[ad_1]

Whether COVID leads to an isolationist policy or a protectionist policy is up for debate, what we do know is that countries from Egypt and Jordan to Pakistan, Taiwan and China are storing agricultural products to increase strategic food stocks and protect their food supplies.

Food storage is a precautionary measure against potential disruptions that could be caused by COVID-19 outbreaks.

“COVID-19 has forced consumers to move from just-in-time inventory management to a more conservative approach that was dubbed just in case,” said Bank of America Corp. analysts led by Francsico Blanch, director of global commodities. . “The result is that consumers have more inventory as a precaution against future supply disruptions.”

COVID is not the only factor behind the increase in corn, wheat and soybean prices. The size of the national supply, local prices, and foreign currencies are also factors. Climate change also has an impact. The floods in China caused that country to increase its purchases of basic products to mitigate any supply problems that might arise.

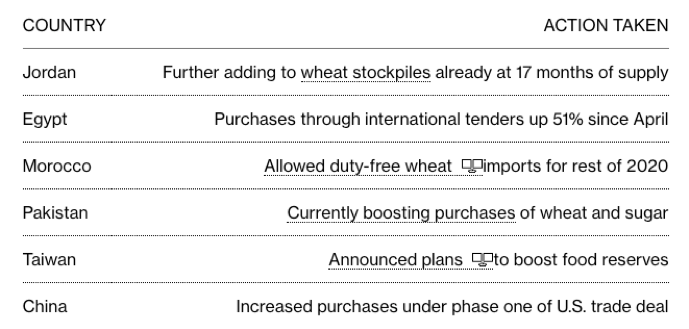

The following table recently published by Bloomberg illustrates the movement of countries to store commodities:

While the countries listed in the table above are likely to survive and prosper in the long term, developing countries are the hardest hit.

A report published by Mining technology recently, he suggests, “Emerging markets and developing economies, which are highly dependent on raw materials, are expected to be hit the hardest. Additionally, the pandemic may result in fundamental changes in commodity markets, including higher transportation fees, higher trade costs, and storage of certain commodities.

Food security challenged

While we have not yet seen the full effects the pandemic will have on commodities, predictions indicate that next season’s food security will be under the microscope as trade restrictions and export bans hit the most vulnerable countries. .

Simply and understandably stated, excessive buying of commodities by developed countries puts developing countries at even greater risk than they are today.

The World Bank tweeted:

Emerging markets that depend on raw materials are very vulnerable in a post-pandemic world.

The World Bank reports that “obstacles to supply chains have already affected the exports of some emerging markets and developing economies of perishable products such as flowers, fruits and vegetables.

What can be done to stop the damage to developing economies?

Empowering local communities to overcome poverty by creating their own food security is the most tangible solution to supply problems.

This is not a small solution.

More than 820 million people around the world suffer from hunger.

To create food security, it is important to close the performance gap.

According to the Food and Agriculture Organization of the United Nations, by 2050, 120 million hectares of natural habitats will be converted to agriculture in developing countries.

However, a study titled Leverage points to improve global food security and the environment led by researcher Paul West shows that much of the currently available agricultural land is not reaching its potential, producing 50 percent less than it could.

The idea then is to bridge the gap between what is being produced and what could be produced.

To do that, the use of fertilizers must be more efficient.

West estimated in his research that the use of nitrogen and phosphorous fertilizers in wheat, rice and corn crops could be reduced by 13-29 percent, while producing the same yields.

Add a little scientific thinking to the timing, placement and type of fertilizer and the efficiency will go even higher.

Improving irrigation systems is another solution, along with targeting food for direct consumption and reducing food waste.

Looking at fertilizers specifically, and using sub-Saharan Africa as an example, crop yields in the region are drastically lower than in other regions of the world, up to three times for common staples like corn.

The problem is the fertilizer. Its consumption is expected to almost double in the next 10 years in Africa.

In Nigeria, Indorama built a fertilizer plant worth 1.5 billion dollars. In Ethiopia, OCP built a fertilizer plant worth 2.4 billion dollars. In Kenya, Toyota Tsusho commissioned a new large-scale fertilizer mixing plant to serve the Kenyan and Tanzanian markets.

There are also companies that are working hard to address the issue of food security among these nations.

More generally, companies like potash companies like Highfield Resources (ASX: HFR), Galaxy Resources (ASX: GXY) in Argentina, Danakali (ASX: DNK) in Eritrea and Salt Lake Potash in WA they mean well. BHP He is also participating in the event with his Jansen potash project in Saskatchewan.

Looking at Africa specifically, Minbos Resources Ltd (ASX: MNB) is effectively building a nutrient supply and distribution business that stimulates food security in Angola and the Congo Basin in general.

Its Cabinda Phosphate Project in Angola is designed to boost fertilizer production and food security in the region: local fertilizer production will improve nutrient availability, reduce transportation costs, and protect against exchange rate fluctuations, all the problems already listed above.

By helping subsistence farmers, local food prices could be lowered, improving Africa’s economic competitiveness while mitigating the high cost of imported fertilizers, which also contributes to the problem of low yields. Of crops.

Minbos is working closely with the International Fertilizer Development Center (IFDC), one of the world’s leading fertilizer research and development organizations, to facilitate the development of an innovative fertilizer product, designed to meet the growing agricultural demand for Central Africa.

Central Africa is just one of many regions that need this kind of assistance.

However, food security for all is far from being achieved.

As such, it is important, given that many countries look inward for their own security, that more and more people look outward and help struggling developing nations feed their people.