Hong Kong’s new technology index increased on its second day of trading, as experts said its diverse list of components will be attractive to traders looking to invest across the sector.

The Hang Seng Tech Index rose 2.64% as of 2:18 p.m. HK / SIN, outperforming the broader Hang Seng Index which was trading 0.34%.

“I think it is a very good list of components across multiple sectors of the technology sector,” said Sam Le Cornu, CEO and co-founder of Stonehorn Global Partners.

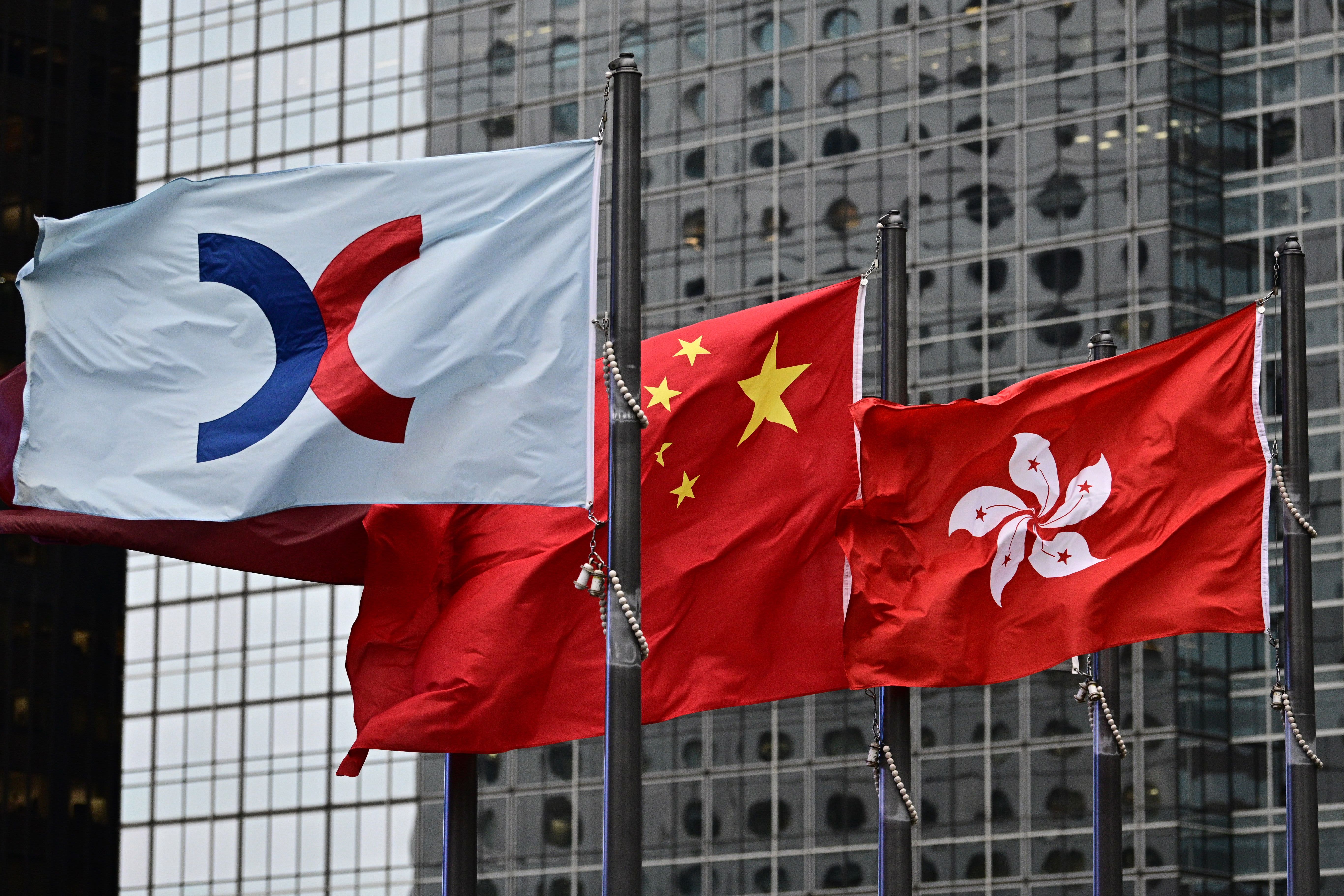

The technology index launched on Monday and will track the 30 largest Hong Kong-listed technology companies that pass the benchmarks.

Tech stocks are some of the main stocks traded in Hong Kong. The new index is trading at approximately 45 times earnings, compared to the price / earnings ratio of the Hang Seng Composite Index of 12, according to data released by the Hang Seng Indexes Company prior to the first day of trading for the new index.

The top five companies listed in the index are Alibaba, Tencent, Meituan Dianping, Xiaomi and Sunny Optical, which had a combined weight of over 40% as of July 17. Others include Ali Health, JD.com, Lenovo, Ping An Good Doctor, and ZTE.

“So it’s not just hardware, you also have insurance there, you have some cloud computing, you have fintech, e-commerce, you have a really nice slice. The only thing it doesn’t do is I think it doesn’t have renewable technology. So , it doesn’t have batteries there, “Le Cornu said on CNBC’s” Squawk Box Asia “on Tuesday.

“Other than that, it is a really interesting technology index and I think it will be one that will be closely watched,” he added.

Citi analysts said interest in the new index may divert attention from the tech Nasdaq in the US a bit and could lead to further turnover in the stock market operator Hong Kong Exchanges and Clearing with “products linked to more related indices “could be issued

The components of the index will be reviewed on a quarterly basis and a quick entry rule could allow for major tech companies to go public in Hong Kong if they meet certain requirements. That implies that when the fintech giant and the Alibaba-affiliated group Ant are made public, it could be added to the index.

Ant Group is preparing a double listing in Hong Kong as well as the technology-focused STAR directory of the Shanghai Stock Exchange. Although details of the stock price are not yet available, some analysts predict a huge valuation that could exceed that of some of Wall Street’s largest banks.

Le Cornu noted that along with Ant Group, other Chinese tech companies that are listed in the US and that can return to Hong Kong or make secondary listings there could also be added to the index under the fast-entry rule.

Increasing tensions between the United States and China have led some Chinese companies listed on Wall Street to return to Hong Kong. For example, the likes of Alibaba, JD.com, and NetEase have held secondary listings there. More could be followed if a US bill is passed that may compel Chinese companies to withdraw from US stock exchanges.

Jonathan Garner, managing director and chief equity strategist for Asia and emerging markets at Morgan Stanley, said the new technology index is important.

“When we really look at the development of the markets here, those intra-regional flows, particularly the north and south channels in and out of China are very important to the future evolution of the markets here,” he said on CNBC’s “Squawk”. Box Asia “on Tuesday.

Garner added that while the US Depository Receipts Market (ADR), which is used by Chinese companies for listing and trading in the US, is likely to decline in relevance, these new indices are “clearly offering a whole of products that will be part of market development here in Asia. “

.