[ad_1]

In recent weeks, the major oil companies have been releasing their first-quarter finances. These reports are particularly notable because they provide the first insights into how much the recent collapse in oil prices impacted industry players. Many of the world’s largest oil companies posted losses in the first quarter, and some saw large losses. This is unusual for an industry accustomed to profit. It’s also disturbing as the price of oil only really fell on March 9, meaning it was only very low for three and a half weeks out of the total 13 weeks in the quarter.

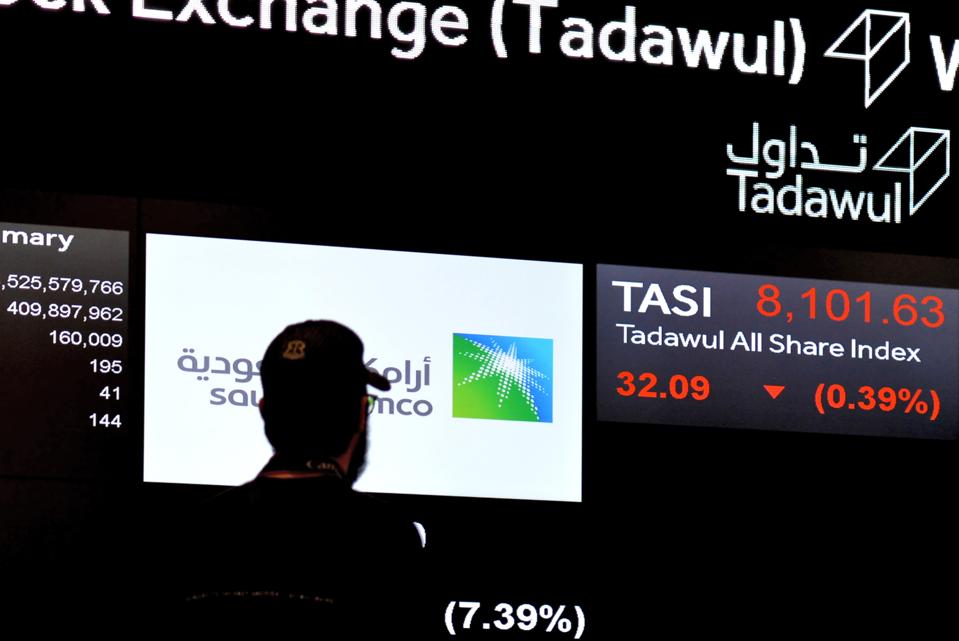

This image taken on December 12, 2019 shows a view of the exchange board in the Stock Market … [+]

On Tuesday, May 12, the last of the big oil companies will announce their finances. Saudi Aramco, which sold shares publicly on the local Tadawul exchange in December, will publish its finances six weeks after the end of the quarter, but decided not to make a profit call to answer investor questions. Aramco is a very different company from its competitors and those differences will be evident in the financial report.

This is what you should look for in Aramco’s first quarter finances for information on the oil market:

- Was oil production profitable for someone in the quarter? Aramco differs from its competitors in that its business is still much heavier towards the production and sale of crude oil (upstream) than refining and products (downstream). Furthermore, Aramco maintains enormous upstream advantages, such as a concession for exclusive rights to Saudi oil and a very low extraction cost of only $ 2.80 per barrel. The question is whether these advantages allowed Aramco to avoid much of the pain that its competitors experienced in March.

- At the very low oil prices we saw for most of March, would it be worth it for Aramco to overproduce to generate revenue? If Aramco remains profitable at very low oil prices, that’s the big question, then it may make sense that Saudi Arabia produces more than expected sometimes. This would be useful information in early summer, when OPEC will review its production quotas. In other words, if Aramco continues to make money even at low prices, it may make sense for the Saudi government to tell Aramco to produce more. After all, Aramco remains the source of more than 60% of Saudi Arabia’s revenue in a normal year, and will account for much more this year when Hajj and Umrah and other religious tourism are essentially canceled. If Aramco makes money from low-priced oil, oil traders may consider that Saudi Arabia could and should advocate for higher production quotas at the next OPEC meeting.

- Does Aramco seem to have the money to invest in new assets and projects?Since the late 1980s, Aramco has expanded internationally and downstream quite regularly. It has expanded especially in East Asia, but it also has the largest refinery in the US. USA And several operations in North America, Europe and India. A couple of years ago, Aramco committed to $ 40 billion of capital spending per year, but that number has since decreased. If Aramco’s cash is running low to pay expenses, its large ordinary dividend, and money for the government, Aramco is likely to cut its global investments. With other companies already reducing capital spending, this could lead to a significant devaluation of the industry and its assets. It could also mean less exploration and refining capacity in the future.

Remember that the finances that Aramco will launch on Tuesday do not include April. That means they will only give a small taste of the pain the company has already suffered from the low prices, and they will not explain how Aramco’s April overproduction (it produced 12 million barrels per day and supplied an additional 300,000 of inventory) impacted the company’s line of background. But Aramco’s numbers, as the last of the major first-quarter financial results for oil, will provide valuable insight into the future of the oil market.

Recent NThe news that came out of Saudi Arabia over the weekend indicates that Aramco’s finances will not be positive. This includes news that both parties can voluntarily renegotiate the price of the petrochemical company SABIC, which Aramco will buy from the Public Investment Fund of Saudi Arabia in the coming months. Furthermore, the Saudi government decided triple the VAT and final cost of living adjustments for the government’s huge sector of employment, which means that the government is concerned about its own income.