Here are the top headlines from Fox Business Flash. Check out what is clicking on FoxBusiness.com.

Auto toe manufacturers are pumping billions of dollars into the development of electric cars, which are now facing a crucial choice: join more in the production of core batteries or buy them from others.

The battery is one of the most expensive components of an electric vehicle, costing between one-third and one-third of the value of the car. Officials say driving down their prices is the key to profitability.

But while traditionally built by internal combustion engine engineering and auto manufacturers, batteries for electric cars are manufactured by Asian electronics and chemical companies, such as LG Chem Ltd and Panasonic Corp., and newcomers such as China’s contemporary Empirex Technology Lie. .

With regulators pushing car companies worldwide to sell more electric cars, auto executives are concerned that there may not be enough factories to make high-quality batteries.

| Ticker | Security | The last | Change | Change% |

|---|---|---|---|---|

| F | Ford Motor Company | 6.89 | +0.14 | + 2.07% |

| G.M. | General Motors Company | 30.46 | +0.08 | + 0.26% |

| TSLA | Tesla Inc. | 415.09 | -33.07 | -7.38% |

California, the U.S.’s largest car market, said last month that it would end sales of new gasoline and diesel-powered passenger cars by 2035, forcing the auto industry to move toward electric vehicles.

In the race to lock up the supply of electric cars, auto manufacturers have resorted to various methods.

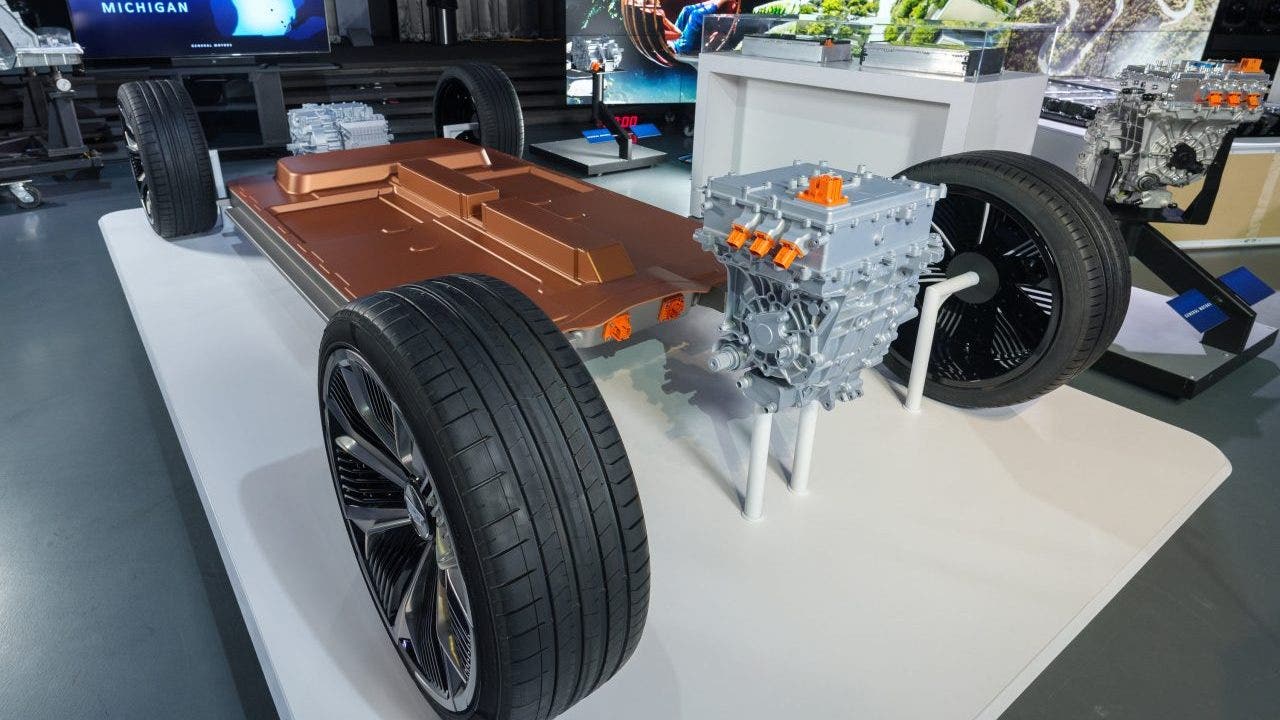

While most people make battery packs, large metal enclosures are often in the bottom of the car, they also need cells that come together to form the main power storage.

Tesla opened its Gigafactory in Nevada a few years ago to make batteries with Panasonic, which will produce cells for packs in a shared space. The electric-car maker specifically wanted to secure the product for its own models and lower production and logistics costs.

Now he finds more resources in that product.

Elon Musk, CEO of Tesla, is looking for sources in further production of its batteries. (AP Photo / Marcio Jose Sanchez, file)

While Tesla will continue to buy cells from Panasonic and other suppliers, it is also working on its own cell technology and production capacity to ensure that it can continue to demand its cars, Chief Executive Elon Musk said last month.

Following Tesla’s leadership, General Motors Co. And South Korea’s LG Cam has put 2. 2.3 billion into a nearly 3 million-square-foot factory in Lordstown, Ohio, which GM says will eventually make enough battery cells to fit every thousands of cars. Year.

In Europe, Volkswagen AG is taking a similar path, investing about 1 1 billion in Swedish battery startup Northvolt Abbey, including some funding to build a cell-manufacturing plant in Salzgitter, Germany, as part of a joint venture.

Others, such as Ford Motor Co. and Deller Miller AG, are clearly managing to build their own cells, with officials saying they prefer to contract with specialized battery manufacturers.

Auto manufacturers say supply chain disruptions have challenged some new model launches and jeopardized projects.

Ford is clearly advancing the production of its own cells. (AP Photo / Jean J. Pushkar, file)

For instance, Ford and VW have agreements with SK Innovation to supply battery sales for future electric-vehicle models. The South Korean company is building a factory in Georgia to meet this demand, but the fight against trade secrets has jeopardized the plant’s future and could disrupt new model dell launches, both automakers said in a legal filing.

GM officials say the risk of relying on suppliers has forced LG to create their own battery cell, despite why.

“We have been able to control our own destiny,” said Ken Morris, vice president of GM for electric vehicles. “

Bringing manufacturing home will give the company more control over its purchased raw materials and battery-cell chemistry, Mr. Morris said.

But installing the product even in a joint venture is a costly proposal, and it will not ensure a timely supply of cells. There are also risks to investing heavily in a battery technology as success can make it obsolete.

Mary Bara, CEO of General Motors, says she has been forced to develop her own battery cells. (Reuters / Brendan McDermott)

Ford cites those factors in making a decision against the same investment now.

Ford executive Hou Thai-Tang told analysts in August that the company looks at the industry’s traditional model of contracting with independent suppliers to make parts to make its battery-cell needs more appropriate.

“We have competitive tensions in dealing with too many suppliers, which allows us to reduce costs,” Mr Thai-Tange said, adding that the company expects GM and Tesla to pay corresponding sale prices.

In the meantime, Ford may leave capital-intensive operations to conduct research and build a manufacturing facility for battery companies, Mr. Thai-Tange said.

Daimler of Germany has tried both strategies.

The car company made its own lithium ion cells through a subsidiary until 2015. But the capital needed for the scale was spent elsewhere, said Daimler chief executive officer Ola Klenius.

The automaker has acquired Chinese battery maker CATL. And signed long-term supply agreements with Asian companies such as Farasis Energy (Gunzhou), which Daimler invested last year.

The company said it was spending about .6 23.6 billion on purchase deals but was keeping its battery research home.

“Let’s put capital into what we do instead of capital,” Mr. Clen Lenius said.