As brick and mortar chains falter in the face of the pandemic, Amazon continues to gain ground.

The retail giant is valued at no less than $ 1.4 trillion, about four times more than it was in late 2016 when its market capitalization was around $ 350 billion. Last year, the Jeff Bezos-led company shipped 2 billion packages worldwide.

Today’s infographic shows how Amazon’s market capitalization alone is bigger than the nine largest US retailers together, highlighting the palpable presence of the once modest online bookstore.

The new normal

The sudden change to COVID-19 has made many retail equipment obsolete.

Neiman Marcus, JCPenney and J.Crew have filed for bankruptcy as consumer spending has migrated online. This, coupled with a large debt load at many retail chains, is only exacerbating the disappearance of the brick and mortar. In fact, one estimates projects that at least 25,000 US stores will be retiring within the next year.

Still, as security and supply chain challenges mount, with COVID-19-related costs in the billions, Amazon remains at the top. Outperforms your next closest competitor, Walmart, by $ 1 billion in market valuation.

How does Amazon compare to the largest retailers in the United States?

| Top 10 largest public retailers in the US * | Market value July 1, 2020 | Market value July 1, 2010 | % Of normalized exchange rate 2010-2020 | Retail income |

|---|---|---|---|---|

| Walmart | $ 339 billion | $ 179B | 90% | $ 514B |

| Costco | $ 134B | $ 24B | 458% | $ 142B |

| Amazon | $ 1,400B | $ 50B | 2,830% | $ 140B |

| The Kroger Co. | $ 26B | $ 13B | 107% | $ 118Be |

| Walgreens Boots Alliance | $ 36B | $ 26B | 38% | $ 111B |

| The Warehouse of the House | $ 267B | $ 47B | 466% | $ 108B |

| CVS | $ 84B | $ 40B | 112% | $ 84B |

| objective | $ 60B | $ 37B | 64% | $ 74B |

| Lowe’s | $ 102B | $ 29 billion | 251% | $ 71B |

| Best Buy | $ 23B | $ 14 billion | 59% | $ 43B |

| Combined retail value (without Amazon) | $ 1,071B |

Source: Deloitte, YCharts

* Largest US public retailers based on their retail revenue from fiscal years ending June 30, 2019, e = estimate

With almost a 39% Share of US e-commerce retail sales, Amazon’s market capitalization has grown by 2,830% in the past decade. His business model, which aggressively pursues market dominance rather than focusing on short-term earnings, is a factor behind the increase.

Similarly, a recent estimate by The Economist set Amazon’s retail operating margins at -1% last year. Another analyst has suggested that the company purposely sells retail products at a loss.

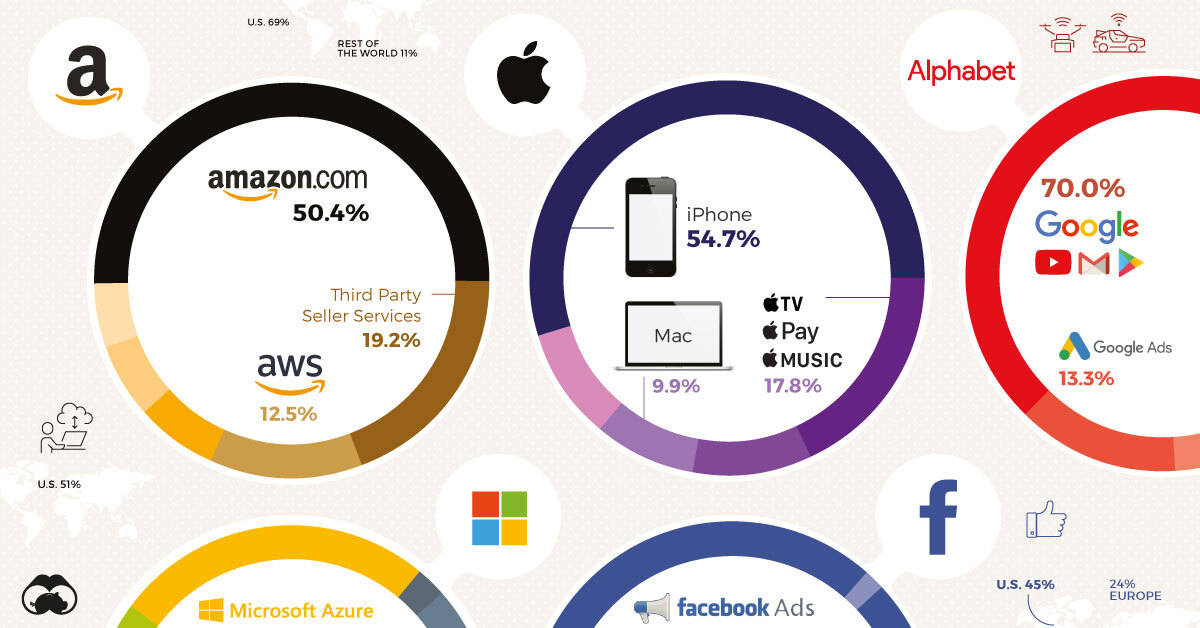

The way Amazon makes up for this operating deficit is through its cash-generating cloud service, Amazon Web Services (AWS), and through a collection of diversified, company-focused services. AWS, with estimated operating margins of 26%, brought $ 9.2 billion in earnings in 2019, more than half of the Amazon total.

Amazon egg basket

Unlike many of its retail competitors, Amazon has rapidly diversified its acquisitions since it originated in 1994.

Take the $ 1.2 billion acquisition of Zoox. Amazon plans to operate autonomous taxi fleets, all of which are designed without flyers. It is the third largest company since Whole Foods acquisition of organic food for $ 13.7 billion, followed by Zappos.

With most of the physical stores owned by Amazon, Whole Foods has 508 stores in the United States, the United Kingdom, and Canada. While Amazon does not describe revenue in its physical retail segments, which include Amazon Books stores, Amazon Go stores, and others, the store’s physical sales turned over $ 17 billion in 2019

Meanwhile, Amazon also owns the Twitch game streaming platform, which it acquired for $ 970 million in 2017. Currently, Twitch represents 73% of the streaming market and generated an estimated $ 300 million in advertising revenue in 2019.

Wearing it

Despite the avalanche of online orders due to quarantine and social distancing requirements, Amazon’s bottom line has suffered. In the second quarter of 2020 alone, you are expected to accumulate $ 4 billion in pandemic-related costs.

However, at the same time, its customer-obsessed business model seems to be thriving under current market conditions. As of July 1, its share price has shot up more than 51% so far this year. On an annualized basis, that’s about 100% in returns.

As margins shrink and expenses grow, is Amazon’s growth sustainable in the long term? Or do the company’s strategic acquisitions and revenue streams provide the catalysts (and cash) for greater short-term success?

![]()