[ad_1]

For veteran readers who follow this author, choosing Nokia (NOK) is not without its disappointments. Value investing requires finding overdue and underprivileged stocks that have positive catalysts nearby to send them higher. With Nokia, markets are slowly recognizing the multi-year revenue potential for 5G.

Opportunistic companies larger than Nokia can also find ways to unlock business value. Before complying with US national security policy, governments are preparing the communications infrastructure. Therefore, in addition to the possibility of purchase, there are several reasons why investors should accumulate Nokia shares.

1) 5G contracts

The Department of Defense awarded various companies contracts worth $ 600 million. It is hiring companies to test its 5G communications technology at five of its military sites. Nokia is one of the many companies participating in the “5G strategy”. This plan incorporates 5G technologies in fighters.

Last week, on October 15, Fierce Wireless reported that Nokia will use From Qualcomm (QCOM) 5G RAN platform. This will boost indoor small cells that cover home and small business locations. Nokia’s 5G Smart Node will have a Qualcomm FSM100xx modem ready next year in Q1 2021.

Previously, Verizon (VZ) famous award winner Samsung (SSNLF) 5G contracts, which hurt Nokia’s shares. Verizon to roll out 5G mmWave sites with Samsung and Corning (GLW). However, Nokia offers a better price and better 5G delivery. For example, operators can “simultaneously address 5G network densification and indoor coverage needs.”

When the Federal Communications Commission auctions its C-band spectrum on Dec. 8, telecom providers can bid for 280 megahertz on the 3.7-3.98 GHz (5G) frequency.

Taken together, the events listed above include compliance with US national security policy.Heating tensions between the United States and China (and the rest of the world to a lesser degree) will increase the importance of the policy for years to come.

2) Relative undervaluation

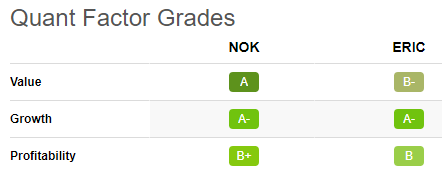

With a recent close of $ 4.20, Nokia is worth $ 23.5 billion by market capitalization. Ericsson (ERIC) is worth $ 36.95 billion. And although it pays a 1.46% dividend, Nokia posted strong positive operating cash flow last quarter. Will do it again this quarter. This suggests that the company will reinstate its dividend as soon as possible.

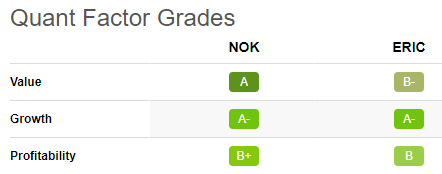

You can see below that Nokia scores higher than Ericsson for value and profitability:

Source: SA Premium

Earlier I wrote that Ericsson is a better stock than Nokia (link for premium subscribers or DIY members). That opinion does not change. Against this backdrop, Nokia scores better on quantitative factors that suggest that a suitor will recognize its undervaluation.

Below: Market capitalization comparison over the past decade

YCharts data

YCharts data

3) More earnings from 5G contracts

Nokia lost 20% of its value since August 2020, when Samsung won a 5G supply deal with Verizon. However, the markets did not realize that Nokia has continued to win big contracts since then. It will supply the communications solution for NASA’s space mission to the Moon. The contract is worth $ 14.1 million. This is the first cellular network on the Moon. The victory reaffirms Nokia’s excellence in LTE / 4G reliability and high data speeds. Furthermore, the solution is inexpensive and consumes little energy.

On September 29, Nokia signed an agreement to supply BT with 5G RAN. In doing so, it becomes the largest supplier of BT equipment. Nokia will supply equipment and services at BT radio sites. And while you’ll likely have low hardware margins due to the size of the contract, 5G-based services and technical support services should increase your profits.

Risks

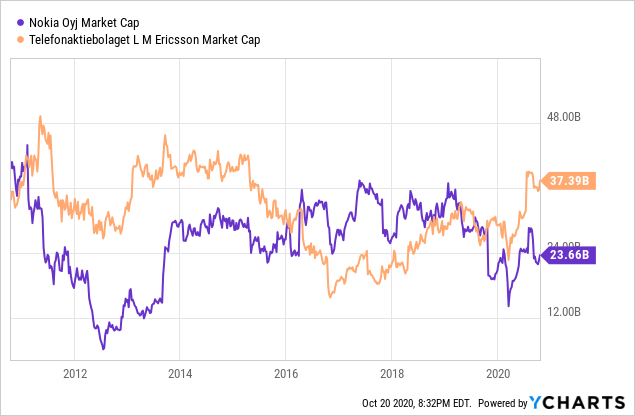

Nokia does not have a consistent track record for beating analyst estimates. The company beat expectations half the time in the last six quarters. Earnings per share estimates were lost on two of those occasions:

Data courtesy of Stock Rover

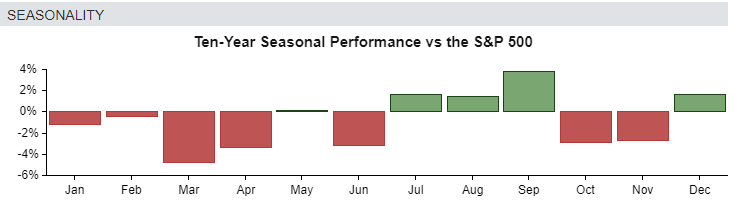

Seasonality also works against Nokia’s stock for the next two months and the first half of 2021:

Nokia fell sharply in the summer instead of rising as it should (due to seasonal patterns). The contrary may view the pattern as a bullish opportunity to buy stocks.

Your take away food

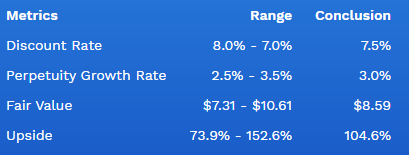

An American company looking to capitalize on 5G can buy Nokia for around $ 9.00. In a 5-year discounted growth exit model, use the following metrics:

Model courtesy of Finbox

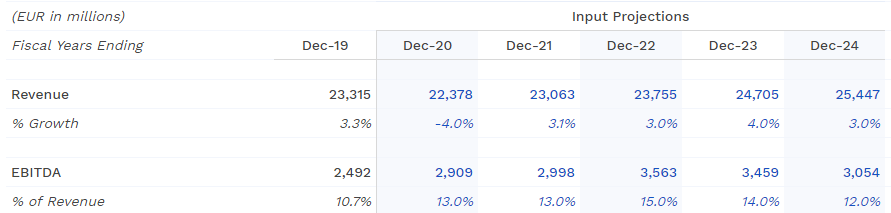

Suppose the maximum EBITDA comes mainly from 5G in fiscal 2022:

In the short term, Nokia shares may continue their rally from the $ 4.00 support line, ahead of the earnings report. If the company posts earnings that exceed expectations under the new CEO, Pekka Lundmark, Nokia will finally rise and stay there.

Please [+]Follow to get coverage on deeply discounted stocks. Click the “follow” button next to my name. Join DIY investment today.

Divulge: I am / we are a lot of NOK. I wrote this article myself and I express my own opinions. I am not receiving compensation for it (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]