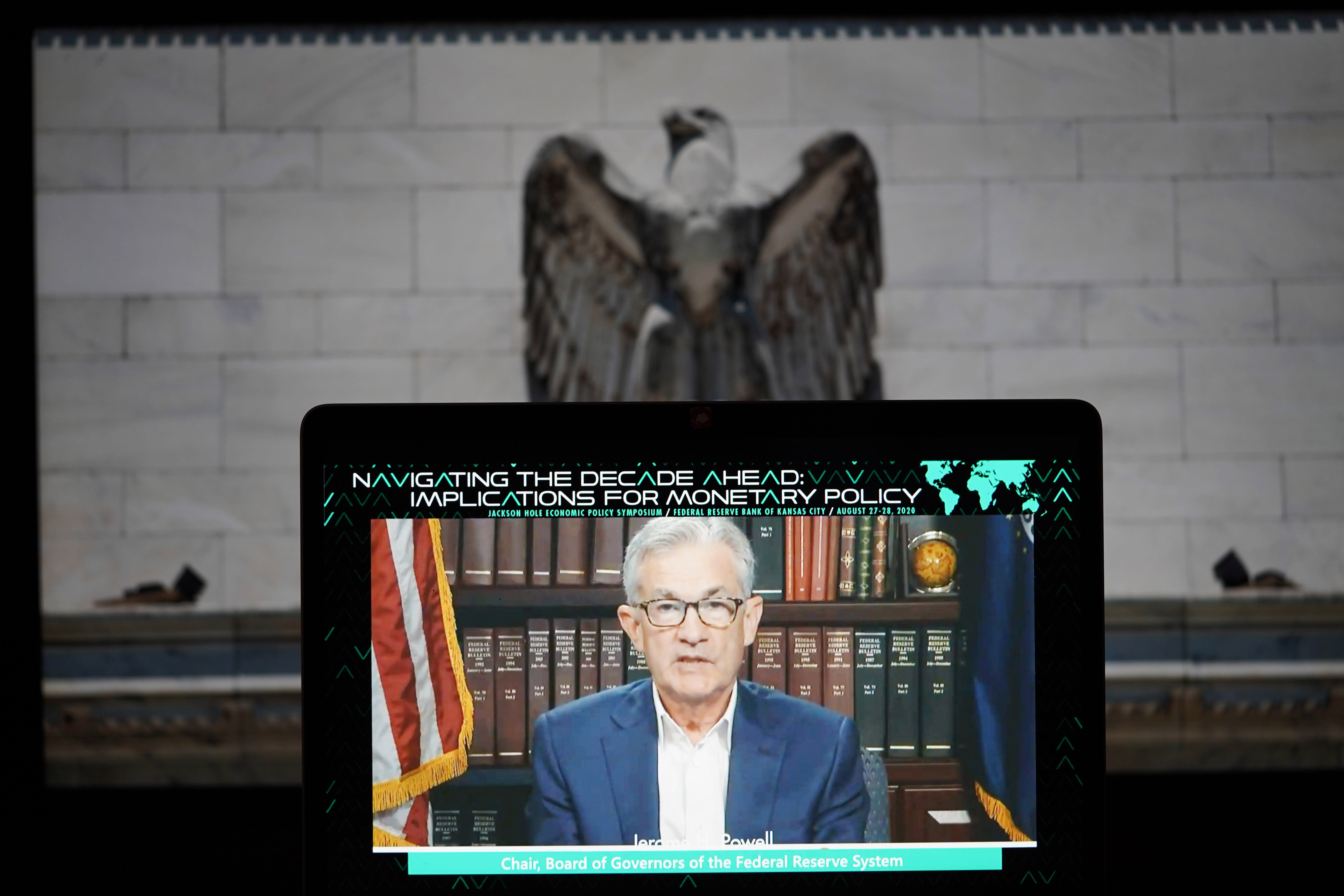

European equities were mixed Friday as markets continued to try and make sense of the historic shift in inflation announced by US Federal Reserve Chairman Jerome Powell.

On Thursday, Powell said the central bank would launch a new monetary policy framework that is likely to keep interest rates low in the US for longer.

The Federal Reserve will now tolerate inflation “moderately” above its 2% target, Powell said, noting that continued low inflation in the US over the past eight years has caused a series of economic problems.

The pan-European STOXX 600 index (^ STOXX) fell by about 0.3%, while the FTSE 100 (^ FTSE) in London rose by almost 0.1%

German DAX (^ GDAXI) fell by around 0.3% after a sharp drop in consumer sentiment in August, while the CAC 40 (^ FCHI) in France was poor.

“Markets have not been overwhelmed by the US Federal Reserve’s new stance on higher inflation, despite implicating that interest rates will remain lower for longer – normally something that would benefit equities,” said Russ Mold, AJ Bell’s chief investment officer. .

“One could argue that the Fed following this path was already anticipated by the market, hence why stocks are not ahead.”

The decline in Europe followed a broad positive session in Asia.

The Shanghai SSE Composite Index (^ SSEC) rose 1.6%, while the Hang Seng (^ HSI) closed 1.4% in the green in Hong Kong.

Japan’s Nikkei (^ N225) fell 1.4% after longtime Prime Minister Shinzo Abe said he would resign over ill health.

The KOSPI Composite Index (^ KOSPI) in South Korea rose by about 0.4%, while the ASX 200 (^ AXJO) in Australia fell by more than 0.8%.

Futures also pointed to a positive opening for U.S. stocks on Friday, as traders continue to dig up stubbornly high unemployment data and Federal Reserve Chairman Jerome Powell’s commitment to push inflation higher.

Futures on the S&P 500 (ES = F) were up 0.3%, putting the index on track for its seventh straight day of profit. Dow Jones futures industry average (YM = F) rose by almost 0.5%.

Futures on the Nasdaq (NQ = F), which snapped the five-day winning streak on Thursday, fell marginally.

Related