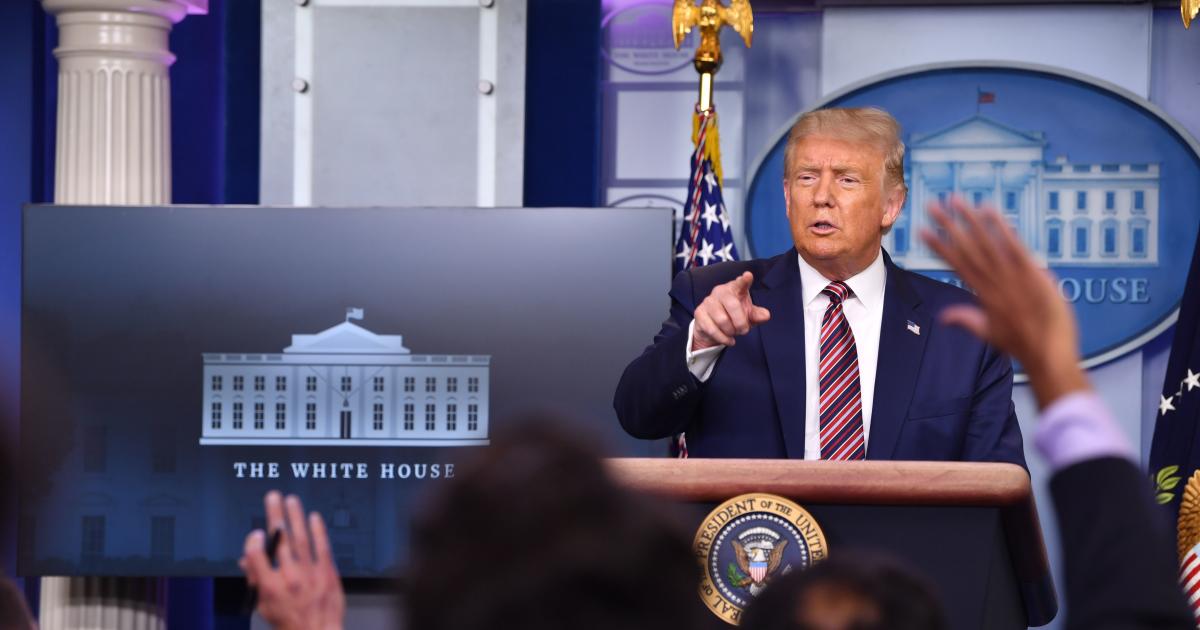

President Donald Trump has ordered companies to defer payroll tax in a move to give Americans financial relief and lift the coronavirus battery economy. However, the plan – which instructs the Treasury Department to stop collecting payroll taxes from workers as of September 1 – raises a number of questions, not the least of which is whether companies will pass that money on to their workers.

Mr. Trump’s efforts to raise wages are also only a temporary assignment, extending only by the end of the year, and it cuts the amount of employee taxes that workers do not actually owe. After all, its executive mandate provides for a “holiday” for tax authorities, allowing companies to delay the collection of payment taxes for four months.

Still, employees will eventually have to pay those taxes in full next year. And companies would automatically have to adjust their employees’ tax rates over the next two weeks, leaving little time to adjust their systems.

But perhaps the biggest hurdle is this: While employees have to pay half of their payroll tax (6.2% of their pay), employers remain on the hook for the full 12.4% owed to the government. thank you. As a result, companies may be reluctant to refrain from withholding tax unless employers are clear on how those taxes will ultimately be paid.

The result: Employers should not expect to see an increase in their pay due to the delay in the tax service – not by September 1st or maybe ever.

“Even a straight-up legislative cut in tax cuts would be far from the top five best measures to boost the economy,” said Josh Bivens, director of research at the left-leaning Institute for Economic Policy. “This is obviously much worse, because it’s not clear how many companies will actually stop holding, and how many people will spend the money given that they have to return it, January. If you want people to spend a tax return “You will not tell them to return it in four months.”

Here’s what you need to know about Mr. Trump:

How much could the average worker get?

Employees now pay 6.2% of their income in tax deductions – the money is deducted from their pay and is used to fund Social Security. Employers also pay 6.2% of employees’ salaries.

The assignment of Mr. Trump defends payroll taxes for workers who make $ 2,000 or less a week. In theory, over the last four months of 2020, that would be an increase of 6.2% for anyone making $ 104,000 or less. The median wage for workers is $ 957 per week, or the equivalent of $ 49,764 per year. Based on that median wage, for workers working up to $ 1,025, or $ 128 more per wage.

Would companies really increase your salary?

That is unclear. Daniel Hemel, a law professor at the University of Chicago, claimed in an op-ed for the Washington Post this week that Mr. Trump to put only taxes for emissions – not to cut – companies in an awkward position. After all, if employers do not collect the taxes now, they will still have to make sure that the full 12.4% in tax services is paid later.

Many companies may also be reluctant to rely on their employees to repay the deferred taxes on their own. So in order to give taxpayers workers now, they may have to be prepared to withhold double the amount of payroll tax next year – a sure way to make employees angry.

In addition, if employees are laid off or leave their jobs elsewhere to work before their payroll taxes are paid, employers can keep them in balance. Such circumstances are the reason why many companies may choose to keep the payroll tax of their employees wherever they are.

Would holiday pay taxes help the economy?

Probably, but the momentum would be marginal. Tax cuts are usually progressive, which means that unlike income tax cuts, the tax cuts tend to lower wage earners. According to Bivens of the Institute for Economic Policy, the bottom two-thirds of American households pay more in tax taxes than they pay in income taxes. And traditionally, workers with lower wages often spend the money they receive through tax cuts.

Ecologists from Goldman Sachs calculate that the executive order of Mr. Trump would postpone a total of $ 145 billion in taxes. This represents a modest boost of 0.7% in US GDP over the last four months of the year. But that’s when employees spend those extra dollars, which people might refrain from doing, given that we’re talking about a delay, not a cut, in taxes.

Based on similar tax proposals in the past, Goldman estimates that about half of all employees choose to withhold their tax deductions. Finally, they estimate that 40% of the extra money will be spent, or just under $ 60 billion. This corresponds to an impetus for the economy of just 0.3% of GDP in those four months. And that impetus would be reversed soon next year, if the tax is to blame.

Mr. Trump has said that if he is re-elected, he would make the tax cut permanent, so it does not have to be repaid. But even if elected, Mr. Trump would need Congress to make the austerity tax permanent.

How would the payment tax holiday affect social security?

Paying taxes are the main source of funding for the Social Security Trust Fund. Again, however, since the order of Mr. Trump is for a holiday for paying taxes and not an official cut, it should not affect how much money is collected for Social Security.

If Mr. Trump were to make the tax cut permanent, it would mean that the trust fund for Social Security would run out of money faster than current projections. But Congress could still choose to fund the program in other ways to keep it solvent.

.