[ad_1]

Trump’s personal finances, low hopes for stimulus, and a grim Covid milestone.

Not much

President Donald Trump paid $ 750 in U.S. income taxes in both 2016 and 2017, according to a report in the New York Times. The documents, which Bloomberg News has not verified, also show that Trump is losing millions of dollars on his golf courses and has hundreds of millions of debts that will expire in the next few years. The president told the story “is a total forgery “while refusing to release its statements until an audit is completed. Biden’s campaign has pounced on the publication weeks before the election. It has also been an opportunity for merchants selling.”I paid more taxes than Donald Trump’s products.

Still hopeful

The rapidly diminishing chances of a new fiscal stimulus package before the elections have yet to be fully extinguished. President Nancy Pelosi said Democrats he will unveil a new “offer” shortly, adding that he would rather see a majority in the House pass an actual deal than simply vote on a package that would be dead upon arrival in the Senate. While there were some conversations between Pelosi and Treasury Secretary Steven Mnuchin On Friday, the continuing deep divisions in the size of any package and the very short deadline for elections means lawmakers remain skeptical whether a breakthrough is possible.

Grim landmark

The global death toll from Covid-19 it will probably exceed one million today, with cases already exceeding 33 million. Experts say the actual death toll may be almost double the official account. The milestone will be surpassed as governments continue to fight to contain the disease, with authorities in many countries imposing or expanding measures. The Times of London reports that the city may be forced to another confinement. New York officials are concerned about localized spikes of infections, even as the citywide rate remains low.

Markets go up

Global investors appear to have taken the weekend to reassess their pessimism from last week, and indices around the world posted strong gains. Overnight, the MSCI Asia Pacific Index added 1.1%, while Japan’s Topix Index closed 1.7% higher, with the country’s Nikkei 500 topping its The high of the bubble era of the 1980s. In Europe, the Stoxx 600 Index had gained 1.8% as of 5:50 am ET, with banks on the rise as all industry sectors they were green. S&P 500 Futures pointed to a jump at the open, the 10-year Treasury yield was at 0.669% and gold was close to $ 1,850 an ounce.

Going up…

European Central Bank President Christine Lagarde testifies before the European Parliament at 9:45 am, where she is expected to call to more fiscal stimulus. Dallas Fed manufacturing for September is at 10:30 am Cleveland Fed President Loretta Mester speaks later. Alibaba Group Holding Ltd. celebrates an investor day and the FT Commodities Global Summit begins.

What we have been reading

This is what caught our attention over the weekend.

And finally, this is what Joe is interested in this morning

A big win for Joe Biden and the Democrats may be the best thing that could happen to oil and banking stocks.

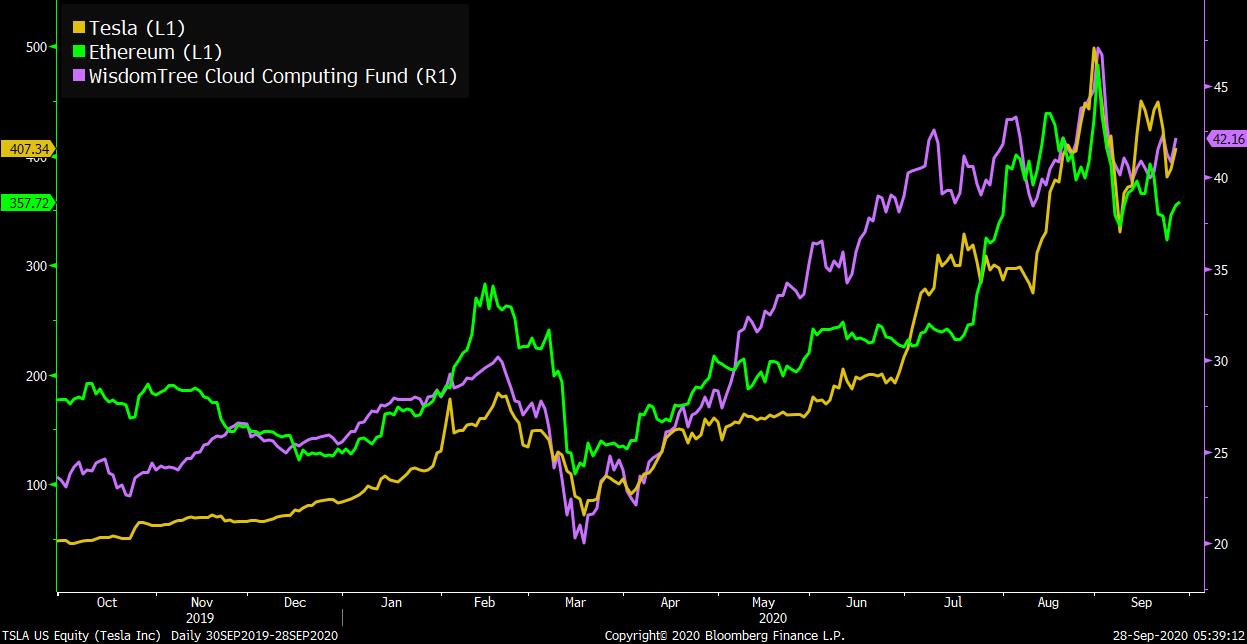

But let me go back a second. In the latest episode of Odd Lots, Tracy Alloway and I spoke with Jared Woodard, who is the chairman of the Bank of America Research Investment Committee. The topic centered on the question of why so many disparate assets these days seem to be trading in unison. Tesla, Ethereum, cloud computing stocks, whatever. The graphics look the same.

This phenomenon, Woodard explains, is a function of the poor growth conditions we’ve seen in the economy for years. Basically, when profits are hard to come by, people will pay a premium for what could be the next big thing, or lottery tickets, or companies that, for idiosyncratic reasons, are growing a lot despite an overall stagnant economy. If Tesla is the future of cars, it will do well if GDP grows at 2% or 4%. If Snowflake (a software company that just did an initial public offering) has a realistic chance of competing with Amazon, then you can see why investors are paying more than 100 times the revenue for it.

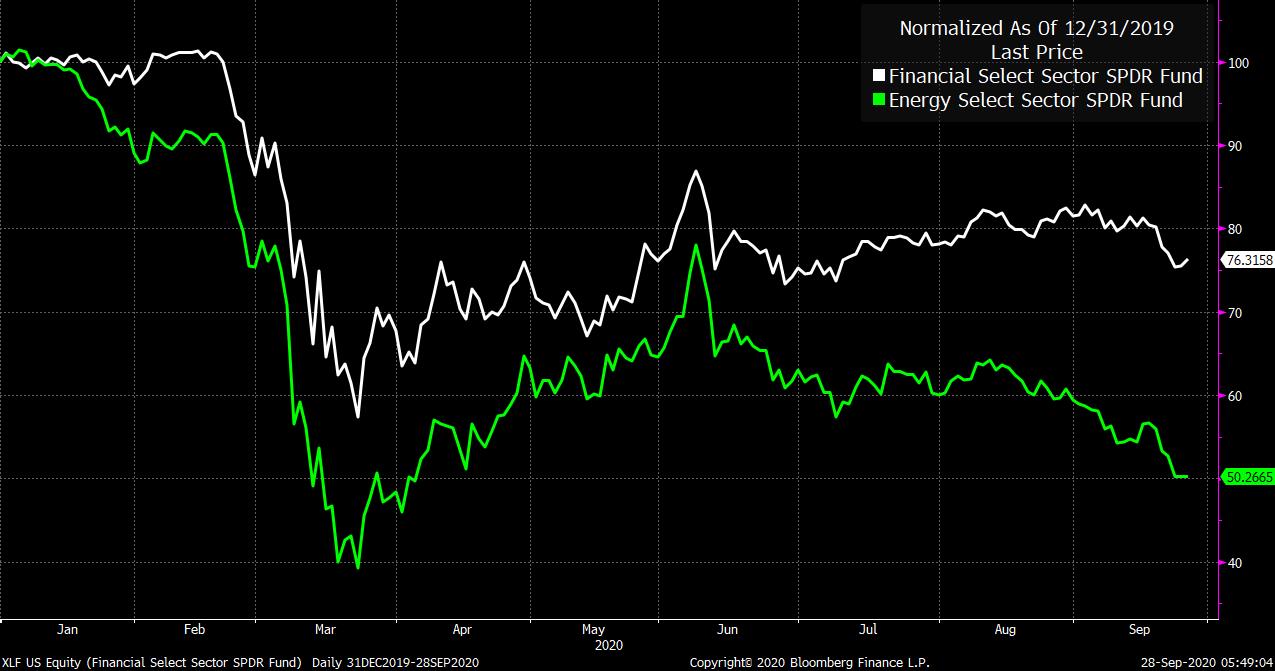

The flip side of all this is that companies with predictable businesses tied to the real growth of the economy are doing pretty badly. Here’s a look at financial and energy stocks, which are having a horrendous 2020.

So what could reverse this situation? INCREASE. And one thing that could generate a significant growth jolt, according to Woodard, is sustained fiscal power and aggressive public investment. In such an environment, the predictable here and now starts to look better, and suddenly there is less incentive to bet on some speculative future scenario where we all drive Teslas on Mars and pay taxes on Ethereum. In the episode, Woodard didn’t take the bait on whether this meant that the unified Democratic DC would be the best thing that could happen to financial and oil stocks. However, according to Moody’s, a Democratic sweep would be the best scenario for rapid growth starting in 2021, due to the increased outlook for fiscal stimulus.

Of course, there is nothing certain about how the policy path would go under any DC power setting. However, it is logical to think that the previous dynamic could be reversed in a situation in which the policy stalemate was broken and the government committed itself to spending money. Anyway, it was a great conversation, which you can check out here.

Joe Weisenthal is editor of Bloomberg.

Like the five Bloomberg things? Subscribe for unlimited access to trusted data-driven journalism in 120 countries around the world and get expert analysis of exclusive daily newsletters. The Bloomberg Open Y Bloomberg shutdown.