Thomas H., president and chief executive of Equity Logic’s Stock Traders Daily. Key Jr. says that while there could be a big price of optimism in the markets, the rest of the year probably won’t see a decline in the big market.

But it’s coming in 2021, he tells MarketWatch, in ours Call of the day.

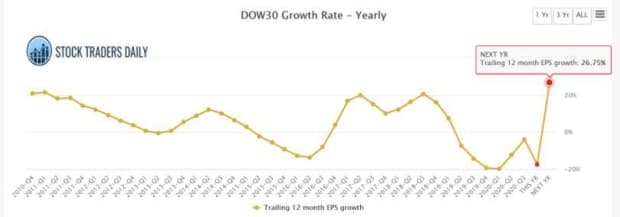

The big reason is that the Dow Jones Industrial Average estimates analysts’ earnings for 2021 in line with share expectations for DJIA

Is too small. That DJI is hovering EPS growth forecast at 26%, down from the recent 32% due to a downdown in the fall COVID-19 wave. As those expectations come down, as they will do, the risk of evaluation increases, he says.

Stock Traders Daily

“Assuming the Dow stays where it is right now, and earnings are up 32% for the Dow in 2021. Crisis, which means it will be very expensive, “he says.” Under those circumstances, the market could see a 25% decline.

“And by the end of next year, you won’t see material drops in the market, even though everything will be normal,” says Key. “When it comes down to it, it will come as a surprise to most investors who expect everything to look pretty good next year. The truth is, this year should look worse, and it’s not, because there’s so much excitement. “

By next year, investors will have dealt with rough economic patches and stimulus cuts from central banks (starting mid-year).

But he says Wall Street bankers will continue to market this year to ensure that bonuses come to an end – a weak third quarter it hangs on, he notes.

For how to play this coming drop in stocks, stick to the recommended strategy of this column in May – rotating between S&P 500 ETF SPY,

And cash. That said, keep going until you see signs that investors are making choices in an overvalued market.

They say the stock market action makes the most difference. “I’m looking for reversal signals and they come in all sorts of different shapes and sizes,” he says. A Possible Hint: Markets break through large levels of resistance and then bounce back. He’s one of many, Key says.

Markets

Dow YM100,

And S&P 500 futures ES00,

Nasdaq futures NQ00, while down

Is creeping. SXXP in European stocks,

Is low. Nikki NIK,

Shortly reached a 29-year high, while China stocks 000300,

Slipped. GBPUSD,

Probable EU / UK trade deals are in the report next week.

Read: This can lead to bad commercial real estate pain for banks and other lenders

Humming

Tesla TSLA,

The electric carmaker will join the S&P 500 next month on news that the stock has risen 12% in the premarket. And in the global-online-rental market, RBNB has announced an initial public offering of 1 1 billion.

E-commerce retailer Amazon AMZN,

A pharma has launched an online pharmacy store, which includes discounts for Prime members.

Home-Improvement Group Home Depot HD,

Reported better than expected earnings and income. Shares of Walmart, WMT

The retailer has taken the top spot after earnings. Kohl’s KSS earnings,

To come

Retail and import prices, followed by industrial production, commercial inventory and home builders index are ahead. Federal Reserve Vice Chair Richard Clarida said late Monday night that the economy would likely need further financial and monetary support.

Georgia’s secretary of state told the Washington Post that Sen. Top Republicans, including Lindsay Graham, are pushing for him to throw out legally absent presidential ballots. Meanwhile, the state’s count has so far uncovered 2,600 unaccounted ballots that were mostly for President Donald Trump.

Hurricane Ayota hit Central America a few days later.

Chief Executive of Take-Two Interactive TTWO,

The next pay generation video aming Ming Ming and more to invest Baron in Tech on Thursday at 1pm Register here.

Reads randomly

Mute relatives on Twitter TWTR,

And other #new Thanksgiving traditions:

NASA’s space station welcomes new SpaceX crew members:

The French radio station accidentally broadcasts dialogues of live people.

.