[ad_1]

A lively cafe in the Ethiopian capital, Addis Ababa

This article is a lightly edited excerpt from Standard Bank Africa Consumer Outlook 2020 Report – Third Edition.

Covid-19 will trigger moderate consumer spending growth in Ethiopia, with real household spending expected to grow 3.6% year-on-year in 2020 compared to the previous forecast of 7.7%.

In the medium term, the outlook for consumer spending is positive, with a considerable increase in household income. Increases in employment in the agricultural and manufacturing sectors are expected with strong demand for Ethiopian exports supporting a transition from subsistence farming to higher-income commercial agriculture.

With a weak birr and many imported consumer goods (including nearly 10% of food), inflation remains a concern. The new forecasts expect inflation to average 10% over the next four years (2020-2024).

Overall, while there are positive trends after the impacts of Covid-19 subside, the overall Ethiopian consumer profile remains weak, with low GDP per capita, inflation eroding income and a large amount of consumer spending. on essential items.

Injera continues to be the most important packaged food in the country

Injera is a sourdough flatbread made from teff, which is a naturally grown gluten-free grain that is served in virtually every meal. In addition to its importance as a food, injera also plays an important symbolic role in Ethiopian food culture, as it is used to collect food from shared dishes, even during the practice known as Gursha. This refers to the manual feeding of close family and friends to symbolize loyalty and devotion.

Injera

Other important grocery items include legumes like beans and chickpeas and various fresh vegetables. These are consumed by consumers of all income levels and are typically bought from open markets without packaging. While meat such as lamb, mutton, goat meat and beef are more consumed by high-income households. The largest religious group of Ethiopian Orthodox Christians and it is common for them to refrain from eating all animal products on certain days of the week. Rice and bread are also important staples for many households, yet most of the rice seen in stores was imported. All the bread found in stores was unbranded.

The consumption of soft drinks is still very limited in the country, and Ethiopians buy drinks mainly during weekends and other special occasions. Traditional fresh-squeezed juice and coffee remain very popular across the country and are largely affordable even for low-income consumers.

We noticed that there were also many shortages of basic items such as fresh milk, bread, carbonated soft drinks and sugar in the various stores. Most of the packaged foods were imported from the Middle East and were expensive compared to prices in other countries. We also discovered that staples such as rice and flour were sold in bulk (5 kg) to be resold in smaller quantities or purchased to share with family members.

Out of stock in some of the stores visited in Addis Ababa.

Personal health awareness campaigns teach consumers the importance of personal hygiene practices

The transition from unpackaged to packaged beauty and personal care products is seen primarily as disposable income increases for Ethiopians. Among the lower income groups, a greater use of traditional alternatives can be observed in all areas. Rather than buying boxed hair dye, for example, Ethiopian women in this income group will opt for henna as an affordable alternative. Instead of using conditioner, women choose to use a clarified butter on their hair called kibbeh, which serves multiple purposes, including heat protection and moisture retention so hair doesn’t become brittle and break.

However, that said, it is not to say that consumers are not evolving or unwilling to change. In most cases, it is about transmitting the hygienic benefits of some practices to consumers. The two featured products that gained significant traction as a result of a conscious boost in health and personal care awareness in Ethiopia are toothpaste and bar soap. Traditionally, many Ethiopians have used mefakia (twigs) to maintain oral hygiene. It wasn’t until the government started an oral health campaign that locals realized the importance of using a toothbrush and toothpaste to care for their teeth.

Mefakia in Ethiopia – Used to remove and clean teeth.

With the lack of access to clean running water for many residents, and fewer than 20% of homes in Ethiopia with a bath or shower, the added sophistication of the product beyond the bar of soap is likely to see mediocre sales in this region.

The two leading brands in the bath and shower category are Lifebuoy and Lux, both owned by Unilever Ethiopia, which is the world’s leading manufacturer in the country. It is difficult to find deodorant and roll-on in this market. There is a perception among low-income people that deodorant and roll-on are luxury items and are only intended for special occasions. Many Ethiopians believe that the practice of washing with bar soap is sufficient.

Household income dictates the complexity of the home care basket in Ethiopia

The complexity of the home care basket is influenced by income and affordability of the home. For many low-income households, who make up the majority of Ethiopia’s population, multipurpose products are useful.

To keep prices low, many companies have changed the size of their packaging. In Ethiopia, we see smaller pack sizes at lower, more affordable prices.

The three players dominating the garment care category consist of two local players named Shemu Soap & Detergent Industry under the Shemu brand; and TTK Soap & Detergents made by Sky. Globally, Proctor & Gamble has managed to dominate this category with its Ariel brand, by guaranteeing the availability and distribution of national products to points of sale.

Bleach is a very popular and fast-growing item within the Ethiopian home care basket and, like the other popular items in the basket, it is a multi-purpose product that has multiple functions and a low price. Many households use bleach to remove stains, bleach and clean clothing, to disinfect and clean your toilet, and as a surface care disinfectant. It can also be mixed with other detergents to make a floor cleaner. The bleach market is highly fragmented and competitive without a clear market leader. Many of the packages are mislabeled or without any label.

Of the three stores visited in Ethiopia, the Safeway supermarket is the most expensive store to buy a basket of household care items. This supermarket has several stores spread out in prime locations in Addis Ababa and is perceived as a thriving store targeting middle and upper income groups, especially expats. Our findings show that Shoa presents the most comprehensive list of items.

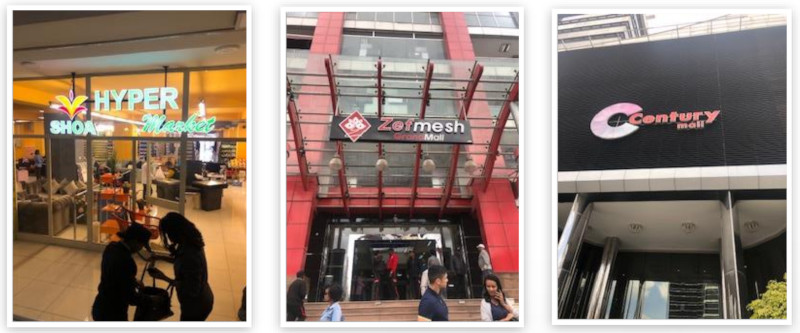

Ethiopia is still in its early stages of retail real estate development

Ethiopia’s retail market has grown significantly in recent years. However, further development is still restricted by the fact that foreign investment is not allowed in this sector. Modern retail in Addis Ababa is in the early stages of development compared to neighboring countries like Kenya, Uganda and Tanzania. There are a few grocery operators in Addis Ababa, however these are only medium sized local businesses like Shoa. The city also has several other small and medium-sized shopping centers, including the Friendship City Center. There is also a new regulation that has just come into effect in Addis Ababa, which requires shopping center buildings to be mixed with residential apartments due to housing / space issues in the city.

Modern shopping malls visited in Addis Ababa, Ethiopia

The country appears to have good growth potential, as Ethiopia is the second most populous country in Africa. However, one obstacle, in addition to being a closed economy, is that, as a landlocked country with relatively poor infrastructure, supply chains can be unreliable.