© Reuters.

© Reuters. By Bryan Wong

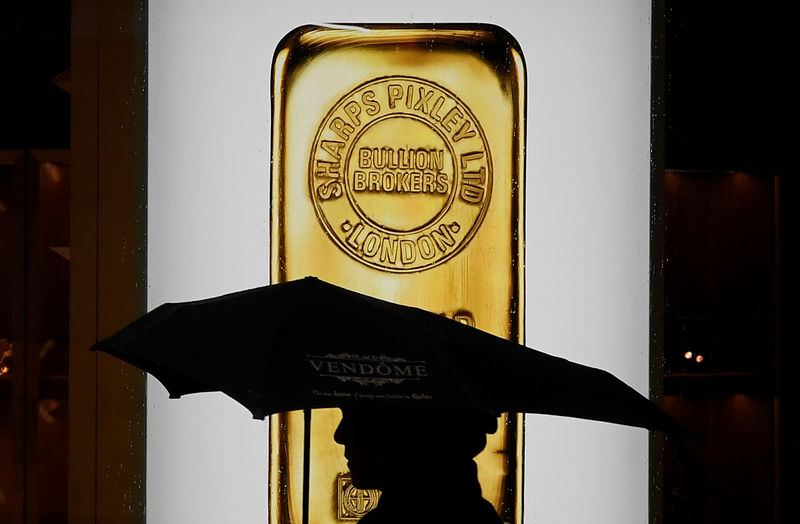

Investing.com – Gold fell sharply in Asia on Wednesday morning, following losses from previous sessions in North America and Europe.

slipped 2.52% to $ 1.897.20 by 11:57 PM ET (4:57 AM GMT). The pullback was not entirely unexpected, with analysts expecting a correction to the price per ununce of the yellow metal above $ 2,000 dollars.

The turnaround came as an appetite for recovered risk assets thanks to a stronger dollar and real rates. It’s up today, continuing to move down vacations of two years.

“The rally is now giving up some of these gains, because these drivers are losing momentum. Real rates are now coupled with nominal returns due to stimulus optimism and risk appetite, with the USD also at its lowest, ”said TD Securities head of global strategy Bart Melek in a note.

The move to riskier assets has been driven in part by optimism that the US could move closer to a new incentive package. US President Donald Trump also announced yesterday that he is “seriously” considering a capital gains cut.

Meanwhile, Russian President Vladimir Putin announced yesterday that a locally developed vaccine for COVID-19, Sputnik-V, has been given regulatory approval and is ready for use. Russian Health Minister Mikhail Murashko said on Tuesday that the vaccine was “proven to be very effective and safe”, with mass vaccination scheduled to begin in October.

But health regulators elsewhere have cast doubt on the vaccine because it has not yet been passed on safety tests and Russia has not provided scientific evidence of the effectiveness and safety of the vaccine.

Fusion Media or anyone involved with Fusion Media will not be liable for any loss or damage resulting from reliance on the information, including data, quotes, charts and buy / sell signals contained on this website. Please be fully informed about the risks and costs associated with trading the financial markets, it is one of the risky forms of investment.