[ad_1]

The coronavirus crisis will cause “lasting damage” to the standard of living of people around the world and taxes on the rich and businesses may have to increase to address this economic damage, the IMF warned.

The pandemic will leave significant scars on the global economy in the form of job losses and bankruptcies and entire sectors of the economy will be left unviable, according to the fund’s first medium-term forecasts since the virus began.

This damage will persist because the adjustment of struggling sectors such as travel to expanding sectors like digital technology will inevitably be slow and painful for many people, the IMF said in its semi-annual World Economic Outlook, released on Tuesday.

In launching the report, Gita Gopinath, the fund’s chief economist, said the period of recovery from the crisis would be “long, uneven and uncertain”.

The need to adapt to less travel and commute and more bankruptcies will lead to “significant production losses” even after the pandemic has subsided and countries that rely heavily on tourism and commodities are likely to be in “a particularly difficult situation. “, the IMF said.

Global economic growth will be negative this year and the worst since the Great Depression of the 1930s, the fund said.

The grim forecast came even after the IMF revised up its growth forecasts for this year, reflecting the fact that the second-quarter recession turned out to be more superficial than feared, and countries experienced more recoveries. quick by relaxing locks.

The IMF expects the world economy to experience a 4.4 percent contraction in 2020, 0.8 percentage points less than its June estimate.

As long as the pandemic is under control next year, the fund expects a 5.2 percent rebound in the world economy in 2021, a forecast just 0.2 percentage points worse than in June.

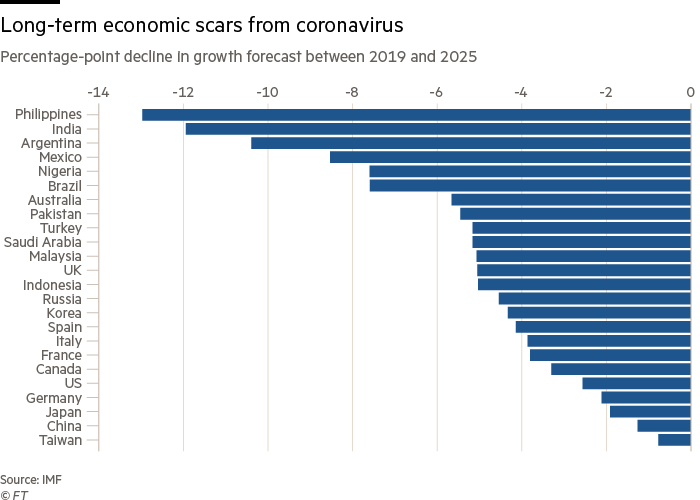

But by the end of next year, advanced economies are likely to be 4.7 percent smaller than the IMF expected earlier this year before the pandemic hit, and emerging economies were hit by 8, 1 percent.

Economies will continue to recover after 2021, but will settle on relatively weak growth at a lower production level than expected before the pandemic, the fund warned; the long-term impact in advanced economies will be 3.5% of national income and 5.5% in emerging economies.

“Persistent production losses are a major setback for living standards relative to what was expected before the pandemic,” Ms Gopinath said. “Not only will the incidence of extreme poverty increase for the first time in more than two decades, but inequality will increase.”

Women and less skilled workers are likely to be the most affected.

As economies will be smaller, the risk that tax revenues will be inadequate to service public debt in the medium term will increase, the IMF said. This is particularly the case in emerging economies, which have not been able to borrow in financial markets at as low an interest rate as the main advanced economies have done.

Gopinath said that in the coming years governments may need to tax the richest people more and ensure that companies cannot avoid corporate taxes.

“While it will be difficult to adopt new revenue measures during the crisis, governments may need to consider increasing progressive taxes on the wealthiest and those relatively less affected by the crisis, including increasing tax rates on income brackets. higher, high-end properties, capital gains and wealth, ”the report said.

But in the short term, countries able to access finance should borrow as much as necessary to protect their populations from the health crisis and limit the scope of economic downturns, the IMF said.

Whenever possible, this should happen before countries begin the difficult work of eliminating emergency support and encouraging workers to move to sectors less affected by prolonged social distancing.

Excess corporate debt increases vulnerability to financial shocks, IMF warns

Companies around the world are increasingly vulnerable to financial shocks after taking on too much debt this year, the IMF warned on Tuesday.

Higher levels of corporate debt could “lead to a deterioration” in companies’ ability to pay their financial obligations and measures of corporate credit quality had already weakened, the fund said in a new report.

“As the crisis unfolds, corporate liquidity pressures can turn into insolvencies, especially if the recovery is delayed,” the IMF said in its semi-annual financial stability report. “The most vulnerable companies, with weaker solvency and liquidity positions, as well as smaller companies, have experienced greater financial stress than their peers in the early stages of the crisis.”

The IMF warned that lenders were not yet out of the woods and could face “considerable credit losses in the event of an increase in defaults and bad debts.”

Losses in corporate debt holdings could lead non-bank lenders “to stop providing credit to these segments of the corporate sector, exacerbating tensions on borrowers and leading to worse macro-financial results,” according to the report.

Eric Platt and Colby Smith