Gilead Sciences Inc. could provide additional authorization for emergency use by U.S. regulators for their drug reimbursement to admit patients admitted to hospital with moderate COVID-19, despite recent mixed test results, the company’s top survey told Reuters on Friday.

Back in May, the US Food and Drug Administration (FDA) approved the sale of brake drug on an emergency basis to patients hospitalized with COVID-19, the disease caused by the new coronavirus, after trial data showed that the antiviral drug helped them hospital short to make recovery time.

Diana Brainard, head of clinical research at Gilead, also told Reuters that the company’s formal FDA application for the drug, submitted earlier this month, seeks approval for use in all patients with hospitalized COVID-19.

The 600 patient analysis, published by the Journal of the American Medical Association, found that moderately ill patients treated with antiviral drugs for up to 5 days had a significantly higher chance of improvement in certain areas, such as whether or not they needed extra oxygen. , compared with patients receiving standard treatment.

Brainard said the clinical significance of the benefit to those patients was uncertain, due to ongoing questions about how best to measure patient outcomes other than survival.

Different test results for remdesivir raise “the question of whether the abnormalities are artifacts of study design choices, including patient populations, or whether the drug is less efficient than hoped,” according to a JAMA editorial accompanying the study.

The study in moderately ill COVID-19 patients demonstrated that 11 days after the start of treatment 65% of the 10-day remdesivir patients, 70% of the 5-day patients and 60% of the standard healthcare patients left the hospital.

Side effects that were more commonly seen in the brake desivir groups included nausea, low potassium levels, and headaches.

The JAMA editorial board asked important questions about the effectiveness of remdesivir, including which patients are most likely to benefit from the drug, the optimal duration of therapy, the impact of the drug on clinical outcomes, and the relative effect when combined with generic steroid treatments.

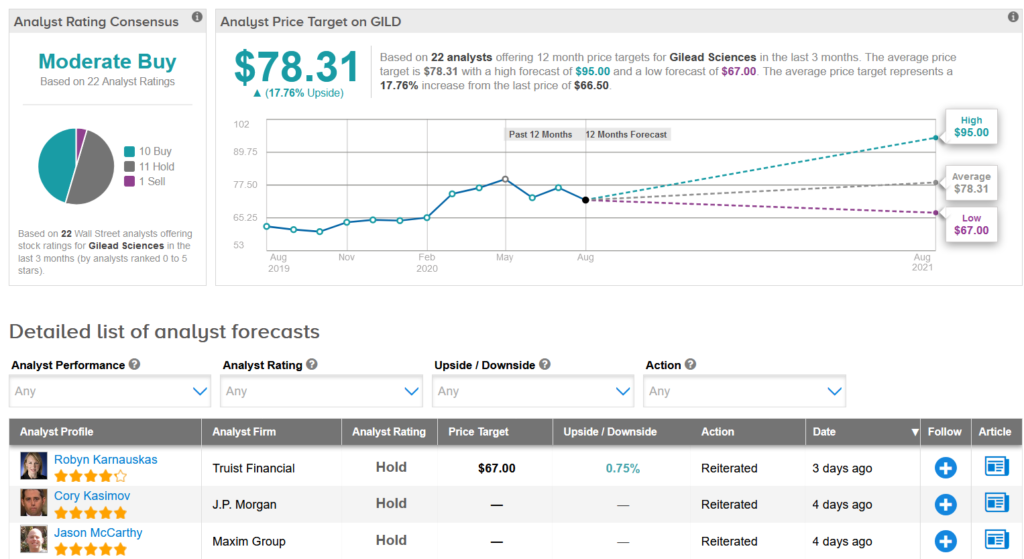

Shares in Gilead have advanced about 2.3% year to date with the average price target of $ 78.31, again indicating 18% upside potential in the shares over the next 12 months.

Truist Financial analyst Robyn Karnauskas last week lowered the stock’s price target to $ 67 from $ 74 and reiterated a Hold rating, saying that although there is some visibility about the commercialization of remdesivir in COVID-19, the r still “commercial risk” for the program.

The rest of the Street is cautiously optimistic up front with a consensus for moderate buy analyst based on 10 Buys vs. 11 Holds and 1 Sell. (See Gilead stock analysis on TipRanks).

More recent articles from Smarter Analyst: