[ad_1]

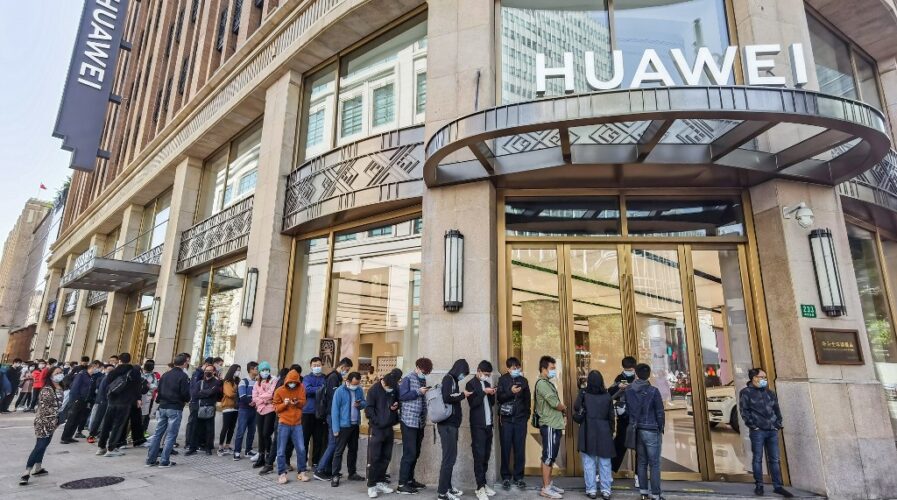

Huawei’s flagship Huawei Mate40 series of mobile devices continues to be popular in China. Source: AFP

- With the latest US sanctions in place, how will Huawei Technologies survive the backlash against its 5G and smartphone businesses?

In some parting shots, the outgoing presidential administration of Donald Trump has revoked the licenses of several of Huawei Technologies Co.’s US suppliers, such as Intel, in an attempt to make it harder than ever for the Chinese telecoms giant to continue operations. critical commercials in the United States. .

The Trump administration’s sanctions have cut Huawei away from critical business relationships with companies like Alphabet Inc.’s Google, which provided Android software on hundreds of millions of Huawei smartphones, and Taiwan Semiconductor Manufacturing Co. for its cutting-edge chips. .

Most of the other major Chinese tech companies have been reprimanded in a similar way, as part of a campaign to curb China’s rise in technology. They include China’s top three telecommunications companies, its top chipmaker, its biggest social media and gaming platforms, and its top two smartphone makers, along with several others.

The ramifications of being on the US commercial blacklist have pushed smartphone companies and Huawei’s 5G network into a downward spiral – virtually no nation with US affiliations will use its leading 5G infrastructure in the world. market for its next-generation networks, and its mobile unit has lost significant market share since its phones can no longer use Google’s Android operating system, while Huawei developed its own proprietary operating system.

Once a global leader in communications technology, the outlook doesn’t look rosy for Huawei Technologies’ consumer companies. But industry watchers expect the company to advance in the software business as its network and mobile units reorganize.

What does this mean for businesses?

With their withdrawal from consumer operations, Asia Pacific companies can expect Huawei’s technologies to emerge more in software-oriented products, most of which are focused on enterprise development.

Huawei is likely to focus on the Harmony operating system it is developing for its smartphones after being disconnected from Alphabet’s Android, said Nicole Peng, vice president of mobility at consultancy Canalys.

The self-developed operating system, HarmonyOS, has been in development for three years. Huawei has also confirmed that its operating system will be available as an open source operating system used by other Chinese OEMs to build bridges between their local market and Western markets.

Elsewhere in the software, Huawei is likely to pivot more toward services such as its cloud computing division Huawei Cloud, as well as developments in smart Internet of Things (IoT) devices, although these are unlikely to offset the slowdown in smartphones and telecommunications infrastructure, analysts said. .

Huawei Cloud itself has launched more than 200 cloud services and at least 190 cloud-based solutions, including 43 artificial intelligence (AI) cloud services powered by Ascend that will enable corporations to harness the computing power of AI in the cloud ecosystem.

This gigantic growth has seen Huawei Cloud work its way to the top, finding itself among the IaaS elite, becoming the third largest cloud provider in China and the sixth largest globally. The strong performance of Huawei Cloud, plus the dwindling fortunes of its other businesses, has led Huawei to give its cloud unit equal credit as it does to its 5G smartphones and devices.

[ad_2]