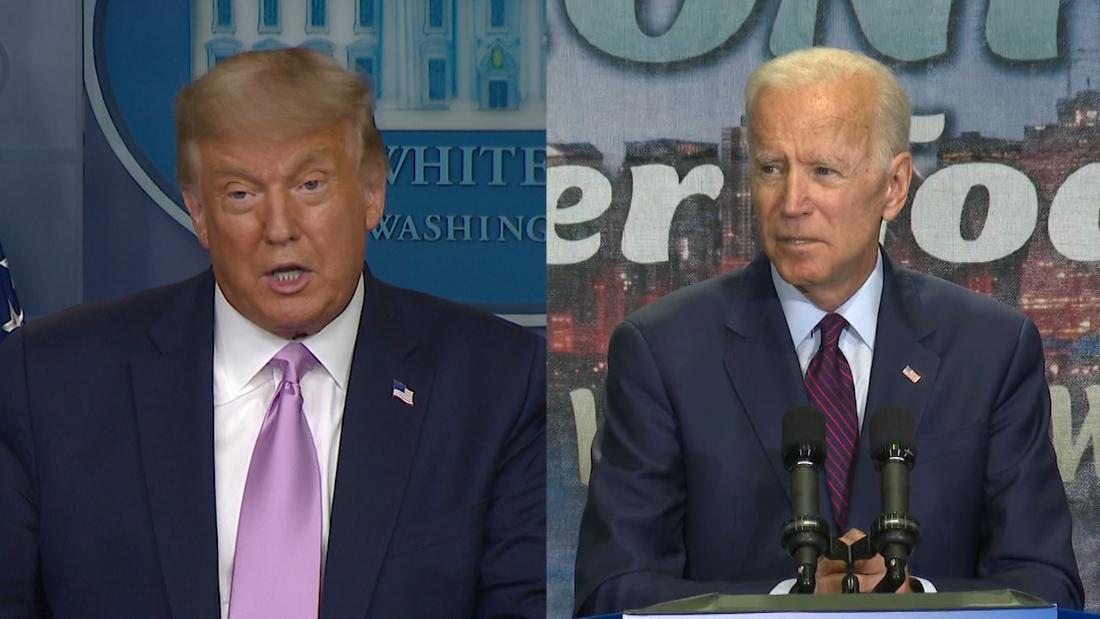

“Donald Trump stepped off the golf course and signed an executive action governing Social Security funding schemes,” the ad begins.

Facts first: Both of these claims require context. There is disagreement as to how far Trump’s executive action will reduce funding for social security, and Trump’s claims to pay for his proposed austerity tax through economic growth strike many as unrealistic. Meanwhile, Biden has supported spending on meetings and reduced cost of living and budget protection for Social Security over his long career in the Senate, but his current proposals aim to protect and expand it.

The executive action of Trump

When asked about the effect this action would have on Social Security trust funds, White House adviser Kellyanne Conway told reporters in a press release on August 11 that the president is still working to protect rights, but did not say how he would do that. Conway also said Trump was more concerned with people currently trying to put an end to meetings, rather than with the longer-term goals of Social Security.

Trump’s current plan

“At the end of the year, with the assumption that I will win,” Trump said, “I will end the tax break.”

Trump went on to say that social security would be paid for through the General Fund. “It works very nicely,” he said.

Only Congress can end the tax bill and it’s unclear, with the House controlled by Democrats and the difficulty of rallying Senate Republicans behind such a proposal, how Trump would fare at the end of the tax year.

During the briefing, when pressed by Fox News’ John Roberts for his claim that the general fund would fund Social Security after the tax was eliminated, Trump claimed that strong economic growth would cover the loss of the tax burden.

Biden’s record

Here’s a look at the facts:

Throughout his long political career, Biden has supported many different actions on the justice program, including a temporary safeguard of spending, budget protection and reducing the cost of life-altering.

The proposal was defeated by a vote of 65 to 33.

Biden’s current proposal

The plan includes a “true minimum benefit” for those who have worked for 30 years, and provides them with “a benefit of at least 125% of the poverty level,” says Biden’s campaign website.

.