Wall Street investors and ordinary Americans waited for Washington to enact legislation in a second round of stimulus to support the covid-affected economy, after completing its last year in July.

Most pundits were relatively optimistic for a while. But in the last few weeks, Congress, which has been delaying the “delay”, has begun to shake up the market.

But if Wall Street really wants to get Washington’s attention, according to one analysis, it could take a more serious step than the steady grind lower we’ve seen in the last few weeks.

“Just 5% down day on S&P 500 SPX,

Nicholas Colas, co-founder of Dettrack Research, said in a note on Tuesday that real investors’ concerns show that Washington needs to raise ASAP. “We don’t have that kind of move yet.”

Kolas described in detail: “As rough as the recent selloff is, we won’t really worry about market sentiment until the S&P 500 is down + 5%. It’s a 5 standalone deviation move and indicates further trouble.”

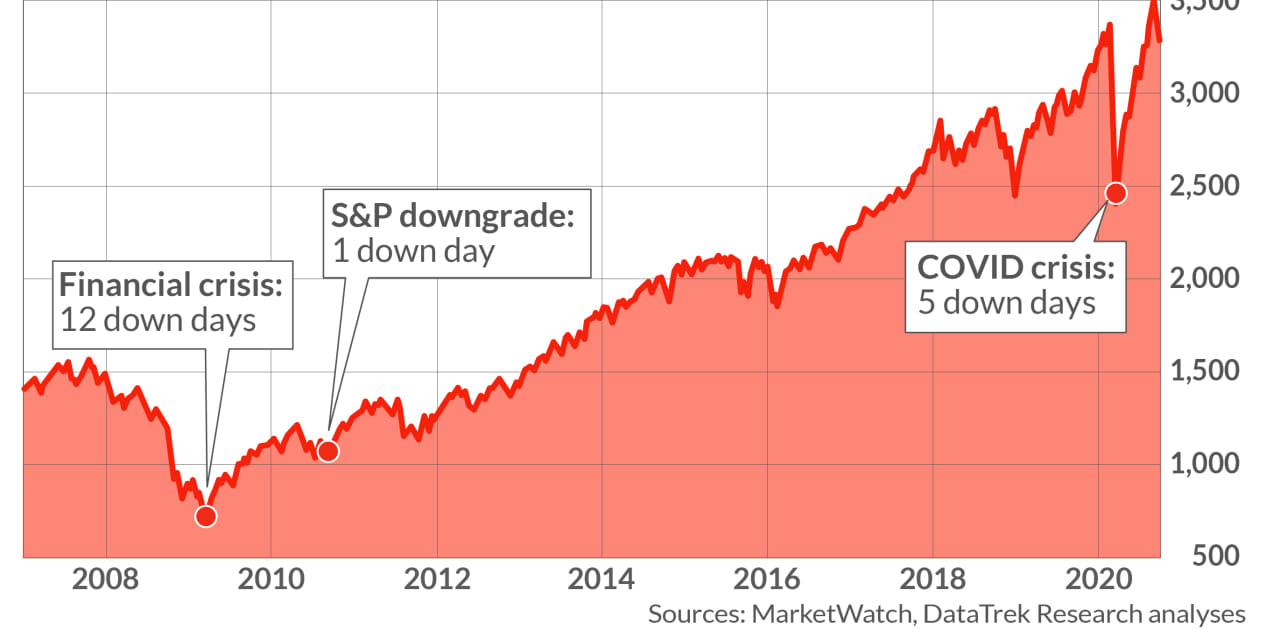

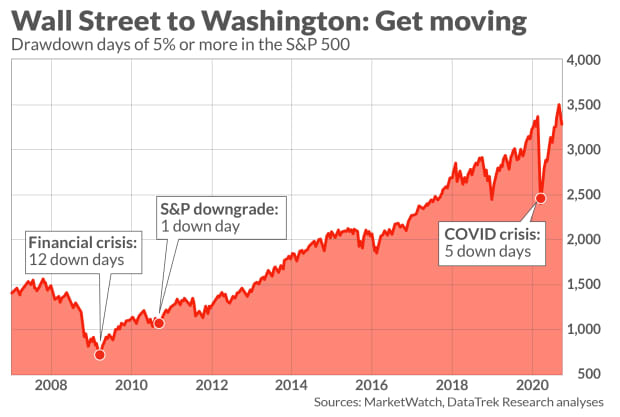

Many days have passed with such a big decline in recent history, he noted. During the period 2008-2009, during and during the financial crisis, 12 were observed, while a status came in August 2011 after the rating agency Standard & Poor’s downgraded the sovereign debt of the United States.

And there have been five this year: four in March, when panic about the COVID crisis first surfaced and one in June.

The funny thing is that such a big market move will not only signal a “real problem”. That could persuade Washington and Washington to pay attention to anything that could cause market turmoil in the end.

As Colas put it, “The crash days of March 2020 and the Wall Street terrorist phone call for financial support for Washington, and it came quickly. ”

Colas is looking for a downturn in this year’s market and the 2008 equivalence, and thinks the previous crisis provides a kind of playbook to navigate this year. In other words, if you are expecting another “torp moment”, the move in the markets after Congress fails to do the right thing, you will hear.

Read ahead: The coronavirus crisis costs states and locals hundreds of billions, the analysis finds

.