[ad_1]

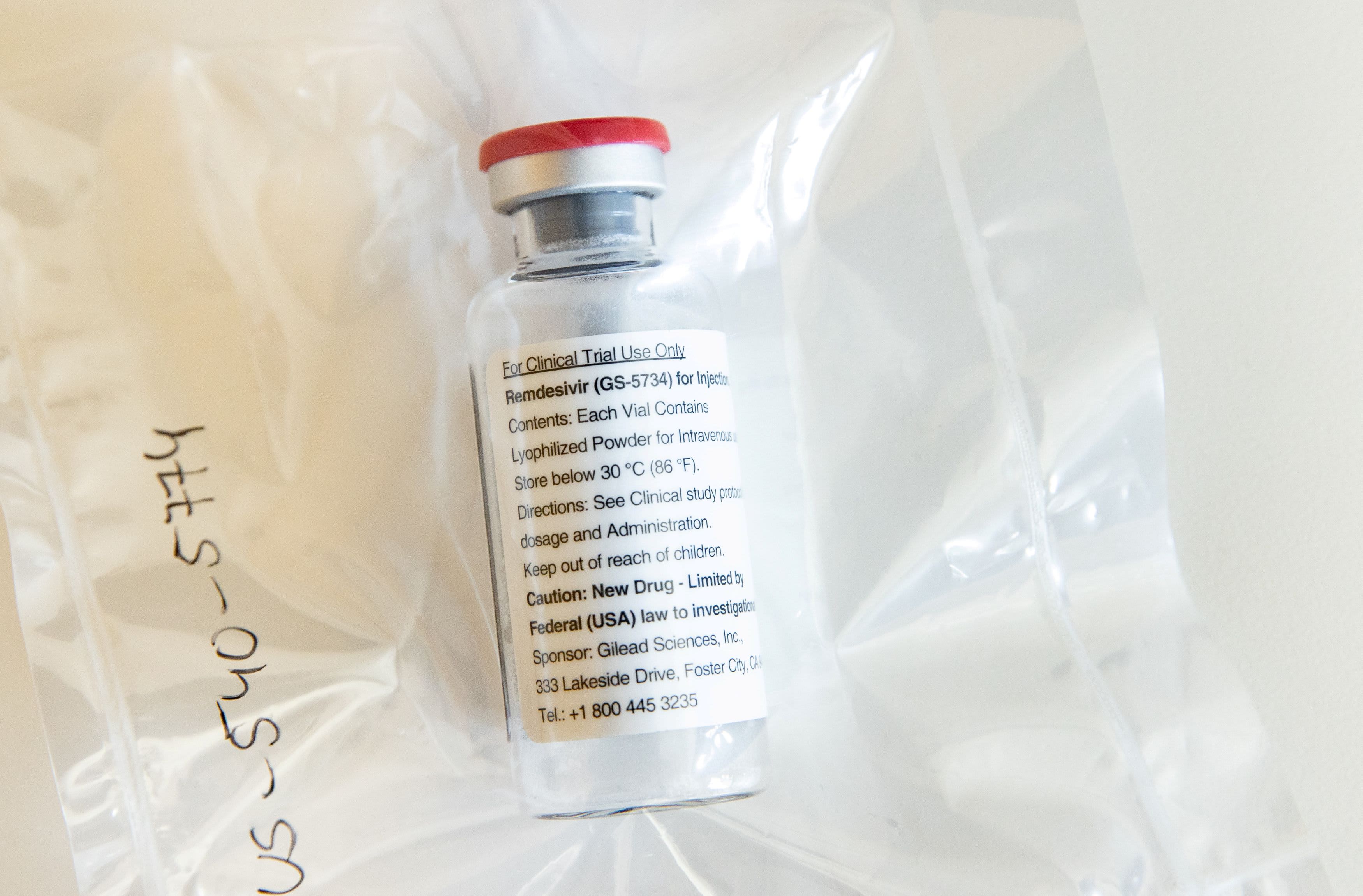

A vial of Ebola drug remdesivir is shown during a press conference at Eppendorf University Hospital (UKE) in Hamburg, Germany, April 8, 2020, as the spread of the coronavirus disease continues (COVID-19) .

Ulrich Perrey | Reuters

Gilead Sciences said Thursday it may produce “several million” of its remdesivir of antiviral drugs next year to help patients fight the coronavirus.

The company expects to produce more than 140,000 rounds of its 10-day treatment regimen by the end of May, and anticipates that it can carry out 1 million rounds by the end of this year.

“Our focus right now is as much on our work with remdesivir as we are on our ongoing commitments to the people who depend on our medications today,” Gilead CEO Daniel O’Day said in the first-quarter earnings report for the company.

On Wednesday, Gilead released preliminary results from its clinical trial with remdesivir, showing that at least 50% of patients treated with a five-day dose of the drug improved. 397 patients with severe cases of Covid-19 participated in the clinical trial. The severe study is a “single arm” study, meaning that it did not evaluate the drug against a control group of patients who did not receive the drug.

The National Institute of Allergy and Infectious Diseases also published the results of its own study on Wednesday. It showed that Covid-19 patients who took remdesivir generally recovered after 11 days, four days faster than those who did not take the drug.

Remdesivir, promoted by President Donald Trump, has not been formally approved to treat the virus and US health officials. USA They caution that the new data on the drug has not yet been peer-reviewed.

Gilead said he spent $ 50 million on his drug research and development in the first quarter.

Overall, the company beat Wall Street earnings expectations, reporting an adjustment of $ 1.68 per share, more than analysts expected at $ 1.57. Revenue increased 5% last year to $ 5.55 billion, more than expected by Wall Street.

Unadjusted, the company’s first-quarter earnings fell 21% to $ 1.55 billion from $ 1.98 billion during the same period last year.

The company said it generated $ 200 million more in sales in the first quarter due to “increased purchasing patterns and patient prescription trends” from the pandemic.