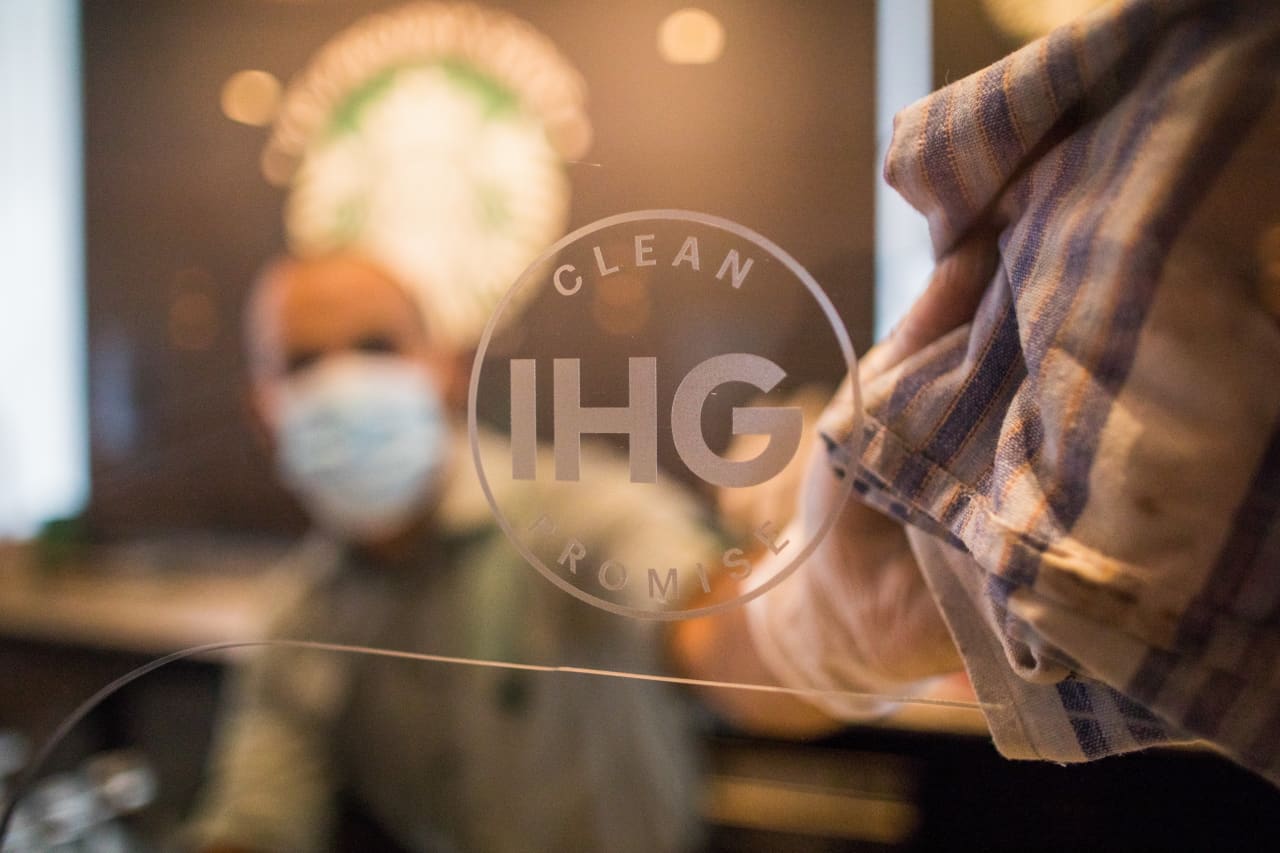

A staff member wearing a protective face mask at the Holiday Inn Whitechapel hotel, operated by InterContinental Hotels Group, is clearing a Perspex screen ahead of the reopening of the hotel for general bookings in London, England, on 3 July 2020.

Chris Ratcliffe / Bloomberg News

European stocks rose on Tuesday, taking to heart signs of a slow spread of the coronavirus pandemic and the possibility of a new round of US stimulus being introduced.

Up 0.3% on Monday, the Stoxx Europe 600 SXXP,

rose 2.1%.

Travel and vacation plays are leading the way, with gainers including International Airlines Group IAG,

cruise operator Carnival CCL,

and InterContinental Hotels IHG,

who reported a loss and said it would not pay a dividend.

Motorists BMW BMW3,

BMW,

Volkswagen VOW3,

and Daimler DAI,

each recorded strong gains, as a gain for the German DAX DAX,

The French CAC 40 PX1,

and UK FTSE 100 UKX,

I jumped.

After winning 356 points for the Dow industrials DJIA,

futures YM00,

pointed to further gains on Tuesday.

The coronavirus image in the US seems to be improving. According to the New York Times tracker, new cases have dropped by 18% in the last 14 days and new deaths have dropped 6%.

The gains in markets come under signs of the executive order President Donald Trump signed to extend unemployment benefits will not actually reach the hands of unemployed Americans.

The extra $ 400 a week that Trump’s order delivers depends on states paying $ 100, and Gov. New York. Andrew Cuomo said no one in his state would get the extra $ 400. But White House and congressional officials say they are open to talks about a reimbursement package.

“The clouds of uncertainty are beginning to split, and a ray of optimism is breaking through as additions to the U.S. stimulus package look more promising as both sides are set to re-enter the negotiating table,” said Stephen Innes, chief global market strategist. by AxiCorp.

Discussion by Trump about a possible capital gains cut – he could order the treasury to index capital gains thresholds after inflation – was also news sought by analysts.

The latest labor market data showed that the UK’s unemployment rate remained flat at 3.9% in the three months to June, reflecting job – seeking people as well as 7.5 million, who ‘ t are either temporarily away from their jobs.

From companies in the spotlight, HelloFresh HFG,

received 3% when the German manufacturer of prepared food kits increased its financial guidance for the third time this year. The share has risen 163% this year.

.