[ad_1]

Nvidia (NASDAQ: NVDA), with its market capitalization of more than $ 300 billion, it is one of the largest publicly traded American chip companies. In the run-up to COVID-19, it surpassed Intel (NASDAQ: INTC), who had traditionally kept the cloak. Now, it has once again surprised investors and gaming enthusiasts with the recent launch of its graphics card.

Nowhere are player opinions on the release of new graphics more obvious than in the following meme. With that announcement, the question arises: Does AMD (NASDAQ: AMD) Big Navi is still relevant?

Nvidia Response Meme – Reddit PC Master Race

Graphics Card Contest

Graphics cards have traditionally been competitive. Gamers’ desire to play increasingly intensive games led to Nvidia’s startup and its success. That slowly expanded to the use of GPUs and their highly parallelized capabilities in artificial intelligence and other important computing fields. Throughout this time, graphics cards have grown.

At some point in the early 2010s, AMD lost its competition to Nvidia. It lost to competition from high-end graphics cards and has been consistently lagging behind ever since. However, since AMD has become competitive with Intel from a CPU point of view (you can read about that in our article here), the company is looking to be more competitive in graphics cards.

AMD Big Navi 2 – Wccftech

Currently, AMD’s next competitive graphics card is supposed to be its Big Navi card. This card will come with its new RDNA2 architecture. Big Navi expected to be built in Taiwan Semiconductor (NYSE: TSM) 7 nm process. Being competitive on the high-end with Nvidia could not only result in high-margin profits, but could also generate significant revenue.

Launch of the Nvidia graphics card

Let’s take a look at the launch of the Nvidia graphics card yesterday.

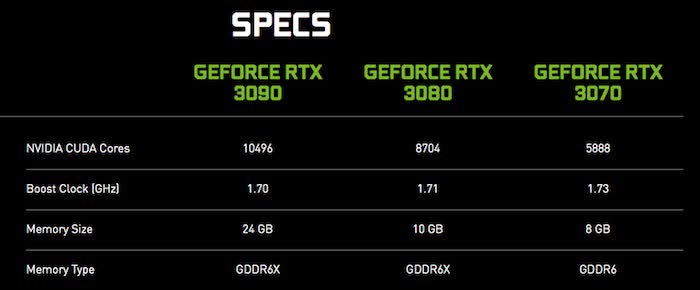

Nvidia 3xxx – IGN

Nvidia released 3 graphics cards yesterday, the 3070, 3080 and 3090. The 3070 is expected to be equivalent to the 2080 TI, priced at $ 499. That’s the first generation jump of two generations in the Nvidia graphics card generation since 2004. That huge jump is due to the switch from 12nm to Samsung. (OTC: SSNLF) 8 nm process.

The key benefit here is that Samsung’s 56 million 8nm transistors / mm are better than AMD’s 7nm Navi process of 41 million transistors / mm. With GDDR6X and more than twice the number of Nvidia CUDA cores, the overall improvement for Ampere is significant. Yours actually owns AMD stock, but plans to buy the GPU 3080 on its September 17 launch.

It’s also worth noting here that Nvidia has vastly improved the price on the lower end to $ 499 for a 3070 and $ 699 for a 3080. That’s the same price as the company’s 2xxx release, but with a dramatic improvement.

Big Navi Response

AMD’s answer was always going to be Big Navi. However, few expected an equivalent jump in two generations of Nvidia. Unfortunately Big Navi has not been revealed here so we are operating on a leak.

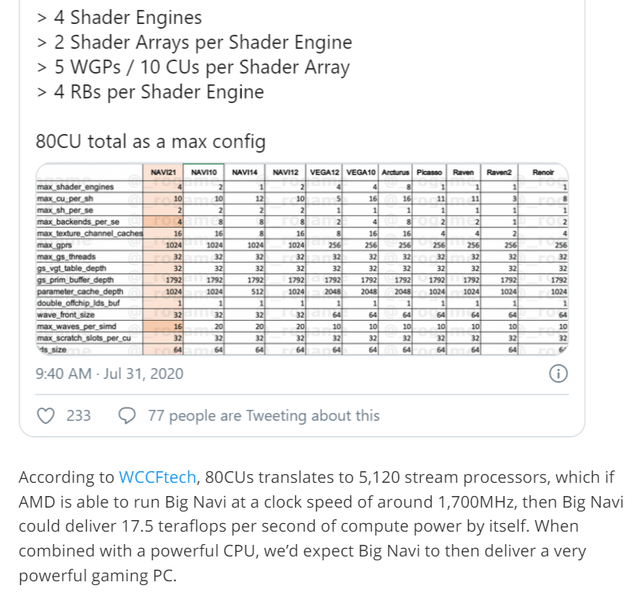

AMD Big Navi Speaks – Toms Guide

The Big Navi specs leaked above are highlighted above. The CPU is considered to have 80 CUs with 5,120 stream processors and, at 1700 MHz clock speed, 17.5 teraflops per second of computing power. That suggests that Big Navi could be 30-50% faster than the 2080 TI. Unfortunately, the force of the Nvidia launch is where Big Navi has a problem.

Nvidia’s 3070 has 5,888 compute cores priced at $ 499. Adding all this up, Nvidia’s 3070, with its 1.73 GHz clock speed, is expected to hit 20.40 teraflops. That’s roughly 15% faster than the AMD Big Navi forecast, priced at $ 499. Once again, we’re operating on leaked specs here. However, it presents a great concern.

It’s also worth noting here that Nvidia has refrained from releasing the 3080 TI. We expect the company to delay announcing GPU pricing while you wait to see what AMD releases. If AMD has a top-tier launch, the price of the 3080 TI will likely approach $ 799 or $ 899 versus the $ 999 2080 TI launch price.

Our forecast

That’s bad news in a big market. The GPU market is currently over $ 18 billion, and it’s expected to grow to $ 35 billion by 2025. That represents a huge market, and AMD currently has a 20% share of it. Being able to expand its market share would be huge for AMD and its ability to generate long-term revenue.

Our forecast is that what happens comes down to prices. For AMD to make a significant impact with Big Navi, it should probably price the GPU at $ 399. With forecasts showing that Big Navi will launch at $ 600-800, that would mean the company has to see a price drop. close to 50%. That would eat up most of the company’s margins, but it might be worth it to keep revenue competitive.

Otherwise, unfortunately, the numbers indicate that Nvidia is pulling AMD out of the water. There is another factor worth paying attention to. Without pre-orders from Nvidia, some expect Nvidia to have a severe supply shortage. That could push people impatient towards AMD regardless of the pricing decision. A less efficient GPU is better than none.

However, we expect Nvidia to do incredibly well, and if the technology sell-off continues, we recommend investors continue to sell their AMD shares for Nvidia shares.

conclusion

Nvidia recently announced its Ampere GPU, exceeding expectations, as highlighted by the PC Master Race “memes”. It represents a two-generation leap in which the 3070 equals the 2080 TI at half the price. That’s a significant price improvement and that means the 3xxx GPUs will probably sell out.

At that time, Big Navi GPUs are still relevant. So far, they look roughly equivalent to the 3070, which means they need a price tag of $ 400 (roughly) to be truly insanely exciting. That’s much lower than current forecast prices and there could be improvements, but that remains to be seen. However, Big Navi and AMD are clearly in trouble.

The Energy Forum can help you generate high-yield income from a portfolio of quality energy companies. The global demand for energy is growing and you can be part of this exciting trend.

Also read about our newly launched “Income Portfolio”, a specific non-sector income portfolio.

The Energy Forum offers:

- Managed model portfolios to generate high-performance returns.

- In-depth research reports on quality investment opportunities.

- Overview of the macroeconomic market.

Click for a 2-week free trial, with an unconditional money-back guarantee and a 47% discount on our popular annual plan. There is nothing to lose and everything to gain!

Divulge: I am / have long been NVDA, AMD. I wrote this article myself and express my own opinions. I am not receiving compensation for it (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]