[ad_1]

Original title: What operation? Many shareholders of listed companies transferred shares to tens of billions of private equity funds, the reason is. . .

Summary

[¿Qué operación? Los accionistas de varias empresas cotizadas transfieren acciones a 10 mil millones de fondos de capital privado]Recently, many listed companies such as Wall Nuclear Material, Huamin Stock, Shentong Express and other listed companies published announcements that their shareholders intend to transfer their shares to private equity through block transactions The fund, and signed a concerted action agreement with the fund, but it does not imply the reduction of shares. The private equity involved includes the new tens of billions of private equity this year, Xuanyuan Investment and Yingshui Investment. Fund managers learned from the industry that this may be because shareholders of listed companies hope to engage in offline innovation through private equity funds and increase investment income. (China Fund News)

Recently,Nuclear wall material、Huamin Stock、Shentong ExpressWaiting for multiple listingsthe companylaunchingad,theirshareholderPassLarge transactionsHow to transfer your shares to private equitybackgroundAnd he signed a concerted action agreement with the fund, but it does not imply the reduction of stakes. The private equity involved includes the new tens of billions of private equity this year, Xuanyuan Investment and Yingshui Investment. The fund manager learned from the industry that this may be because shareholders of publicly traded companies expect to participate. offline through private equity funds.Make new, Increase investment income.

Shareholders of several listed companies transferred their shares to private equity funds

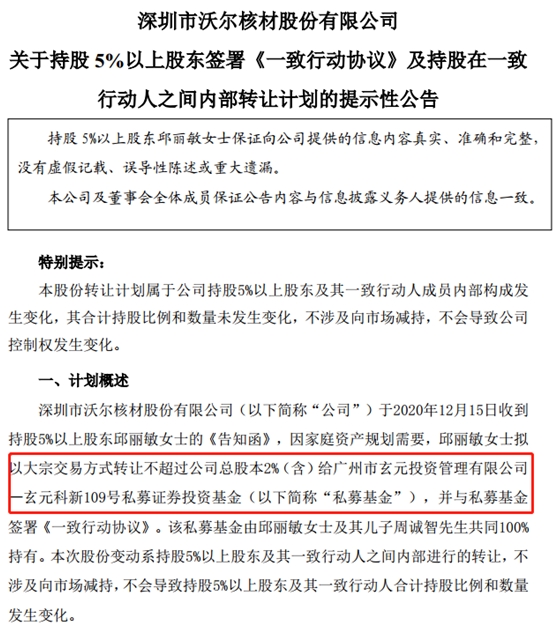

December 15Nuclear wall materialAccording to the announcement, due to family asset planning needs, Ms. Qiu Limin, a shareholder who owns more than 5% of the shares, intends to buytransaction mediumTransfer no more than 2% (inclusive) of the company’s total share capital (i.e., no more than 25,178,500 shares) to Guangzhou Xuanyuan Investment Management Co., Ltd.-Xuanyuan Kexin No. 109 Private EquityInvestment in sharesFund, and signed the “Concert Agreement” with private equity funds. The private equity fund is 100% jointly owned by Ms. Qiu Limin and her son, Mr. Zhou Chengzhi.

The announcement also indicated that the share change is an internal transfer between shareholders who own more than 5% of the shares and their concerted actions, and does not involvemarketThe reduction of shares will not lead to changes in the total share ratio and the number of shareholders with more than 5% of the shares and their concerted actions. Before the implementation of this plan, Ms. Qiu Limin had 157 million shares of the company, which represents 12.47% of the company’s total share capital; After the implementation of this plan, the total number and proportion of shares held by Ms. Qiu Limin and private equity funds remained unchanged.

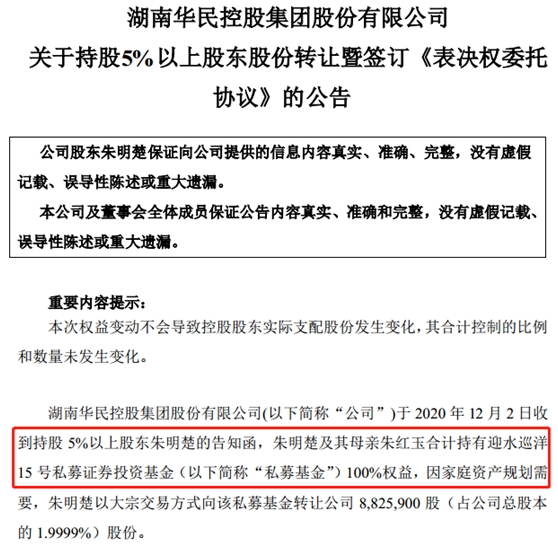

December 2,Huamin StockAccording to the announcement, Zhu Mingchu, a shareholder who owns more than 5% of the shares, and his mother Zhu Hongyu own 100% of the share capital of the private equity investment fund Yingshui Xunyang No. 15. Due to planning needs of family assets, Zhu MingchuLarge transactionsMethod to transfer 8,225,900 shares of the company (representing 1.9999% of the company’s total share capital) to the private equity fund, with an average transfer price of 4.8 yuan per share.

The announcement also stated that, in view of the fact that Zhu Mingchu had entrusted the voting rights of his 24.81 million shares (5.6221% of the total share capital) of the company to the controlling shareholder Hunan Jianxiang Huihong in March of 2019.industryThe investment company exercises, the entrustment period is until March 5, 2021.WarrantyThe previous attribution of voting rights remained valid. After the private equity fund received the mentioned shares, it signed the “Voting Rights Attribution Agreement” with Jianxiang Huihong, agreeing to entrust Jianxiang Huihong with the exercise of the voting rights of the transferred shares.

The announcement emphasizes that this share transfer will not result in actual expense on the part of the controlling shareholder.AssignmentParticipation has changed and the proportion and amount of your total control have not changed.

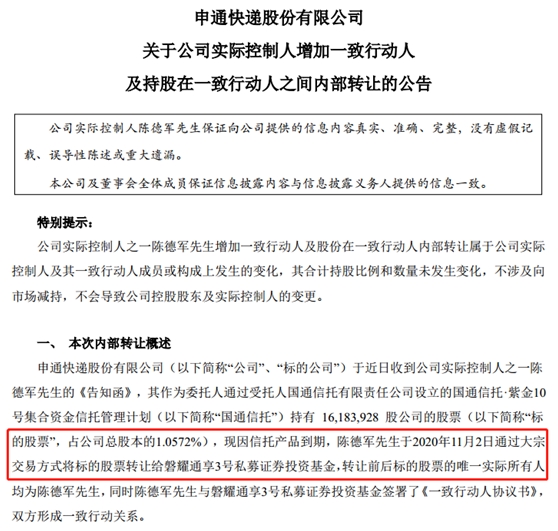

November 2Shentong ExpressThe ad said that the companyReal controlOne of them, Mr. Chen Dejun, originally passed GuotongTrustPurple Gold Episode 10joint projectThe Golden Trust Management Plan owns 16,183,900 shares of the company, representing 1.0572% of the total share capital.productAt maturity, Chen Dejun transferred the underlying shares to Panyao Tongxiang Private Securities Investment Fund No. 3 through a block transaction on November 2, with an average transaction price of 13.86 yuan per share.

The announcement emphasized that the only real owner of the underlying shares before and after the transfer was Mr. Chen Dejun. At the same time, Chen Dejun and Panyao Tongxiang No. 3 Private Equity Securities Investment Fund signed the “Concerted Persons Agreement”, and the two parties formed a concerted action relationship. This change in ownership is an internal transfer between the real controller of the company and those acting in concert. It does not imply any reduction in the market and will not cause changes in the total proportion of participation and the amount of the actual controller and those acting in concert.

Is it the transfer of shares to participate in the new market and increase investment income?

Many shareholders of publicly traded companies transfer their shares to recognized private equity fund products through bulk transactions. Judging from the reasons stated in the ad, it is for family asset planning. In the past, listed companies used cash to directly purchase private equity products.Financial managementYes, now shareholders transfer shares to private equity funds. What is the difference? To this end, the fund manager interviewed several private equity funds and industry experts for interpretation.

One of the private equity managers told the fund manager that shareholders of publicly traded companies do so primarily to increase investment income. “Shareholders will assign their shares to private equity funds through block transactions to buy our products. In the future, we will participate in new projects. To meet the requirements, we need a concerted action agreement. This product is customized, the strategy isclientInvested in the form of shares. “

An expert from the private equity industry said: “Shareholders of listed companies transfer their own shares to private equity fund products through block transactions, mainly for the purpose of opening new positions. Yingshui and Xuanyuan are participating in The market. There are more new private equity institutions. For shareholders of listed companies, shares are also held, but transfer to private equity funds does not imply a reduction in holdings and can participate in the generation of new and large profits. “

He further said, “Public offerThere are also position restrictions and certain requirements for participation ratios, but private equity funds are more flexible, so after shareholders are transferred to private equity funds, it is more convenient to keep this custom fund product. For private equity, you can also get clients from listed companies. “

The fund manager found that Yingshui Investment and Xuanyuan Investment are new private equity institutions with 10 billion yuan on the market this year. They have expanded rapidly this year and are actively engaging in offline innovation.

Data show that since the beginning of this year, Yingshui Investment has 235 products, participating in the first launch and accumulating allocation.Invest inGold was 1.46 billion yuan; Among them, 25 products participated in the first assignment more than 300 times, and the number of assignments received the most is Yingshui Qihang 15 who participated in the first assignment and received 346 times.

Since the beginning of this year, Xuanyuan Investment has 98 products, and the accumulated investment funds to participate in the first launch is 307 million yuan; 5 of these products have participated in the first distribution more than 300 times, and Xuanyuan Kexin No. 8 participated in the largest number of distributions. The holder was assigned 358 times.

Additionally, Panyao Assets has 37 products under its control this year, and the cumulative investment in the first issue is 167 million yuan. Among them, 2 products have participated in the first assignment more than 300 times, and the first phase of Panyao FOF is the most assigned. Participated in the first round and was assigned 370 times Fund manager noted that Panyao Tongxiang 3 already participated this yearTianqin Team、Yiming food、Masamoto YoshidaiWaiting for several companies to launch new ones offline.

(Source: China Fund News)

(Responsible editor: DF524)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]