[ad_1]

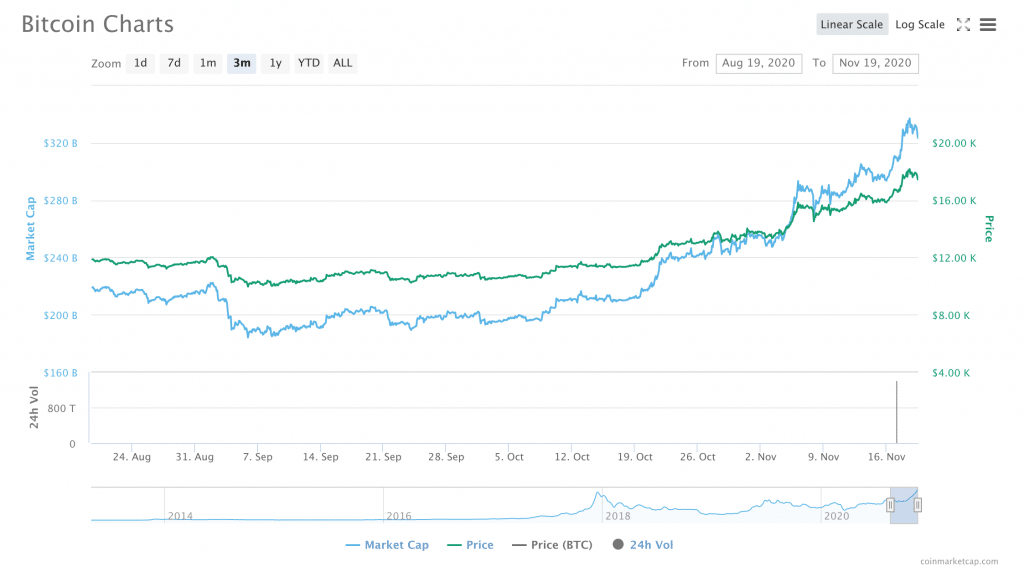

Although the week is not over yet, it has been another important one for Bitcoin, although BTC was at around $ 17,700 at press time, Bitcoin had briefly passed above the $ 18,000 mark earlier this week.

To many analysts, the move above $ 18,000 seemed to indicate that another major price target was just around the corner: $ 20,000.

Bitcoin, of course, has passed the $ 20,000 mark before – the ICO boom in late 2017 and early 2018 lifted Bitcoin (along with many other cryptocurrencies) to a fever pitch before prices plummeted.

However, several analysts have said that this time it is different. This is why.

This time around, Bitcoin’s price rise is more stable and appears to be driven by bigger players.

On the one hand, “Bitcoin’s current run has been much less volatile than previous extreme price movements, further solidifying its current rally,” wrote Clara Medalie, market analyst at digital asset data provider Kaiko. , to Finance Magnates.

“Volatility has hovered around 50% annualized over the last month when previous bull runs have seen volatility spike past 100%,” he said, adding that “this implies that current momentum is sustainable and built on. a more stable base. “

In fact, in the past, Bitcoin’s move up to $ 20k seemed to be driven by hype and FOMO (fear of missing out). Now, however, analysts believe that the factors that would support a move to $ 20k are more sustainable.

Growing institutional interest is fueling the Bitcoin rally

“Bitcoin’s current bull run was undoubtedly started by growing institutional interest that started in mid-October,” Clara explained to Finance Magnates.

And indeed, there have been a number of high-profile institutional investments in recent months: “Each successive announcement of institutional involvement with Bitcoin, from companies like StoneRidge Asset Management, Square, MicroStrategy and Paypal, caused an almost instantaneous reaction from the market, pushing BTC to 2020 highs, and this week, 3-year highs above $ 18k, ”Clara said.

But why is so much institutional money coming into space in the first place?

Clara believes that this higher level of institutional interest could come from a desire to diversify investments after an unstable year for the dollar: “Bitcoin’s record month has been driven mainly by institutional interest in the cryptoasset, in addition to the uncertainty generated due to the US elections and the unstable economic outlook, prompting investors to seek alternative assets that are not directly tied to the US economy, “he said.

In fact, Philip Gradwell, chief economist at blockchain data analytics firm Chainalysis, told Finance Magnates earlier this month that “[…] the current trend since mid-March is that Bitcoin is seen as an asset to maintain in a world of macroeconomic uncertainty, “he added.

Bitcoin in 2017: “We saw a digital gold rush.”

But Bitcoin’s growth is not entirely driven by institutional interest: “it’s a combination of” retail and institutional investment, Garrick Hileman, research director at Blockchain.com, explained to Finance Magnates. For example, “that PayPal allowed people to buy, sell and hold crypto was a huge win for the adoption of retail crypto.”

And indeed, beyond the institutional space, analysts have also observed that retail investors are engaging with Bitcoin in different ways than in 2017.

“In 2017, we saw a digital gold rush,” Garrick explained. “Bitcoin was in the news, the price was skyrocketing, but it felt like a bubble about to burst, and it did.”

“This feels different in part due to the quieter discussion and the absence of hype about recent price movements,” Hileman said. In fact, while Bitcoin may be enjoying more of a spotlight now, BTC’s recent price spike largely came in the context of some of the major global events, namely the US presidential election.

In fact, when Bitcoin topped $ 15k earlier this month, “anti-authoritarian technology” investor Nic Carter referred to BTC’s move above $ 15,000 as the “quietest run to the upside ever.”

The quietest confinement of all time

– nic carter 🧊 (@nic__carter) November 5, 2020

Suggested Articles

Award-winning platform FBS Trader received a major new update Go to article >>

In any case, the lack of hype around BTC (despite its rise towards $ 20k) may indicate that this latest push is driven by more stable retail interest in Bitcoin. Garrick Hileman also noted that “we see this in Google’s search data now comparing to 2017, when ‘buy bitcoin’ was a much more common search term.” In other words, the retail investors who are buying Bitcoin now are probably people who already know how to buy it.

Interestingly, “we also don’t see much of a difference in the search engine data between last week and early this year,” Hileman said.

Clara Medalie also told Finance Magnates that “this momentum is different from the bull run of 2017 because it has been largely driven by fundamental news events, such as PayPal’s plan to enable cryptocurrency purchases for millions of providers across the world. rather than pure market sentiment. “

Beyond institutional and retail investors, Garrick Hileman also noted that “big finance’s new convenience with cryptocurrencies due to regulatory clarity shouldn’t be overlooked either”; nor the “growing recognition of the inevitability of CBDCs,” which he believes “[..] it will be very beneficial in attracting new users to the crypto space. “

Why is $ 20k important for Bitcoin?

But why should we care if Bitcoin hits $ 20k (or not)?

Hileman explained that this figure is more than just a symbol of prosperity: “Ultimately, for Bitcoin to fulfill its promise as a widely held global reserve asset, it must at some point stay above $ 20k indefinitely,” he said.

After all, while Bitcoin is increasingly being talked about as a store of value asset, it has a lot to grow: “At current prices, the total market value of Bitcoin is about $ 330 billion, which (although significant) is still well below the trillions in value stored respectively in gold, sovereign bonds and major reserve currencies. “

To become a truly global reserve asset, Bitcoin will likely have to reliably hold a value greater than $ 50,000 per coin, which equates to a total market value of greater than $ 1 trillion. “

A larger, more stable Bitcoin could also potentially serve a broader range of financial functions: “Bitcoin is still too volatile to be a widely used currency, but volatility has been decreasing over the years and has had some use as coin”. Hileman said.

“A short-term store of value seems more likely, and it is not inconceivable to see Bitcoin on central bank balance sheets in the future. The state of the world around Bitcoin, from widespread adoption to geopolitics, will continue to drive how it is viewed and used. “

Setbacks are likely to occur later

However, even though Bitcoin appears to be closer to $ 20k than it has been in years, the road to $ 20,000 could be steep.

Part of the reason for this could be psychological – as BTC had to break its “$ 10,000 Curse”, the “$ 20,000 Curse” could be next. Harumi Urata-Thompson, CFO of Celsius Network, “Whenever the market peaked and fell like Bitcoin did in 2017, it creates a psychological (and physical, as there will be many sell orders that will be placed around that level) higher It will take a little more than a few purchases to move forward, ”he said.

Therefore, BTC could suffer some pullbacks before $ 20k is a realistic target. “As there are more participants, the drop may not be as rapid and dramatic as what we saw back then, but we will still have to fight a bit and we might even see an initial sell-off,” he said.

“Lots of market participants are likely to be long at the moment so there is no doubt that we will see some profit taking before we hit $ 20,000, but just the reason why I can think it could cause a sell. massive will come from the bad economic figures that will trigger a liquidation in the stock market; Bitcoin itself is not likely to be the main reason for this. “

Garrick Hileman also pointed out that despite the hype-laden narrative that pushed Bitcoin to $ 20,000 in 2017, BTC fell back many times before hitting nearly $ 20k: “On the way to nearly $ 20k in 2017 there were four pullbacks out of 30 % or more, ”he said.

And indeed, there is some evidence that the pullbacks are already happening: “On Tuesday night we saw Bitcoin almost break $ 18,500, and then we saw a drop of almost $ 1,000 in the same night,” Hileman said. “Setbacks are to be expected and can be healthy.”

Still, “it looks like we have the momentum and support to go above $ 20,000 in the near future.”

[ad_2]