[ad_1]

Addis Ababa, October 18, 2020 – Ethiopia’s effort to eradicate counterfeiting by introducing new banknotes is attracting people who have never had a bank account into the financial system.

Over the past four weeks, nearly a million Ethiopians who previously had no access to banking services have turned in their two-decade-old bills, according to the central bank.

In return, they were given a bank account from which they can draw the new bills. The regulator is trying to deter cash hoarding that allows corruption and illegal trade to flourish, and escapes the tax net.

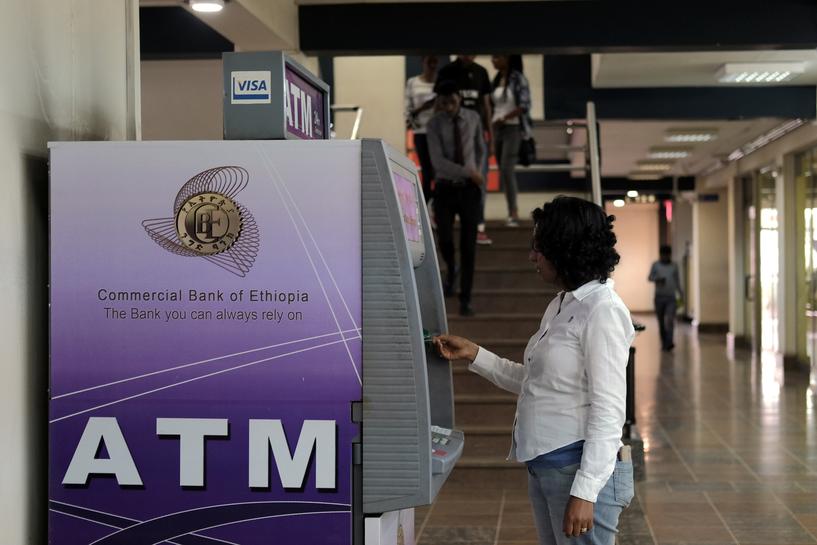

The flood of applications forced the largest commercial lender in the country to assign more ATMs to only handle money exchange at its main branch next to its headquarters in the capital Addis Ababa.

The Commercial Bank of Ethiopia branch gained many new clients last month, while many others deposited cash into accounts that had been dormant.

“The first day of the new bills, you wouldn’t believe what happened here, they all came,” said Nebyou Birhanu, who runs digital services at CBE. “The money is entering the bank.”

The demonetization initiative has added 31 billion birr ($ 830 million) to the 990 billion birr of deposits that were in the country’s 19 banks at the end of March. The central bank estimates that there were 92 billion birr of unbanked cash in Ethiopia in July 2019.

“We hope that more people, in rural and urban areas, will open bank accounts,” the governor of the National Bank of Ethiopia, Dr. Yinager Dessie, told state television last week.

The central bank is preparing to allow non-financial institutions to offer mobile money services, opening up banking to local phone companies.

To guard against that threat, Commercial Bank of Ethiopia updated its banking application to allow customers to obtain credit, pay utility bills and transfer cash more easily, Nebyou said.