[ad_1]

Next Africa, a weekly newsletter on the current situation on the continent and where it is going next.

McKinsey & Co., one of the world’s largest management consulting firms, humiliated itself this week before a South African judicial investigation into government-related corruption.

The firm pledged to return R 650 million ($ 43 million) in fares to Transnet, the state logistics company, and South African Airways. That money came from joint contracts with a firm linked to the Gupta brothers, who have been accused of influencing the South African government’s appointments for their own benefit and have refused to return from Dubai to face corruption charges.

A McKinsey & Co. logo

Photographer: SOPA Images / LightRocket

McKinsey’s chief risk officer, Jean-Christophe Mieszala, testified before the commission, admitting mistakes and “firing” employees for their role. He did not admit to corruption on behalf of McKinsey.

It may not be enough.

Transnet claims it is owed more than 1.2 billion rand and Iraj Abedian, one of the country’s leading economists, questioned how the company could set its own atonement terms.

McKinsey has paid before. In 2018, it returned a billion rand to the state power company Eskom for participating in similarly tainted deals. He is no longer accepting lucrative contracts to help South African state-owned companies and has declined to say what remains of the rest of his business in Africa’s most industrialized nation.

“We learned some lessons from South Africa,” Mieszala said in the investigation. “We should have known who we were dealing with.”

It’s easy to forget that McKinsey is not alone. KPMG, SAP and Bain & Co. have caught up in South Africa graft investigations, while contracts Eskom concluded with some of the world’s largest engineering firms are being investigated.

News and Opinion

Ghana Votes | Nana Akufo-Addo vowed to restore economic growth in Africa’s largest gold producer after securing a second four-year term as president. In another close contest between the incumbent and his predecessor, John Mahama, Akufo-Addo won 51.6% of the vote. The opposition has threatened to challenge the result, a A rare move in what is considered one of the most stable democracies in Africa.

Farm attacks | An increase in attacks on Nigerian farmers is having a knock-on effect on the West African nation’s grain reserves. Stocks have fallen to less than 30,000 metric tons, a fraction of what the country of 200 million people needs, and growing insecurity makes it difficult to increase those supplies. Last month, suspected Islamist insurgents killed dozens of subsistence rice farmers in the northeastern state of Borno, where the insurgency has raged for more than a decade.

The funeral of 43 farm workers in Nigeria on November 29, 2020.

Photographer: AUDU MARTE / AFP

Humanitarian crisis | An attack on a team of United Nations security officials in northern Ethiopia has stalled plans to send emergency assistance to the conflict-ravaged Tigray region of the country. Aid groups are unable to deploy to the region nearly two weeks after the government said it would allow relief supplies to be shipped there. It is unclear who the soldiers were who fired at the group, as UN teams have observed troops wearing Eritrean uniforms on the move in the area.

Nigeria Gold | Smart investors have found a new and less obvious benefit from exchange-traded funds in Nigeria. Foreigners are using a small gold ETF to withdraw cash from the West African nation amid the country’s current dollar shortage. Portfolio managers are buying the Newgold Issuer ETF in Lagos, the trading capital, using naira. They then transfer shares to the fund’s main listing in South Africa and sell them for rand, even though it is an almost certain waste of money.

Wave of virus | The South African government declared a “second wave” of coronavirus infections as the number of cases increased in the country’s four largest provinces. Confirmed cases rose to more than 8,000 a day, the highest number since early August, raising the possibility that authorities could reintroduce restrictions to contain the spread. Much of the outbreak was attributed to youth attending “super spreader” parties to celebrate the end of the school year.

A volunteer sprays disinfectant during a deep cleaning operation inside a clinic in Johannesburg.

Photographer: Guillem Sartorio / Bloomberg

Past and Prologue

Data surveillance

- Ghana’s inflation rate fell back within the central bank’s target range of 6-10% for the first time in eight months in November.

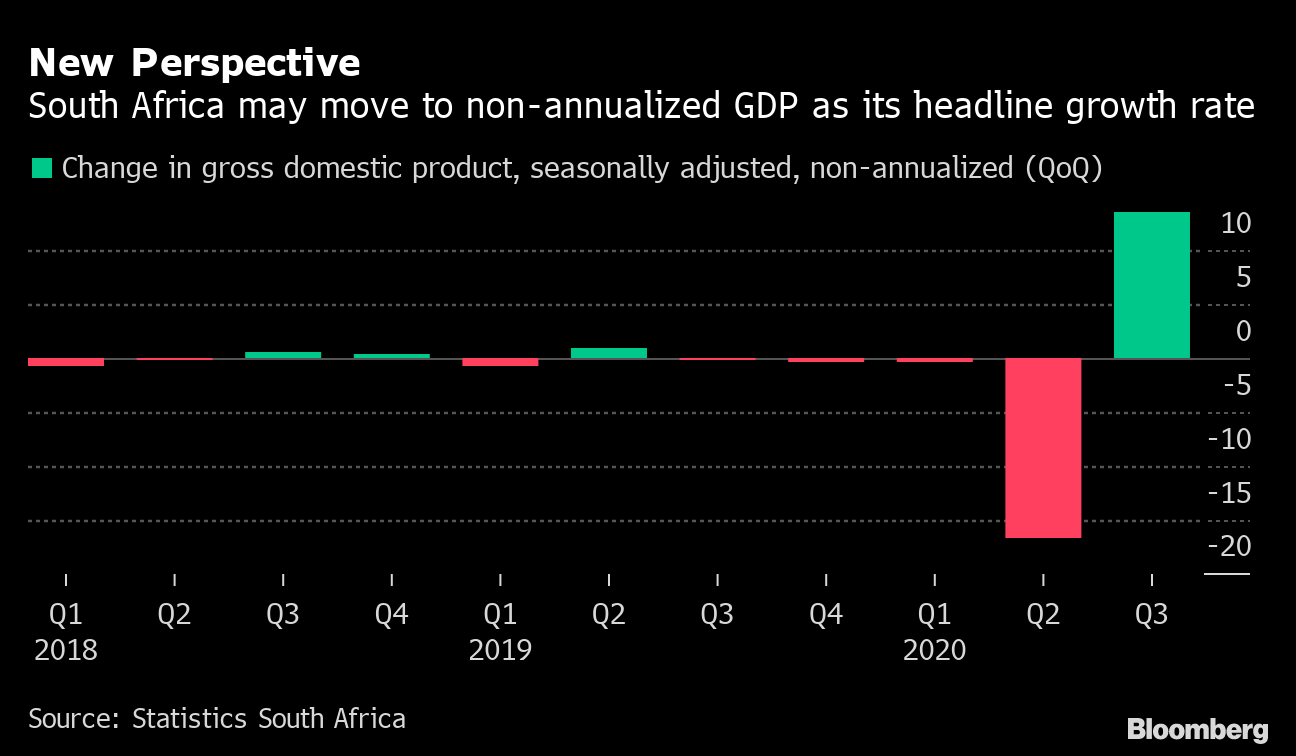

- South Africa posted its largest trade surplus in more than 30 years in the third quarter. 5.9% of the positive balance of gross domestic product came as exports recovered after the restrictions of the second quarter virus.

- The South African economy in general, in part it recovered in the third quarter from the record drop of the previous three months, with an annualized growth of 66.1%. The statistics agency is considering move from the volatile measure in the future to focus on non-annualized change.

Going up

- December 14 Ivory Coast President Allasane Ouattara to be sworn in for a third term, South Africa 4th quarter business confidence, Ugandan interest rate decision

- December 15 South Africa Central Bank Leading Indicator, Nonfarm Payrolls and Producer Inflation Data, Consumer Inflation Releases for Nigeria, Namibia and Botswana

- Dec 16 Ghana 3rd Quarter GDP and producer inflation, Mozambique interest rate decision

- December 17 Namibia 3rd quarter GDP

Last word

Ivory Coast and Hershey have resolved their differences over cocoa prices. The West African country lifted an order to suspend the global chocolate maker’s sustainability programs following a “final” commitment to pay a premium on cocoa to improve farmers’ incomes. The governments of Côte d’Ivoire, the world’s largest cocoa producer, and neighboring Ghana had accused Hershey, the maker of Kisses, Reese’s and other chocolate treats, of trying to avoid the $ 400-a-ton premium by buying cocoa through from the New York Stock Exchange. Hershey revolutionized the markets in November when it unexpectedly bought large quantities of cocoa through futures contracts, causing prices to rock.

Photographer: Daniel Acker / Bloomberg

– With the assistance of Rene Vollgraaff