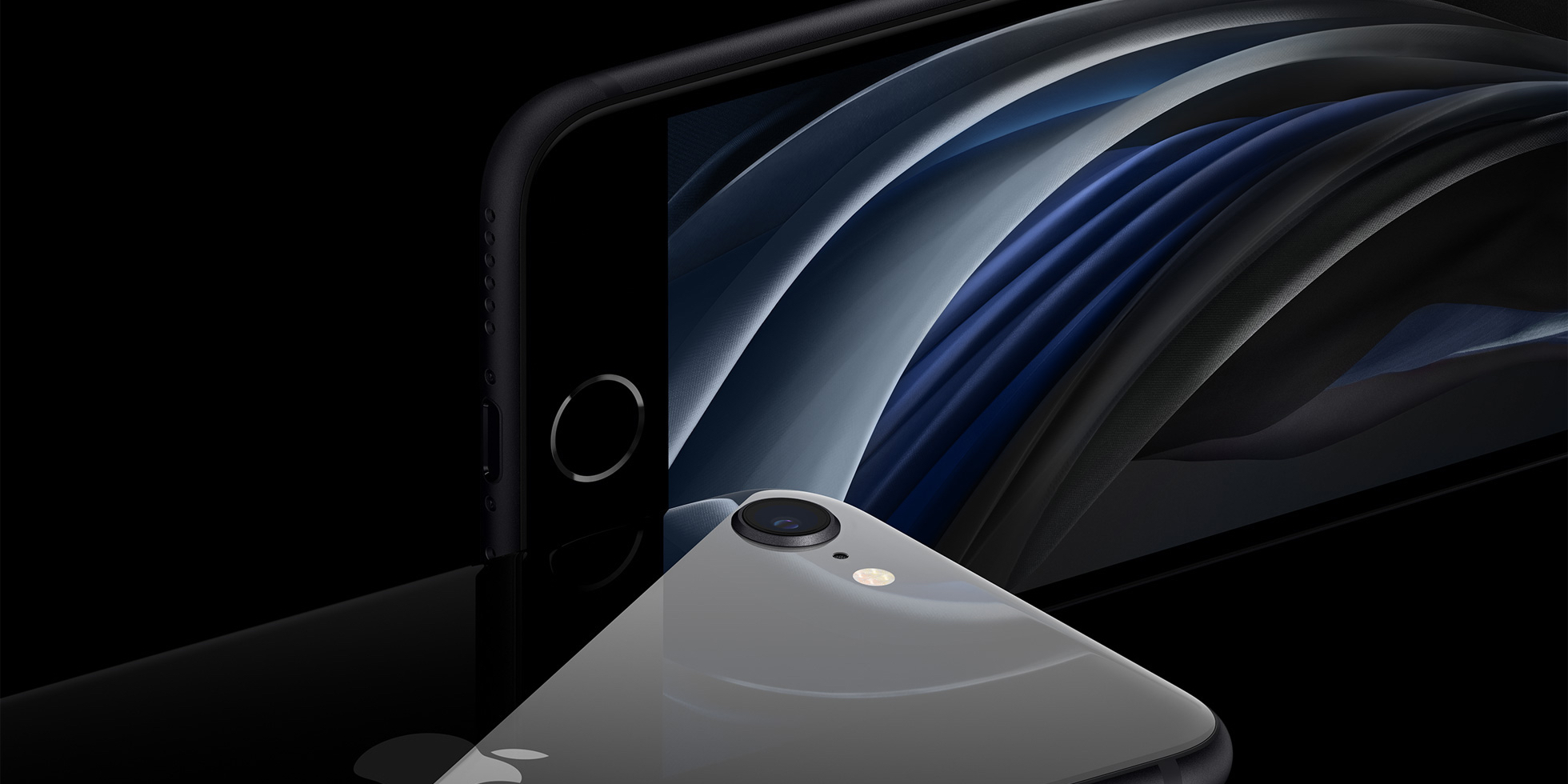

New data from Counterpoint Research today highlights the effects the COVID-19 pandemic has had on smartphone sales. According to the data, direct smartphone sales volumes in the United States fell 25% year-over-year during the second quarter of 2020, but the iPhone SE represented a “bright spot” for the market.

Samsung was least affected with 10% declining sales volume in the second quarter, followed by Alcatel, which experienced an 11% decrease. According to the data, Apple’s direct sales volumes fell 23% year-over-year. LG volumes doubled at 35%, followed by OnePlus at 60%, Motorola at 62% and ZTE at 68%.

According to Counterpoint Research Director of North America Research Jeff Fieldhack, the new iPhone SE significantly helped Apple’s performance during the second quarter of 2020. The entry-level device is said to be selling above expectations and is unlikely to cannibalize iPhone 12 sales this fall.

“Apple volumes grew during the quarter and were especially helped by iPhone SE volumes. The device has been successful and sold above expectations in both postpaid and prepaid channels. Since the launch of iPhone SE, carrier stores and national retail have reopened. Some channels saw huge promotions to attract shoppers to stores. This was especially true at Walmart, Metro by T-Mobile, and Boost. Our controls show that iPhone SE sales are unlikely to be cannibalizing fall iPhone 5G sales. IPhone SE buyers are more pragmatic about price, less concerned with 5G, and the smaller screen isn’t seen as a drag. “

Fieldhack went on to explain that the iPhone SE has been especially attractive to Android switches, with more than 26% of buyers coming from Android:

“More than 30% of iPhone SE buyers come from using an older iPhone 6S or phone, phones four years old or older. More than 26% of iPhone SE users moved from an Android device, which is higher than the normal switch from Android to iOS. “

Counterpoint estimates that smartphone sales from May through the end of June grew week after week, while June 2020 sales were stronger than June 2019. This indicates that the smartphone market has started to recover in the United States ahead of the iPhone 12 launch this fall. Read the full tailstock investigation piece below.

US smartphone direct sales volumes drop 25% in Q2 2020; iPhone SE a bright spot

New York, San Diego, Los Angeles, Boston, Toronto, Buenos Aires, London, New Delhi, Hong Kong, Beijing, Seoul – July 20, 2020

During the second quarter of 2020, smartphone sales in the US fell 25% year-over-year, according to the US Smartphone Shared Channel Tracker. Prepaid channels were the most affected during the COVID-19 outbreak despite a higher percentage of open stores compared to postpaid. Postpaid channels decreased 20%, a sharp drop but partially offset by an almost doubling of the percentage of devices sold online.

Commenting on the second quarter, Director of Research for North America, Jeff FieldhackHe said: “The weakest sales were recorded in mid-March to mid-April, as this was the heyday of the first COVID-19 blockades in the United States. April was the weakest month for smartphone sales, as approximately 80% of smartphone sales channels were closed; sales volume decreased more than 50%. Smartphone sales from May to the end of June grew week-on-week. June 2020 sales were stronger than the ones in June 2019, showing that the US smartphone market is resilient. ”

Fieldhack He added, “Smartphone sales in the United States rebounded when consumers received the first stimulus checks during the second half of April. Soon after, carrier stores and national retail began to reopen, further helping the recovery. There was also a bit of pent-up demand created by the weeks of store closings. Many consumers who may have wanted a new device but still had a working phone simply postponed their purchase. Finally, the net additions of US carriers will probably not be as disappointing as smartphone sales due to spikes in sales of access points, other connected devices, and used smartphones to be connected again. “

Commenting on OEM performance, Senior Analyst, Hanish Bhatia He noted: “All OEMs fell in the second quarter of the previous year. Due to the blockages, the share of online sales grew to 31% from 14% last year. However, due to the strong online presence, Samsung and Apple volumes performed better than the overall market with the help of a higher percentage of online sales. Alcatel also performed well considering the tremendous market decline. Alcatel benefited from strong sales within government-subsidized programs and within prepaid channels. “

As for the launch of the Samsung Galaxy S20, Bhatia adding: “The timing of the launch of the S20 family was unfortunate. Like channels full of devices, most stores closed. This led to an estimated 38% fewer activations of the Galaxy S20 series than the series. Last year’s S10 for the first four months, March-June period. Many potential Galaxy S20 purchases will simply be included in the third quarter, but some will be lost. “

Commenting on the launch of the Apple iPhone SE in late April, Fieldhack he added, “Apple volumes grew during the quarter and were especially helped by iPhone SE volumes. It was not a typical Apple launch with much fanfare and a launch event at the Steve Jobs theater, which typically also includes a series of However, the device has been successful and sold above expectations on both postpaid and prepaid channels. Since the launch of iPhone SE, carrier stores and national retail have reopened Some channels saw huge promotions to lure shoppers into stores. This was especially true at Walmart, Metro by T-Mobile and Boost. Our controls show that iPhone SE sales are unlikely to be cannibalizing iPhone 5G sales. Fall iPhone SE buyers are more pragmatic about price, less concerned with 5G, and smaller screen isn’t seen as a drag the. More than 30% of iPhone SE buyers come from using an older iPhone 6S or phone, phones four years old or older. More than 26% of iPhone SE users moved from an Android device, which is higher than the normal switch from Android to iOS. “

FTC: We use automatic affiliate links that generate income. Plus.

Check out 9to5Mac on YouTube for more Apple news: