After Tesla and Apple announced plans to share their shares within weeks of each other, there has been a growing buzz that more companies with triple and square digits stock prices will follow in their footsteps.

“Everyone is talking about it,” Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, told MarketWatch in an interview on Thursday.

“I get requests from companies looking for raw data… ask: ‘Is there a reason I should split [my shares]? ‘ he said.

Silverblatt said he thought corporate executives might be following Tesla and Apple in one way or another and splitting their shares in an attempt to appeal to a wider retail audience, even if that was done almost entirely cosmetically by a company and one that can be expensive.

‘Will, are there others who split? I have to say yes. Dy [companies] may not be the only ones, ‘he said, referring to Apple and Tesla.

Apple AAPL,

on July 30 announced a 4-for-1 action split that will take effect on August 31. At the time of its announcement, made after closing regular trading, shares of the iPhone maker were closed at $ 384.76. They have since made nearly 20% profit up to $ 460, as of Thursday.

Earlier this week, Tesla TSLA,

said it would complete a 5-for-1 action split by Aug. 31, which also zoomed the shares of the electric car maker higher.

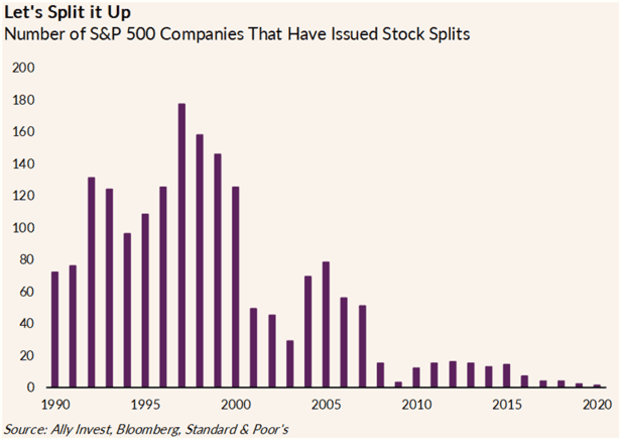

Stock splits were once a common occurrence on Wall Street as companies sought to make their share prices more attractive to average investors.

Back in the late 1990s and early 2000s, amid the dot-com boom, stock splits were all the rage (see attached chart).

Ally Invest, Bloomberg, S&P

But such divisions, of companies creating more shares, are nowadays a rarity.

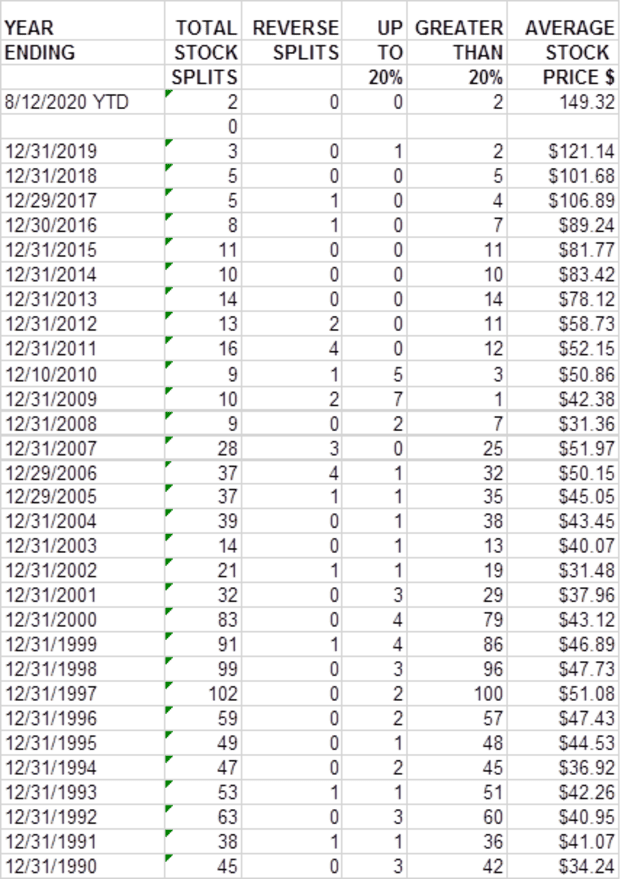

Indeed, Tesla and Apple are the only stock distributors to date in 2020, even though the average share price among publicly traded companies was $ 149.32, compared to an average share price of $ 51.08 in 1997 when there were 102 shares were, marking the largest number split over the past three decades, according to data from the S&P Dow Jones Indices.

S&P Dow Jones indexes.

The Wall Street Journal in a 2017 article entitled ‘Split Decision: The Pros and Cons of Splitting Shares,’ wrote that outside of an appeal to retail investors, making a stock more liquid and less overvalued was among some of the reasons that companies had chosen to introduce splits.

MarketWatch columnist Mark Hulbert back during Apple’s latest announcement of a stock split in 2014 said that stock splits can also be read as a vote of confidence by a company’s management.

“Of course, the stock split itself is just a cosmetic accounting thing that brings the share price down. The reason it is Bullish is that it is a signal of something that is good news on the fundamental side and that good news is confidence on the part of management that its share price not only stays at its current level but stays grow and for that reason they have to divide it to bring the share price back to a sweet spot, ‘he explained.

Speaking of stock splitting comes as mom-and-pop investors find themselves in a verified golden age of trading, where commissions are at or near $ 0 and many brokerage platforms offer fractional share ownership of shares, leaving small stocks in companies are affordable and relatively low cost.

In addition, a recent gain in performance by retail investors, who have made aggressive and so far successful bets on the comeback of a number of Coronavirus-affected industries, compared to professionals, has put a spotlight on investing through a new, young cohort of stock buyers .

That background would probably make the case for stocks to drive retail ownership, but proponents of the move say encouraging a pro-retail environment could be good for the stock market and companies in general in the long run. .

‘Remember, the size of the price tag makes sense here [young investing] crowd “and” you want this no-commission paying crowd in your stock, “CNBC’s Jim Cramer said during” Mad Money “on Wednesday.

“This new cohort of investors, those who love low-dollar stocks, will start buying and keeping these best-of-breed names instead of the darned penny stocks,” he said.

Lindsey Bell, chief investment strategist at Ally Invest, wrote last week, following Apple’s announcement that it’s hard to say if this is the start of a new action split. ‘

She only listed Netflix NFLX,

followed Apple’s lead in 2014 when it completed a 7-for-1 stock split in July 2015.

That said, Bell says that “a little support from companies with expensive stocks could be a big win for those who want a bite of Apple (and other big tech / high price stocks).”

Silverblatt said there are a number of high-priced companies that may fit the profile of those interested in lowering their share price through a split.

Its data show that there are 63 companies with a share price at or above $ 250, up from 44, as of August 12, 14 companies with shares at $ 500 and more, up from 10 at the end of 2019; nine traded at or above $ 750 per share, up from six, and seven companies with a share price of $ 1,000 or higher, two more than the end of last year, and two issues that have a price tag of $ 2,000 a share or better, when at the end of 2019 there were none.

CNC’s Cramer said he favors an action split for Amazon.com Inc. AMZN,

Google Parent Alphabet Inc GOOGL,

, Chipotle Mexican Grill CMG,

Netflix, Nvidia NVDA,

Adobe ADBE,

Costco Wholesale COST,

Home Depot HD,

Facebook Inc FB,

and Microsoft Corp. MSFT,

Amazon, whose shares closed at $ 3,161 on Thursday, has not split its stock since 1999.

An article in the Wall Street Journal recently said that administrative costs can serve as an additional constraint for companies considering a stock party, with an academic paper indicating that the administrative costs of a stock split are around $ 800,000 for a large company.

That cost to some megalith companies is relatively small, especially when management thinks the long-term value of a split is greater than the cost.

Hulbert, citing a study written by David Ikenberry, a professor of finance at the University of Colorado, says the average stock that split a two-for-one stock hit the market by 7.9% in the year after announcing the split – and by 12.2% over the three years following that announcement.

That said, he recently acknowledged that that split effect has weakened in recent years.

But it has also noted that buying a business solely because of a planned split is not likely to be a good long-term investment strategy.

.