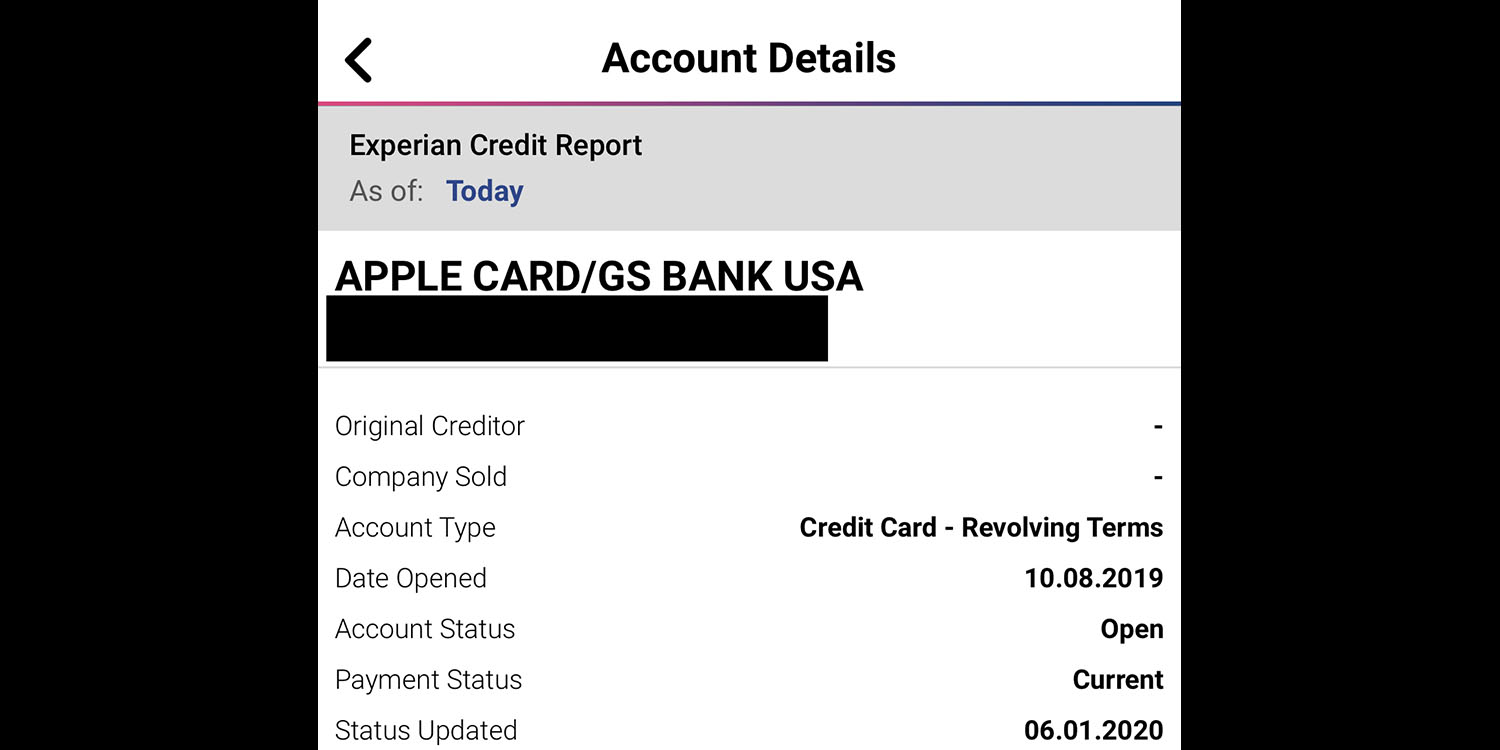

Some Apple Card users report that the card appears in their Experian reports. The card has been included in TransUnion credit reports for some time, but had not previously appeared on Experian or Equifax.

Apple Card feed on Experian seems to be gradual as the card is being shown for some but not all Reddit users who reviewed their reports …

Federal law entitles you to obtain a free copy of your report once a year from each of the top three credit reference agencies in the United States. It requests them through a joint website, annualcreditreport.com. However, you can currently get free weekly updates.

During these COVID-19 times, it is important to access your credit. That’s why Equifax, Experian, and TransUnion now offer free weekly online reports through April 2021.

Some banks and other financial institutions also allow you to view your credit score from one or more of these agencies, and the agencies also offer subscriptions with on-demand access to your report through an app.

Your report will show your credit account, which includes loans, credit cards, and financial deals. Some Reddit users report that the Apple Card appeared in their Experian reports in the past few days.

“Apple Card now informs Experian”

“Now I can confirm that it is also displayed in my Experian application.”

“Himself. It appears in my Experian app as well.”

“Apple Card shows you in my Experian”.

Others, however, still do not see it.

Those who track their credit scores regularly are seeing an increase or decrease in their score as a result of the Apple Card being added to their report, which is to be expected.

The calculation of credit scores is based on five factors:

- Payment history

- Utilization

- Length of credit history

- Recent activity

- Total capacity

For example, getting an Apple Card without changing your spending habits means that you now have access to more credit, but you are not using more, so its use decreases (which is good). Additionally, you are creating a payment history with a new credit provider, which is also increasing your score.

Conversely, any new line of credit reduces the average length of your credit history on all cards and other sources, which can damage your credit score for a time.

You can learn more about how credit scores are calculated here.

Via MacRumors

FTC: We use automatic affiliate links that generate income. Plus.

Check out 9to5Mac on YouTube for more Apple news: